Catching A Falling Knife - My Foray Into The MOEX

A strategy that has served me well the last few years took a turn for the worse in the last 24 hours. As we know, the FED and other central banks around the world have been expanding their balance sheets like there is no tomorrow. This has meant that buying the dip has been the best game in town for buying stocks and adding to your positions.

This is what "Tapering" looks like to the Fed

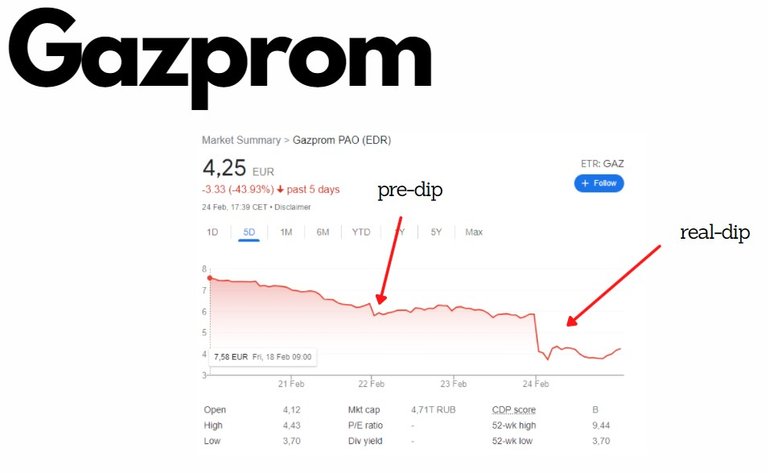

However, i had my gambling hat on and decided to "buy the dip" in russian stocks. The dips were much larger and some potential gains looked great. It was also much more exciting than just buying some Adobe or Microsoft. Things were looking great with my Gazprom purchase when it rebounded from its lows to produce a nice gain after just 1 day. Unfortunately that turned out to be just a "pre-dip".

You can then imagine my horror when Putin decided to do a full scale invasion and the "real dip" came, smashing my russian stocks to pieces. First you can see the carnage with my purchase of Gazprom. Within the last 5 days, it had a high just below 8 Euro and has dropped around 50% at one point to a low of just 3.70 Euro.

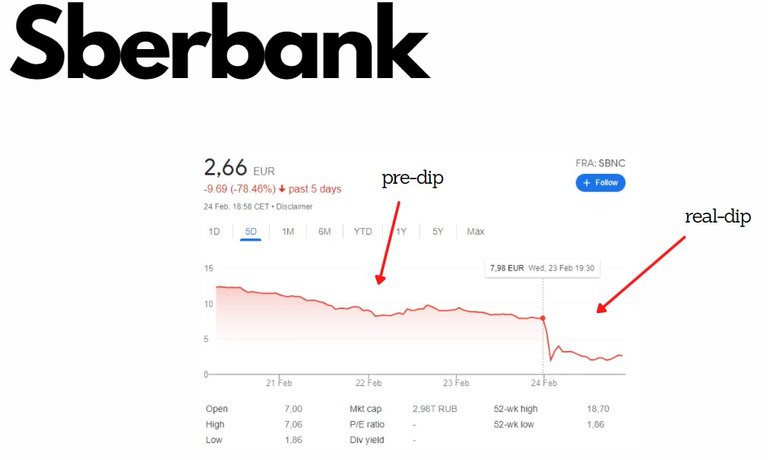

My next foray into the MOEX was even more of an eye-opener. After buying the initial "pre-dip", things didn't look so bad for Sberbank as they were not on the list of banks facing sanctions. However that soon changed after last nights invasion and you can see the carnage that unfolded on the stock below. In 5 days, Sberbank fell from over 12,35 Euros to a low at one point of 1,86 Euros. Well over an 80% fall in a week (70% in 1 day).

The picture is probably even worse, as there could be sanctions on owning these stocks and trading prohibitions with war breaking out. Where it goes from here, we will find out in the coming days or weeks. In the meantime, should i buy the dip again? I mean, the price is tempting, right?

Buying the dip the right way

Buying the dip isn't necessarily a bad idea. However, there are some things you can do to reduce the risk and avoid catching a falling knife.

Large Cap US Stocks

Some ways to reduce the risk are to buy large cap stocks, preferably from the US. These large companies (Enron excluded) are usually much safer and likely to continue trading for a long time into the future. Not only that, you are likely to be able to receive a dividend while you wait for any capital appreciation.

ETF

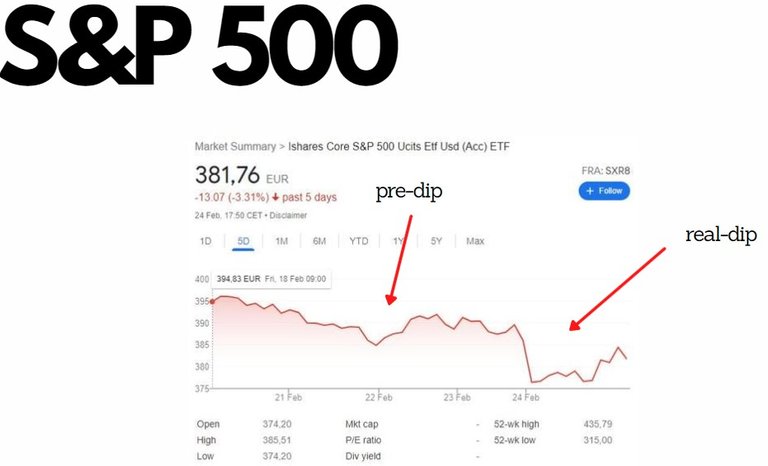

An even safer way to buy the dip, would be to spread the risk and buy the dip in your favourite ETF. This way the market risk is spread among hundreds, if not thousands of shares. You will then be able to sleep even more soundly at night.

The S&P500 ETF had a nice dip worth buying on Tueday and the large dip today would be another opportunity to rebuy at a new low again. But you can see that it has already "recovered" half of todays dip and the drop is not so critical like with the stocks above.

Did you buy the dip recently?

How did it go?

Thanks for reading.

Posted Using LeoFinance Beta

https://twitter.com/mypathtofire1/status/1497135060583022592

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.