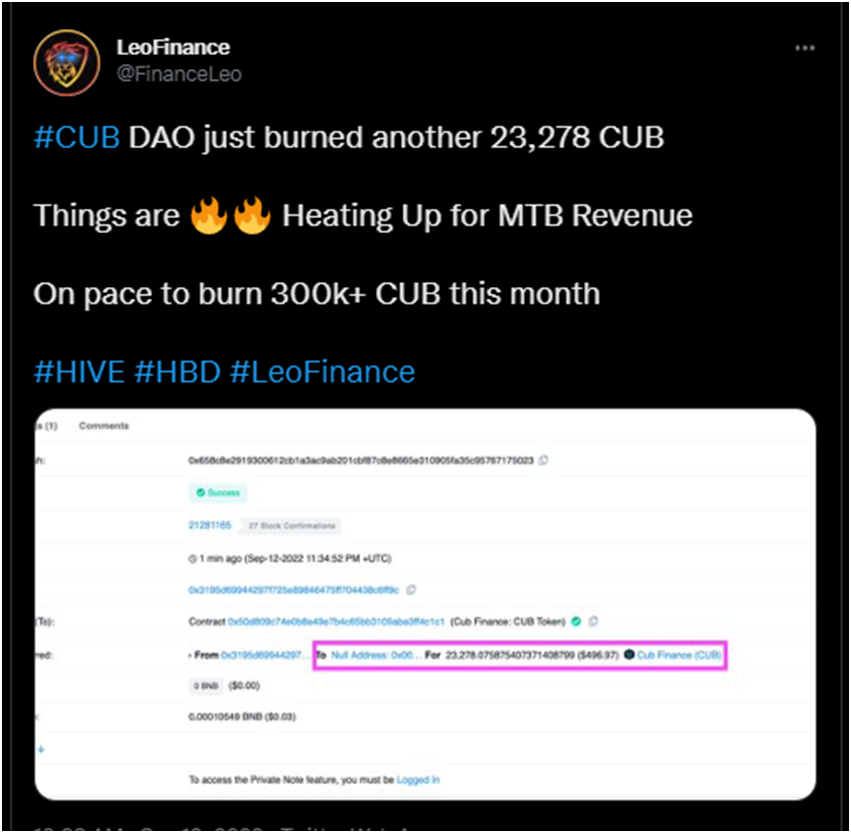

$CUB burns are ramping up.

53K in the past three days.

It looks like the recent changes have had an effect on the $CUB operations.

Looking at the latest cubdaily reports that can be found here this is all down to the multi token bridge.

At the moment liquidity is growing daily.

- bHBD-bHIVE: $53k

- bHBD-BUSD: $161k

- bHBD-CUB: $86k

- bHIVE-CUB: $103k

Total: $403k

with all of these transactions generating fees that are burning $CUB at irregular intervals.

This is not the solution to the low price of $CUB but it is the start.

As long as funds are moving and prices keep changing then $CUB will keep getting burned.

The biggest question is whether the burn can flip the selling and make the token increase in value again.

At the moment there about $12K in $CUB produced every month with 4K in fees generated last month.

The rough calculation put the deficit at about 50% last month. CUB DAO earned $4k last month from the MTB revenue.

So if we see $8k in revenue, we'll see Escape Velocity. That basically means that CUB's price has bottomed out and the buying pressure from the DAO outpaces the selling pressure from the CUB Liquidity Providers.

The interesting part for me is market mentality when it comes to situations like this.

If the herd changes direction and feels that the price is going to go up then they stop selling or even better start buying themselves.

Then we enter a much more interesting phase of the token.

FOMO.

From Khal himself,

It’s 1 CUB / block

BSC has 28,000 blocks per day = 840k CUB per month

Currently, we’re burning 35% / 100% of the total inflation per month (300k burned CUB each month out of 840k)

The speculative figure is simply outpacing the amount of that 840k that gets sold each month.

The non-speculative number is outpacing the actual 840k which turns CUB deflationary.

Under both scenarios, CUB has to go up in value. The DAO buying pressure is outpacing community selling pressure in the first scenario. In the second, it’s doing the same but exponentially

The only reason that the price has been suppressed to this level is that the token is being dumped on the market. People are earning the rewards and selling for other tokens.

If they decide to keep staking it and reduce supply then the price will start to creep up.

With a higher price the liquidity rewards look a lot better.

If more people move funds to cubfinance then it will generate even more fees for burning $CUB.

It would be a reverse of the past two years where the price kept dropping, people then sold off and it became less and less valuable.

It's all about changing the mob mentality now that there is some actual revenue and utility for the token.

Those positive cycles are massive and if the leofinance team can break the negative cycle of the past two years then we could see huge price increases and the burns take effect.

It's not a guarantee by any means but it is a distinct possibility.

Posted Using LeoFinance Beta

Good stuff I am sure ready to see an increase in CUB prices!

Posted Using LeoFinance Beta

I need to pay more attention. My original cub is still sitting in the kingdom. I'm hovering right around 500 cub. I think I paid $1000 for it lol

Posted Using LeoFinance Beta

It's always nice to see the CUB being burned but it doesn't look like the burn is able to completely offset the inflation. Then again, some inflation is not bad and it depends on the pools CUB has. From what I saw, a few of the farms were also finished and no longer paying out rewards.

Posted Using LeoFinance Beta