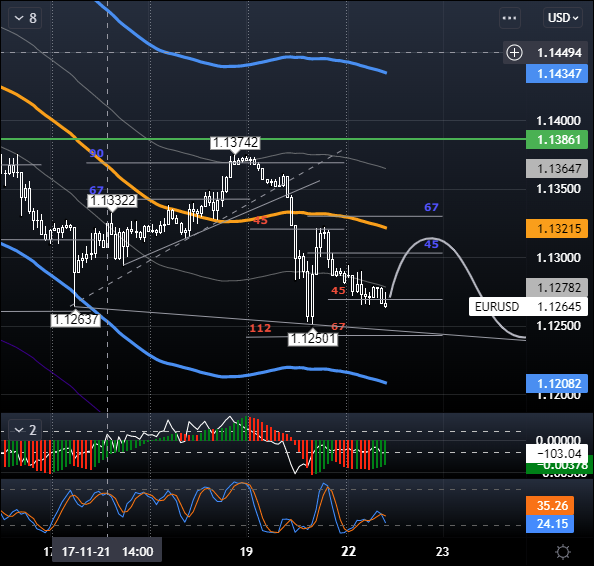

November 22th, Euro has stabilized at 1.1270

- Austria announced a lockdown. Germany is also ready to introduce a nationwide lockdown.

By the end of the week, major currencies closed in the red, except for the British pound. The largest decline was shown by the common currency (-1.42%) and the Australian dollar (-1.41%). A smaller drop was shown by the Swiss franc (-0.98%), the New Zealand dollar (-1.03%), the Canadian dollar (-0.76%), the Japanese yen (-0.41%). The British pound closed in positive territory (+ 0.22%)

On Friday, November 19, trading in the euro ended in decline. The euro fell 0.78% to 1.1281. Euro and other currencies plummeted on news of the lockdown in Austria. Europe again faced new restrictions. The euro fell to 1.1249.

The Austrian government has announced a lockdown in the country, which may subsequently last 20 days. Austria became the first European country to impose restrictions on the movement of people who have not been vaccinated against COVID-19.

German Health Minister Jens Spahn also did not rule out the possibility of introducing a nationwide lockdown. In Germany, the number of coronavirus infections is breaking records. Last Wednesday, the number of confirmed new cases of coronavirus infection in the country per day increased by 68,366, which was a new maximum for the entire pandemic.

Scheduled statistics (GMT +3):

- At 18:00, Eurozone Consumer Confidence Index November. US Existing Home Sales October.

Current situation:

The dollar opened with a slight increase. The dollar index rose to 96.20 p. The growth did not continue. At the time of this writing, the index value is 96.12. The growth leaders are the Australian and the New Zealander.

The economic calendar is blank for today. This week, traders are focused on news about the coronavirus, speeches by K. Lagarde and E. Bailey, PMI indices for the manufacturing and services sectors in Europe and the United States, as well as the RBNZ meeting.

Technical analysis:

The EUR/USD pair has stabilized at 1.1273 (45 gr.). Considering the growth of the AUD/USD and NZD/USD pairs, on Monday, on an empty calendar, buyers had the opportunity to return to the balance line (1.1320). The longer the flat is around 1.1250, the lower the target. On the daily TF, the key support is at $ 1.0900.

In the EUR/GBP pair, the euro is under pressure due to expectations of a 15 bp rate hike. Bank of England. If the pressure on the euro in the cross increases, it will immediately affect the main pair. If at the same time the dollar rally resumes, then the euro will collapse following the example of the falls on November 15 and 19.

Summary: on Friday, the single currency fell against the dollar amid a lockdown in Austria. The German authorities can also introduce a lockdown in the country. Given that the market expects a rate hike by the Bank of England, due to the difficult situation with the coronavirus, the euro may remain under pressure until December.

Posted Using LeoFinance Beta