November 2th, Euro won back 50% of losses from Friday's fall

- Tensions have increased between France and Great Britain.

- Retail sales in Germany fell in September.

- Economic activity in the US manufacturing sector in October grew at a high pace.

On Monday, November 1, at the end of the day, the euro rose in price against the dollar by 0.39%, to 1.1606. The growth of the currency pair began in the Asian session. Buyers received support from the growth of the EUR / GBP pair. The cross rose 0.61% to 0.8500.

The pound has come under pressure due to increased fishing rights between France and the UK. Traders even ignored the September decline in German retail sales. The growth turned out to be below the forecast.

American statistics were released at the American session. Economic activity in the US manufacturing sector grew at a high pace in October. The index of business activity in the manufacturing sector amounted to 58.4 against the forecast of 57.2. The release notes that production has been negatively impacted by long lead times for raw materials, continued shortages of critical materials, higher commodity prices and difficulties in transporting products.

Scheduled statistics (GMT +3):

- At 10:30, Switzerland is to publish consumer price index for October, retail sales for September.

- At 11:15, in Spain will be released the index of business activity in the industry for October.

- At 11:45, Italy is to publish an industrial PMI for October.

- At 11:50, France is to release the final data on the industrial PMI for October.

- At 11:55, Germany is to publish the final data on the industrial PMI for October.

- At 12:00, the Eurozone is to publish the final data on the industrial PMI for October.

- At 23:00, the RBNZ semi-annual report on financial stability will be released.

Current situation:

In trading in Europe, major currencies show mixed performance. Almost all are trading in the red. The greatest losses are incurred by the Australian. He lost ground after the publication of the RBA protocol. The focus is still on the meeting of the US Federal Reserve, the Bank of England and the report on the US labor market. Investors expect the US Federal Reserve to cut its QE program. We look forward to hearing from J. Powell on Wednesday.

Technical analysis:

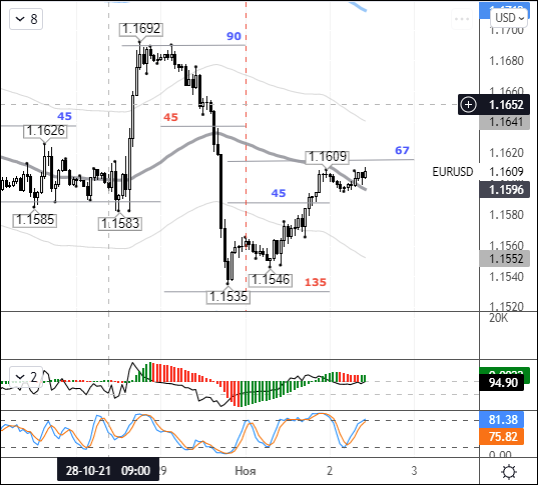

At the time of writing, the euro is worth 1.1609. The euro recovered 50% from falling from 1.1692 to 1.1535. The price is at the balance line and 67 degrees. Buyers were able to gain a foothold above 1.1590, showing that they are still able to return the rate to the 1.1690 level. They are strengthened by the EUR / GBP cross and yesterday's strengthening of the franc. The Swiss franc won back Friday's losses and went up against the dollar.

It is also worth noting that the yield on 10-year US bonds is declining. If the value of UST10 falls below 111.20, then we should expect the continuation of the strengthening of the euro, following the example of the franc. For today, corrective movement to growth to 1.1570 is interesting in order to test the strength of buyers and intentions to move higher. Otherwise, the price fell back to 1.1609, and sellers keep their finger on the pulse to resume sales before the US Federal Reserve meeting if the opportunity arises.

Summary: the euro began the month with a recovery. At the end of Monday, the EUR / USD pair closed with growth. Buyers were getting support from the EUR / GBP rally following increased tensions between France and Britain. Market participants are awaiting the decision of the US Federal Reserve on the interest rate and the QE program. There is still a high probability that the pair will remain trading in Friday's range until the announcement of the Fed's decision.

Posted Using LeoFinance Beta