The crypto fever: How to overcome

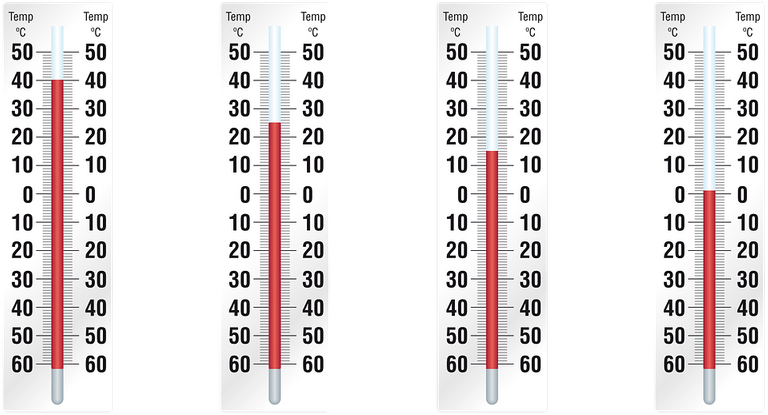

As crypto market prices rise or fall, conditions change, and with them the mood of most of the people who observe and intervene in them.

Image Source

Crypto fever

This is how we frequently find ourselves with what I call, "The crypto fever"; which is nothing more than a phenomenon dependent on the current market moment. Crypto fever increases, as crypto prices increase, and decreases, as the exact opposite happens.

One might think that when talking about "crypto fever" I would be talking only about people's interest in buying or selling cryptos to the extent that they go up or down respectively, but the phenomenon goes much further than that; and even comes across and confused with what we usually know in the middle as "FOMO" and "FUD".

To explain it better; when the crypto market (always led by Bitcoin) begins to show signs of recovery; or even more still; when it is in full uptrend; It happens that all social media, all pages, all news, everywhere we look, will show us headlines of people, institutions and governments, putting their money (even millions of dollars) in this or that crypto.

But when the opposite happens, in bear markets, we see the headlines slow down. In such a case, there seems to be a deep recession from which it is not going to come out.

But... Is it really like that?

Image Source

Without fanaticism, it is better to be objective and look at the panorama patiently

The truth is that crypto fever is a curious phenomenon, because it is directly linked to people's emotions. And most of the people in this world are not able to put their logical rationality over their emotions. This is why the markets are so erratic, and we're not just talking about the crypto market here; but of any activity that involves the understanding and action of human beings.

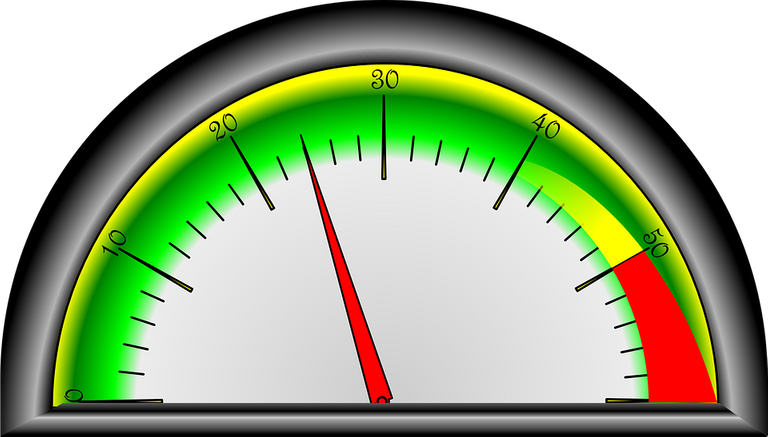

That small percentage of people who are able to put their rationality over their emotions, are truly capable of being objective both in the good times of the market, and in the not so good ones.

Because in order to be free from crypto fever, we must be objective, and avoid fanaticism; since this will allow us to be objective and patiently wait for the right moment to act when we must.

This behavior will allow us to win more frequently in the markets, because it will give us wisdom in our thinking, acting and proceeding; something extremely necessary and worth both for investments and for trading itself.

People suffering from the worst cases of crypto fever

The worst cases are those we call "maximalists" and "minimalists". Bitcoin maximalists (for example) are the ones who say Bitcoin will hit $1 million before 2025, and minimalists are the ones who say Bitcoin will go to $0 before then.

The dates are not relevant in what I want to point out here, the fact is that both the maximalists and the minimalists suffer from the same evil, which is the crypto fever, that they have fanaticized opinions about the crypto market.

There are two types of people who maintain fanaticism: On the one hand, we have those who know that the market really fluctuates, and that we can know nothing about the price of a crypto beyond the potential of its base project; and on the other hand, we have those who truly believe that a crypto project will go "To The Moon" or "To the Hell" without a doubt.

Image Source

The former know what they are doing, they are sowing FOMO, to create confidence in the markets (albeit in the wrong way); and the other are falling prey to the most extreme fanaticism, the kind that prevents them from thinking clearly and that will sooner rather than later lead them to bankruptcy.

The reality of Bitcoin and the crypto market

The reality in all this is that, beyond fanaticism, everything in the crypto market (starting with Bitcoin) is based on fluctuations. So the market will never go forever up, nor will it go forever down.

Everything works based on market cycles, these cycles are accumulation, reaccumulation, distribution and redistribution. All these cycles lead to what we know as trends in the markets. These are the facts, beyond what the crypto fever would have us believe. So let's put fanaticism aside.

The only thing about we must be aware of and be very sure of is to choose the cryptoprojects that really represent a solid base in themselves, such as Bitcoin, Ethereum, HIVE, Polygon, or any of the most solid cryptocurrencies on the market.

Therefore, believing in crypto is fine; investing and trading in cryptos is excellent, but always without falling into crypto fever. Let's remember it.

This is the fundamental in all this from my point of view.

What do you think about the topic discussed? Please comment.

Gif created by @piensocrates

Posted Using LeoFinance Beta