Trading Patterns: Head and Shoulders

Today I want to start explaining what trading patterns are. There are many patterns in trading that allow us to orient ourselves in the market and make the best decisions accordingly. However, for the purposes of the posts, I will explain and detail each pattern in a separate post from the others and with due examples on real charts.

The purpose of this is to create a series of articles that you the readers can read and properly understand the content pertaining to this very important part of trading. After I finish explaining the series of patterns in each separate post, I will also publish a post explaining them all together through a single post.

Image created by me

In any case; Today I have come to talk to you about one of the most fundamental patterns in trading: The Head and Shoulders. This is one of the most important patterns because its proven effectiveness in the markets is indisputable and because if properly identified it is practically an infallible tool that tells us traders and investors where the market price of the crypto asset will most likely move next.

But before we start explaining what the Head and Shoulders pattern is, let's first somehow define the word "pattern" in trading.

What is a trading pattern?

As I do not want to get too technical when explaining it, I will explain it to you in the simplest terms possible; because once you understand the meaning of what a pattern is, the most important thing will be to know what said pattern consists of and to know how to identify it properly in charts.

That said, A pattern in trading terms can be understood as a frame of reference in the price movement of an asset on its corresponding chart. Through a properly identified pattern, the trader can understand what will happen in the market beyond what may independently be happening at the time.

So, chart patterns are part of the tools that traders and investors use to carry out technical analysis of the markets we operate.

If we want a slightly more technical definition, let's say it like this: A pattern is a sequence of movements in the price of asset that allows us to define or anticipate whether the price of said asset will rise, fall or continue its course.

Therefore, a pattern can tell us of a change in trend, but also some will tell us of a continuation of it. As I see, understand and operate the markets (I mean, as my experience) the most useful patterns in trading are those that allow us to anticipate changes in trend; because this will allow us to position ourselves in the markets obtaining great profits thanks to it.

That is why today I have decided to start this series of articles by speaking precisely to the Head and Shoulders pattern. But...

What is the Head and Shoulders pattern?

It is a chart formation, a configuration of the price of an asset, which shows us the shape of a head with two shoulders.

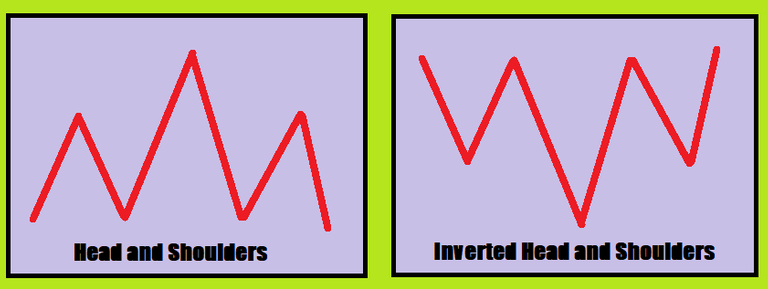

In this sense, there are two possible formations for this pattern; on the one hand there is the Head and Shoulders pattern, and the inverted Head and Shoulders.

Image created by me

The Head and Shoulders is a pattern that indicates a reversal of the current trend in the market up to that moment, or in other words, it allows us to anticipate a change in the trend in the price that is being shown in the asset market at that precise moment.

In this sense, the Head and Shoulders pattern, in which the shoulders and the head are shown upwards, indicates a change from an upward trend to a downward trend, or in other words, a reversal from an upward trend to a downward trend.

And in the case of the inverted Head and Shoulders pattern, exactly the opposite happens. The inverted Head and Shoulders pattern is one in which the head and shoulders in the pattern are shown pointing downwards; and this pattern shape indicates a change from downtrend to uptrend; or put another way, reversal from a downtrend to an uptrend.

How exactly do traders profit from this pattern?

As you will guess, in the case of the normal Head and Shoulders, we traders benefit because we can identify during a period of increase in the asset price, that said price will surely begin to fall or collapse from one moment to another, and this will allow us to go short or sell at right time the cryptoactive; and take profit or cut loss.

In the case of inverted Head and Shoulders, we traders benefit from the fact that by making use of this pattern we can identify, during a fall in the price of an asset, that from one moment to another it will begin to rise, and therefore, we can enter in long or in purchases getting important profits with it.

How to identify the head and shoulders pattern on a chart?

This is really very easy, to explain it I will use the current chart of Bitcoin

This is really very easy, to explain it I will use the current chart of Bitcoin, as coincidentally, the pattern can be visualized at the moment I write.

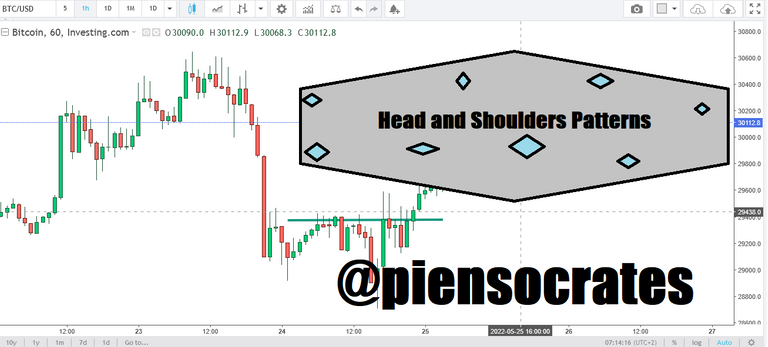

Image of the BTC chart in a 1 hour time frame on investing.com

As you can see, we are in the presence of the inverted head and shoulders pattern, and after the pattern we can visualize how the price of BTC went up immediately.

Traders who knew how to identify the pattern at the right time were comfortably placed long, and with that, they are already making profits right now.

Now to show you the case of the Head and Shoulders pattern (the opposite case of the inverted Head and Shoulders pattern); I show you an example of the Bitcoin graph on a daily basis. I am showing you something that happened many periods ago, and I am doing it to show you what this pattern looks like and its respective effect according to what I have been explaining to you in this post.

Image of the BTC chart in a daily time frame on investing.com

As you can see, we are in the presence of the simple head and shoulders pattern, and after the pattern we can visualize how the price of BTC immediately fell.

Traders who were able to identify the pattern at the right time were comfortably placed short and profited as a result. Or also, simply (if they were in the spot market), they sold and avoided losing money just in time.

By the way, when using the Head and Shoulders pattern when trading, the best point to position ourselves waiting for the reversal is calculated by marking a line at the base of the shoulders and the head of the pattern. In the examples you can see that I marked the base with a green line in both cases.

The most important thing to remember when we are identifying the Head and Shoulders pattern

The head and shoulders pattern isn't always absolutely perfect (I mean, we won't always see the shoulders in the same size or proportion), but what we need to know to identify it correctly is that:

The most important thing to keep in mind when identifying the Head and Shoulders pattern is that we have to clearly see the pattern in the price movement; that is, we must see clearly defined the head and shoulders of the pattern; and most important of all, we must be very clear that the shoulders can sometimes be disparate (that is, one shoulder can be a little higher or lower than the other on occasions); but the important thing is that the head is completely above both shoulders. Due that if the head does not exceed the peaks of the shoulders, then we are not in the presence of the Head and Shoulders pattern, this is the most important thing to remember about it.

Summarizing

The Head and Shoulders pattern is practically an infallible tool in trading, the problem is that you have to know how to identify it properly, because an error when identifying it, and everything can go wrong when trading.

Also, the Head and Shoulders pattern does not always show up in the markets, but occasionally. What I mean by this is that many times other trading patterns will be see on the asset charts that we analyze, and even most of the time we may not be able to see patterns of any kind on the charts.

However, as traders, we must always be attentive to know how to identify this and other trading patterns in order to take advantage of them to get profit, since, as you can see in the post, they are a good guide in the markets.

Thanks for reading my post, see you in the next post of the series. Please comment.

Posted Using LeoFinance Beta