When you know what you're doing, you're calm

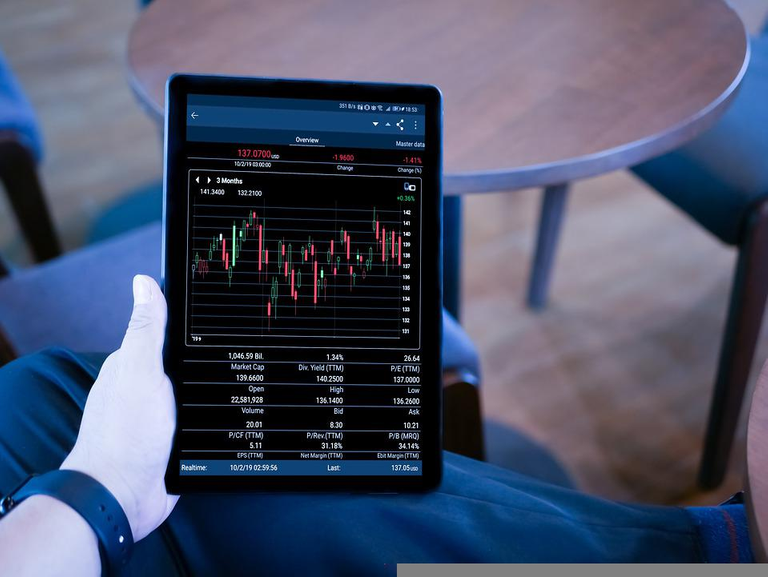

It is quite evident that, for many people, the crypto market is like an emotional roller coaster, in which they suffer minute by minute, and fluctuation by fluctuation, the levels of the prices of Bitcoin and other cryptos.

Image Source

Why is this happen?

What I have just mentioned usually happens to novice traders in the crypto market, because they are focused on making immediate profits, or after a few minutes, hours, or days, while making the terrible mistake of believing that they can never lose.

But in the crypto markets (just like the stock market) you win and you lose; and in fact, they have a peculiarity

additional, and it is that in the case of some cryptos (such as Bitcoin, which is the mother of all cryptocurrencies), the behavior is volatile, and sometimes even erratic.

Then novice traders (and not so novice) start to worry when it turns out that they are not only losing in the markets, but also continually chaining losses on an ongoing basis.

Trading or Investing?

Many would say that the solution to this problem for traders is to stop trading and start investing, and this can be a solution to the mentioned problem, because when investing you will have to deal with much less volatility in the markets, since the Waiting periods to obtain profits are much longer than those that must be taken into consideration when doing trading of another kind.

As a counterpart, if you want to invest in cryptocurrencies you must (as in any other type of asset), have enough liquidity to hold out for as long as it takes until exactly what you have projected in the market happens, to take profit. This is like a bet (yes, it is), but it is also based on a strategy that allows you to set the limits to which the price of the crypto in which you invest must reach to take profits or get out of the market without further ado.

Another solution, in the event that you decide to continue trading, instead of investing, is to make a suitable strategy based on the type of trader you are (whether you are a scalper, intraday, etc), and then set Take Profit points and Stop Loss when you make any trade in the market and stick to those points when they happen.

Image Source

Your peace of mind will depend on the discipline you adopt around your strategy in the markets

Whether you invest in cryptocurrencies, or trade cryptocurrencies, the point here is that you must have a strategy, and be disciplined enough to apply it to the letter.

And the strategy must cover two issues, fundamentally speaking, first of all, you must make a correct management of your available capital, separating your working capital from your personal capital so that you have liquidity for your daily survival, and at the same time have defined what you are willing to put on the market at any given time.

Secondly, from the portion of your capital that you have already separated and destined to invest or trade, you must decide how much you want to risk or not at a given moment, and depending on the particular circumstances that arise. In addition, you must decide in which crypto asset you want or can invest, so you must learn to detect the opportunities available in the markets.

Plus to the aforementioned, you must decide whether to diversify or not, and in case of diversifying, do the corresponding previous studies to decide exactly which assets you will do it with, and how you will do it; that is, what portion or percentage of your working and investment capital will you allocate to each of the cryptos that you will trade or in which you will invest.

Image Source

When you know what you're doing you're calm

Knowing what we do in the markets, we will be completely calm, because our emotions will not overwhelm us every moment, as it happens to most people today (especially to novice traders).

One thing that we must also keep in mind to have such peace of mind is that, as I already said, we must learn to detect profit opportunities in the crypto markets, and for that, we must specialize in doing technical and fundamental analysis. Although these analyzes are not infallible, because nothing is, they will help us very well in every way to detect opportunities appropriately.

Because it is clear that emotions are of little or no use to us in the markets, what is useful to us is knowing exactly what we are doing in that sense, because this will give us peace of mind and assertiveness. By trading without self-imposed psychological pressures, we will be able to be more successful in the crypto markets.

What do you think about the topic discussed? Please comment.

Gif created by @piensocrates

Posted Using LeoFinance Beta

I absolutely love this post and I think you did a great job with the explanation. However, sometimes, I wonder if it is actually possible to completely withdraw our emotions as humans.

Personally, I'm more of an investor than a trader In fact, I haven't performed any day trading activity like scalping and the likes in roughly two years. I buy, hold long term and sometimes take profit but only when it is for sorting out my personal needs.

What I have noticed over time is that at some point down the line, I get emotionally attached to some of my bags. For example, my NFTs and some tokens that includes Leo, Cub and Polycub. How does one actually detach their emotions?

Posted Using LeoFinance Beta

Well, although it is difficult, it is what we must try to do at all times, because the cryptographic markets are erratic and volatile in large part, due to the greed and fear of the people; which are basically emotions that they do not know how to control.

There is a good book on trading that speaks abundantly on this subject; It's called "Trading in the Zone", I recommend to you (if you haven't read it yet).

Thank you very much for reading and commenting on my post. Greetings.

Posted Using LeoFinance Beta

!1UP I really like your way of thinking and the way you expose it in this post! Discipline and method when well defined will guarantee you lower risks along the journey.

In Brazil there is an investor focused on Price Action that has been in the market since 1998, known as Stormer. He is a master at creating a strategy and following it rigorously, and I have learned a lot from him.

Click this banner to join "The Cartel" discord server to know more.

Its very interesting what you say. I think I'll do some research on that investor you mentions. Thank you for reading and commenting on my post. Greetings.

Posted Using LeoFinance Beta

You have received a 1UP from @underlock!

@leo-curator, @ctp-curator, @vyb-curator, @pob-curator, @pal-curator, @cent-curator

And they will bring !PIZZA 🍕.

Learn more about our delegation service to earn daily rewards. Join the Cartel on Discord.

Wow! Thank you so much!

Posted Using LeoFinance Beta