A potent way to think about money.

The choice we make comes with a compromise. Money is an invitation to critical thinking as it brings you into numerous thoughts and decisions to make when handling money. We often say money can buy anything but not everything because there are limits to spending money or getting something with it. When you value something, like buying a house, travelling for exploration, getting a new car, etc, you can have it once you have the money at hand.

When you have come to the understanding of practising how to manage your money, it means you are able to manage your life, how you live your life, what you do with your lifestyle, how you make decisions on being a better person and also, practising on how to break off from the chain of poverty into financial independence. You can afford anything you want once you are able to make smart decisions about your own money.

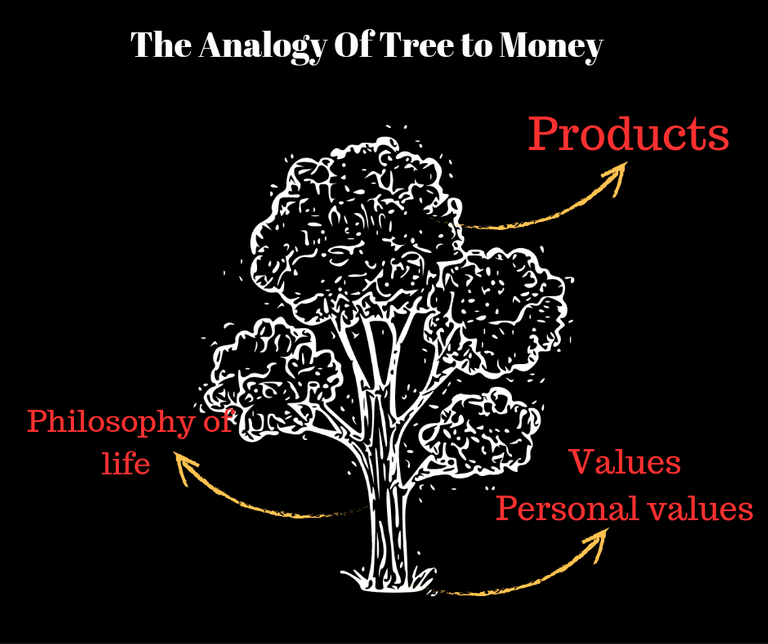

One mistake some people make when it comes to money is asking questions like, "How do I manage my money? how can I afford this? should I use this app? Should I invest in cryptocurrency? etc." They also go about enquiring about a product without first having the knowledge of the principles of critical thinking about money specifically. The first thing is ignoring these questions at the beginning and getting to the root of something in particular. For this, I would be using a tree as an analogy to explain my point here.

Just like this tree, the products are just like the leaves of a tree which are very visible and it's why people first ask the question, "What product to get first?" Then comes the roots of the tree which are called values, I mean personal values and it is what matters most. Looking at the root, it sprouts out the trunk of the tree which stands for the philosophy of life — which is the kind of life you want to live and lead, and your goals to take action on. Moving forward to the branches which come next and they stand as the strategies.

After understanding your philosophy of life, the kind of life you want to lead, and the goals and objectives, the next is how to come up with them which are the strategies on how to go about it. At this point, you would have to come up with various ways or steps to achieve your goals and once you are able to get through this, you will then get to the point of the leaves which are the products.

With this illustration, when one is starting to ask questions like the kind of products to get, it typically means that you only have got leaves in your hand without having an idea of the root system that is constructed.

It is really hard to be excited about the idea of financial independence being enclosed in the context of delayed gratification, like an individual trying to wait till they reach a particular age, let's say 50-70 years before having lots of money but it becomes more enticing when we have to say that financial independence and how taking care of your money leads to a life of flourishing, opportunities, freedom and choice.

Financial Independence is achieved more when you have numerous passive incomes through investments and are able to cover your bills without relying on your 9-5 salary. At this moment, you have a series of endless opportunities that are opened up for you, like doing whatever you want to do, the freedom to travel to any place of your choice, etc. You may decide or choose to stay in your current profession, have a career change, become a full-time parent, or do whatever you want without having to struggle or sweat about how you will keep the candle burning.

Financial Independence is for everyone, but the steps are different for each individual as it depends on where such a person is in the journey. When it comes to achieving financial independence, there are three ways to do that: Balancing the difference between what you earn which is your income and what you spend which is your expenses, investing, and then repeating the same thing again. The only way to increase the gap between what you earn and spend is to earn more and spend less. If you are earning more but have a problem with your spending, the best is to reduce how you spend so you can have enough to save and invest.

It is crucial to save and invest at least 10-20% of your income if you want to achieve financial independence and if you think it's getting slow, then increase it. When you are consistent with this method and repeat it over again, you will see a lot of changes and differences on your journey to financial independence.

Thanks for your time on my blog.

Thumbnail Images are designed on Canva

Posted Using LeoFinance Alpha

Saludos @princessbusayo

Realmente escribes muy bien ! Me gustó mucho el artículo, y hay cosas en las cuales concuerdo contigo, nuestra manera de ver el mundo y nuestros valores como personas determinarán como gastaremos nuestros dinero, hacia donde centraremos la atención de nuestro poder adquisitivo!

Un abrazo fraternal

Greetings @princessbusayo

You really write very well! I really liked the article, and there are things in which I agree with you, our way of seeing the world and our values as people will determine how we will spend our money, where we will focus the attention of our purchasing power!

A fraternal embrace

This is why our perspective to money must be right in order to get the best of what we could achieve with money. I appreciate your reading my post. God bless 🙌

Great Post! The analogy of the money tree was an eye opener for me. What good does a leaf have if there aren't clearly defined roots or trunks. Financial independence will be different for everyone and it's good we start at the root of what our personal values are and steadily climb up to the leaves or fruits.

Exactly. We have to begin from the grassroot so that when we get to the leaves, we would have understood what to do and the knowledge of building our ways into financial independence.

Thanks for reading, Takhar.

Managing and budgeting, am really good at that, its like the gift God bestowed upon me, for investing nahh got a lot of badlucks with those, will click the links to see were it takes me, cause everyone needs that peaceful life you just wrote about

https://leofinance.io/threads/view/princessbusayo/re-leothreads-33pxyypse

The rewards earned on this comment will go directly to the people ( princessbusayo ) sharing the post on LeoThreads,LikeTu,dBuzz.

Most of us still don't understand the philosophy of life but they are not ready to accept it. They don't know what they actually want in their life. And even if they set a target, they don't have any proper planning for it.