Institutions Buy While Individuals Sell Bitcoin. Bitcoin Supply on Exchanges Is Decreasing.

While some investors sell their Bitcoin holdings, others continue to buy. It is noteworthy that there are more institutional investors on the buying side. It seems that individual investors are selling and institutional investors are buying low prices. While individuals selling their assets drops the price of Bitcoin, on the other hand, the buying of Bitcoin by institutions reduces the supply of Bitcoin on exchanges.

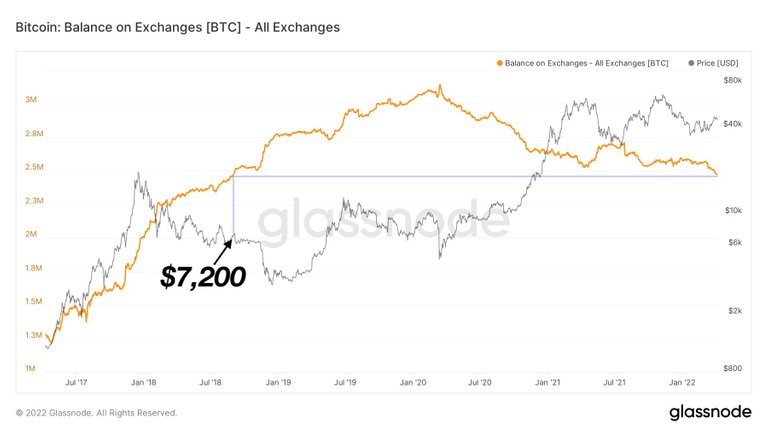

According to Glassnode data, the supply of Bitcoin on exchanges has been decreasing since the third quarter of 2020. Currently, the supply of Bitcoin on exchanges has decreased to the levels of 2018. This decline indicates that institutional investors are buying more Bitcoin. Because most institutional investors do not hold their assets in exchanges, in other words, almost all of them hold their assets in their own wallets. This shows why the amount of Bitcoin on exchanges is decreasing.

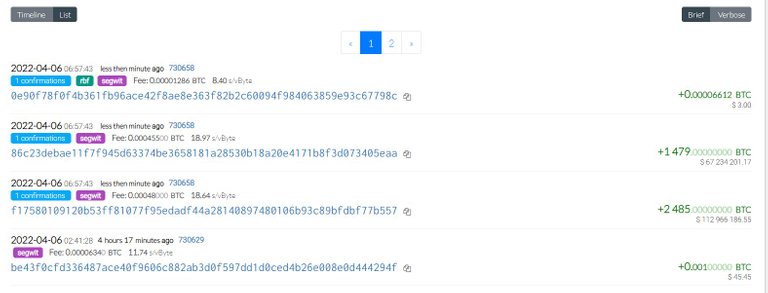

MacroStrategy announced yesterday that it purchased 4,167 bitcoins for $190.5 million, paying an average of $45,714 per Bitcoin. The buying took place on April 4th. MacroStrategy holds 129,218 BTC in total and has bought them for a total of $3.97 billion. According to the current price, the value of Bitcoins held by MacroStrategy is more than $ 5.6 billion. It shows that MacroStrategy is making significant profits from Bitcoin, due to buying it at the right times.

Also, today LUNA Foundation Guard bought 3,964 Bitcoins. Currently LUNA Foundation Guard has a total of 34,691.9 BTC.

The decrease in Bitcoin supply on exchanges indicates that more institutional investors are buying Bitcoin. Generally, institutional investors do not make a statement, but we will be able to see the amount of Bitcoin in their Balance Sheets in the future. Institutional investors work with expert financiers and make forward-looking long-term investments. The increase in institutional investors in the crypto market is a sign that Bitcoin will appreciate even more in the future.

Currently, Bitcoin is trading at $43,530. When we evaluate according to the available data, institutional investors buy cheap while individual investors sell cheap. In addition, if the supply of Bitcoin on exchanges continues to decrease in this way, the price of Bitcoin may rise even more in the future. It will also decrease in volatility.

Posted Using LeoFinance Beta

https://twitter.com/rtonlinetv/status/1511765238525399048

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

I wish individuals are buying or at least HODLing their BTC though, it is better having individuals BTC giving it a spread than the big boys.

Posted Using LeoFinance Beta

I agree with you. But it seems that some individuals do not think long-term. This increases the dominance of institutions in Bitcoin.

Posted Using LeoFinance Beta