Spinvest-leo weekly update post 24-July-22

Welcome to the weekly update post for @spinvest-leo, where I (@jk6276) record on chain for transparency our transactions for the week, and update @spinvest investors with our progress.

After last weeks 2 week report, we are back to normal this week.

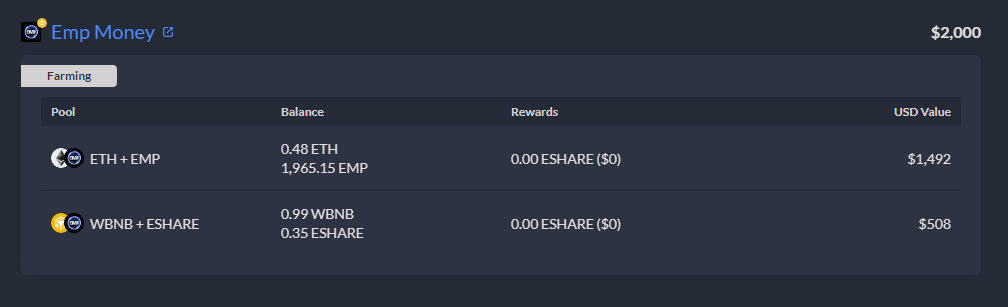

EMP Money.

First, I just want to shout out @roleerob, who wrote an awesome post with lots of detail about EMP. I highly recommend checking out that post.

Farmed just under 0.05 ESHARE this week.

Converted half to bleo - received 240.

Value for dividend = $18

Compounded the remainder into the ESHARE/BNB pool this week. Moving forward I will compound into whichever pool generates a lower $ amount in income, to build the yield. This week the ESHARE/BNB pool returned $16, the EMP/ETH pool returned $20.

Asset values this week:

- ETH/EMP - $1492 (up $249 from last week)

- ESHARE/BNB - $508 (up $165 from last week).

A great week for Ethereum has translated to a great week for EMP.

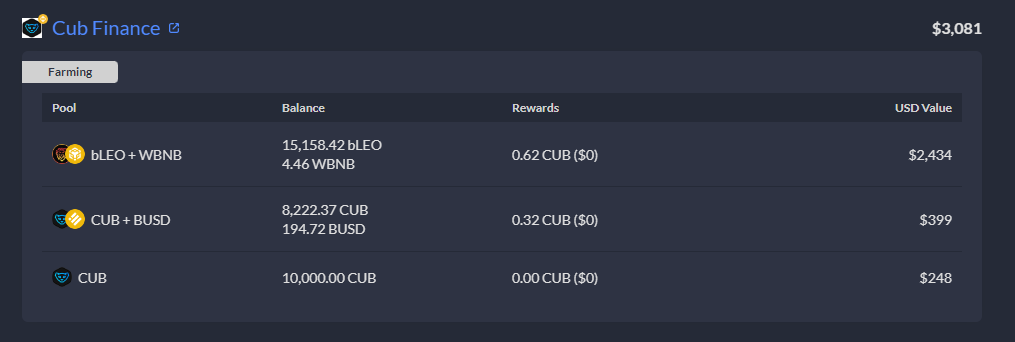

CUB Finance.

- Farmed a total of roughly 575 CUB this week.

- Converted half to bleo - received 93.

- Value for dividend = $7

Decision time has arrived for altering the investments we hold on CUB - starting with the DEC/BUSD pool. The only reason to hold this has been to accumulate the SPS airdrop. This ends in a couple of days, so it is time to close out this pool position. The funds here (roughly $900 worth) will be moved to build a position on POLYCUB.

I am likely to make further changes to CUB positions in the coming weeks. I feel these funds can generate better returns elsewhere. Some exposure will remain, with the hope of still having exposure to a possible recovery for CUB when/if that happens. But for now, the DEC/BUSD pool is closed, and those funds will move to POLYCUB.

So, to move these funds, plus the "compound" portion of the weekly income, I first traded all to bLEO. received a total of 10800.293 bLEO. Unwrapped these, then wrapped them to Polygon. More on how I deploy these funds further down in this post.

Asset value this week:

- BLEO/BNB - $2434 (up $286)

- CUB/BUSD - $399 (up $13)

- CUB kingdom - $248 (up $15)

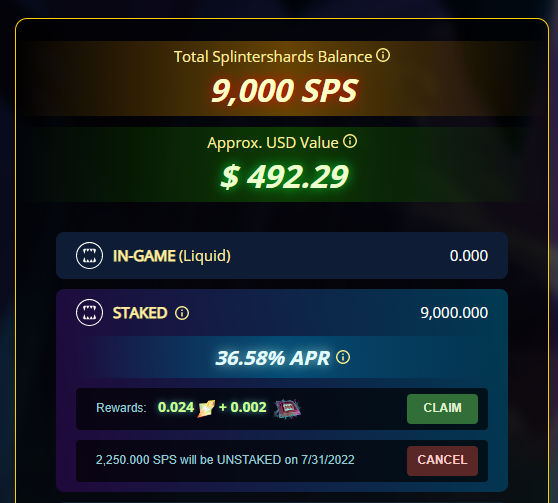

Splinterlands.

As the airdrop comes to a close, these funds also need to be reconsidered. I don't see us holding staked SPS long term, however it is my intention to move this SPS to POLYCUB also to LP there.

Claimed almost 700 SPS, plus 2.8 vouchers from the drop.

Transferred the full amount to Leodex.

Initiated a full unstake of 9000 staked SPS.

From the claim, sent 365 SPS to Spinvest for the dividend - value $20

Asset value this week - $492 (up $46 since last week)

So, over the next 4 weeks, the SPS will reduce to 0 here, and I'll shift it to Polycub to build an LP position there.

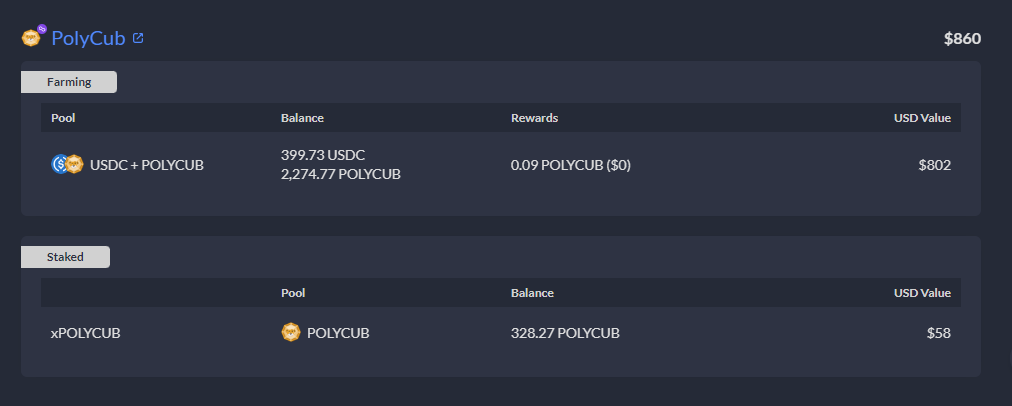

POLYCUB.

I deposited all the funds moved over from the closed DEC/BUSD pool into the POLYCUB/USDC farm.

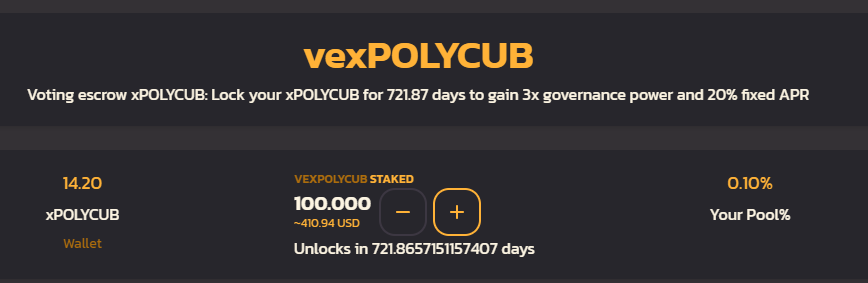

Next I staked 100 of our XPOLYCUB into vexPOLYCUB.

Then I voted for the POLYCUB/USDC farm to gain more rewards.

After all that, here is this weeks asset values:

So the Debank summary does not include the vexPOLYCUB.

Asset values this week:

- xPOLYCUB + vexPOLYCUB - $469 (up $37 from last week)

- USDC/POLYCUB pool - $802 (new position, $931 of DEC/BUSD last week - lost some to slippage)

Reminder - no income will come from these new positions on Polycub platform for 4 weeks, as I don't intend to pay half the income to unlock yield immediately.

HIVE

Sent 11 LEO and 3.8 HBD from post payouts this week.

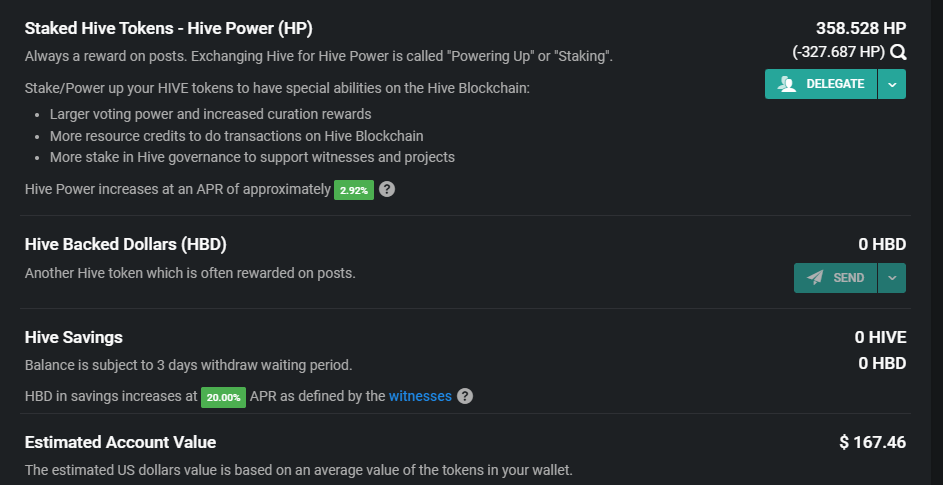

I traded the remaining SPS to Hive on Leodex, as I am running out of time to play with Polycub some more. Powered up the HIVE received.

Asset value this week - $167 (up $30 including the power up)

Summary.

Some big changes this week, with the DEC/BUSD pool moved to POLYCUB/USDC, and the SPS unstaking begun.

Total Asset value this week: $7011

Change from last week: gain of $714

Funds sent for dividends: $45

Funds sent from post payouts: $4

Thanks for reading everyone. More happening than usual.

See you all next week,

JK.

Posted Using LeoFinance Beta

Thank you for the shout-out @spinvest-leo / (@jk6276). I enjoyed writing that post, as it has been nice to have some encouraging news over the last few days. Been in short supply of late ...

Out of curiosity, how do you determine where funds are moved, e.g. why did you elect to move the CUB funds to PolyCub, to increase your (our) holdings there, vs. moving them to EMP Money?

P.S. LeoFI UI currently "dead" for me ... 🙁

Good question, I did seriously consider putting the funds into EMP. It is a pretty subjective decision really. My goal is really to rebalance the funds fairly evenly between the three platforms, being CUB, POLYCUB and EMP.

The CUB holdings are so far down, that I don't want to miss a recovery when/if it happens. I'd hate to move out of CUB, and then it gets some updates and turns around. I didn't have any funds on POLYCUB, except for a little xPOLYCUB, so wanted some exposure there basically.

The next weeks will see the SPS added on Polycub, and potentially some funds shifted from CUB to EMP.

As much as I am a fan of EMP, lots of recent events are teaching me to follow the old adage of "don't put all your eggs in one basket". I think a balance between CUB, POLYCUB and EMP is the safest option.

The other factor is that @silverstackeruk has a sizeable stake on EMP also of @spinvest funds, and me putting a bigger share there is possibly overexposing the combined fund.

Personally, if this was my own money, and not Spinvest funds, It would probably be mainly on EMP, with some POLYCUB.

I hope all that makes sense.

Posted Using LeoFinance Beta

Makes sense, based upon your stated desire for balance.

The only comment I would have on "don't put all your eggs in one basket" is ask whether CUB and POLYCUB can truly be considered a different ... "basket"

I personally believe (and experienced the devastating consequences firsthand ...) they are not, i.e. the launch of POLYCUB had a massive downside impact on CUB. CUB would have to 15X - 20X from here, just to get back to where it was, before the POLYCUB launch ...

Posted Using LeoFinance Beta

https://twitter.com/noadvice3/status/1551160426641211393

The rewards earned on this comment will go directly to the people( @no-advice ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.