Spinvest's weekly earnings and holdings reports #14

Hello, SPIer's. Today is Sunday and we end the SPI week with our weekly dividend payment this evening and every Sunday at 21.00 GMT.

What is SPI?

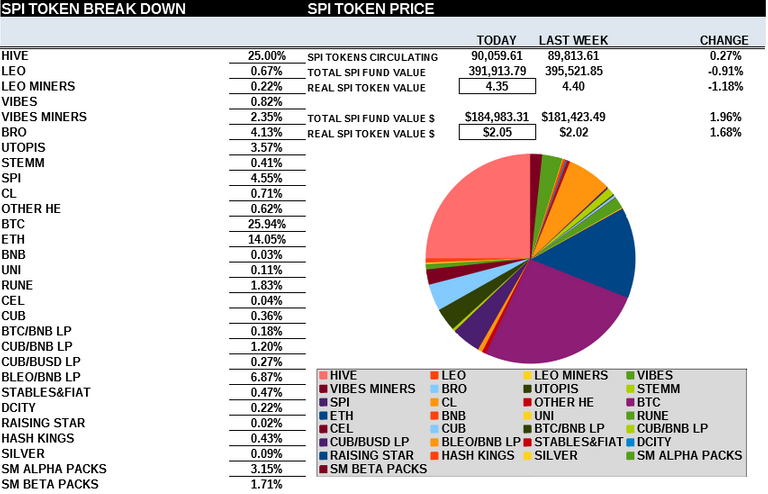

SPI tokens are growth investment tokens that pay a weekly dividend. They have been circulating for over 2 years, on STEEMHIVE. Mostly sold for 1 HIVE, each token today is worth over 4 times its HIVE issue value and 12x its dollar value. On top of that, token holders receive roughly 8% more SPI's every year from weekly dividends. We raised $13k from issuing SPI tokens for the first year which has been used to grow a diverse portfolio of investments, many of which provide streams of passive incomes. SPI tokens are part ownership of all SPinvest tokens/accounts, assets and income. The price of each SPI token is its liquidation value as SPI tokens are 100% backed by holdings. Handcapped to roughly 94,000, no more can be minted are issued. Adding, hold and compounding has us on the road to major growth and these tokens are still growing in value.

SPI tokens are part ownership in an actively managed fund. We have our hands in over 20 investments with the lion share being HIVE, BTC & ETH. We dont FOMO are chase pipe dreams. Tried and tested works best and is safest. Our motto is "Get rich slowly" and compounding down on sound investments is our game. You should invest in SPI tokens with the mindset of not selling for 3-5 years minimum. Let's have a look at this week's on-chain HIVE earnings.

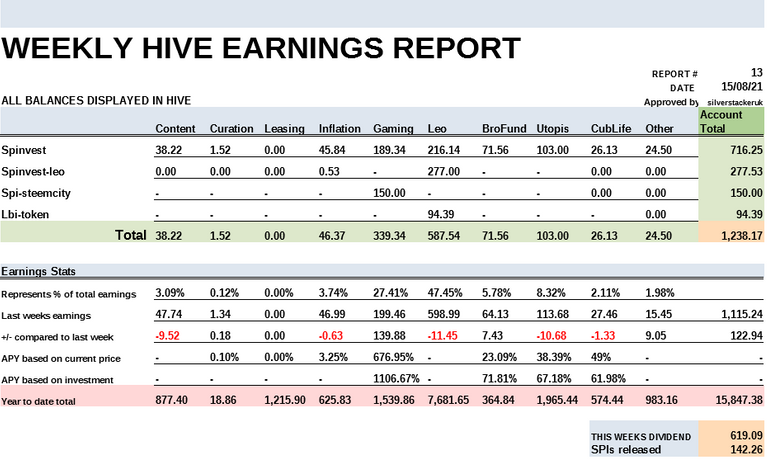

We've had good earnings this week all around. Our content earnings are way down but this is an easy fix if we want. SPS tokens have been kind to us the past few weeks, let's hopes it continues. SPS has also been pushing our BRO div's which are back up to a decent 23% APY. Half our earning now come from LEO as we are delegating almost 75,000 HP to leo.voter. SPInvest-leo is pulling in a really good income for us and our testers in both easydefi and noloselottery paid out this week as well. I think we got 20 LEO from the lotto and 27.62 LEO from easydefi. I put 500 into the lottery so we've had 4% back already and i put 1000 into easydefi and we've had 2.76% of that back. Not bad for the first week and we'll get good averages in another 4-6 weeks time.

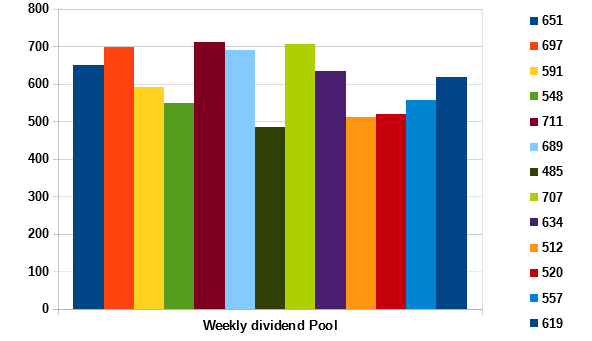

Our dividend payment this week is higher than last week and we are winning.

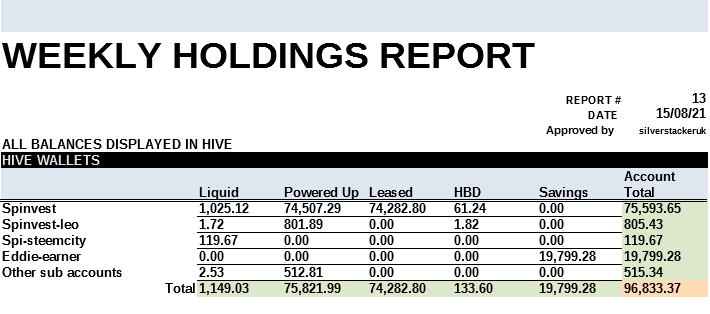

Still waiting on a good ETH>HIVE ratio and we'll get the wallet a nice boast back up toward 90,000 with spinvest. I seen this week that we are one of biggest delegaters to leo.voter, top 5 i think which was nice to see. Pulls us in around 42 LEO a day and it adds up.

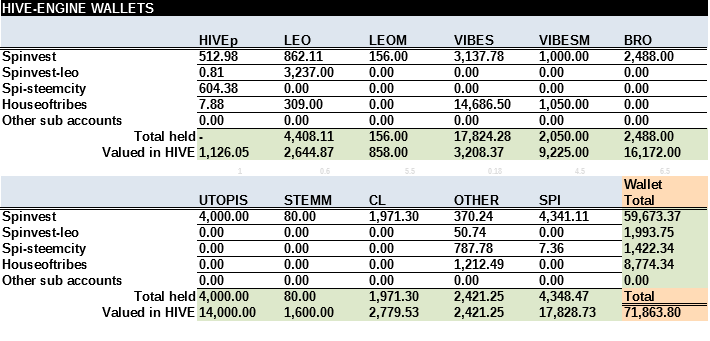

Not much change here this week, we have 1 more powerdown on the spinvest-leo account which is to be converted to bLEO. I have stopped buying back tokens from HE to let our holdings of SPI deplete a little. SPI's as dividends were supposed to last 1-2 years, we are 1 year in and hold enough to continue SPI div's for at least 30 more weeks. We'll either switch back to HIVE or offer a different token. Our houseoftribes account is back to normal this week but still growing. We started this account with 5000 VIBES and now hold over 14,600, not bad for 6-7 months. We dont hold that much on HE but what we do hold is growing.

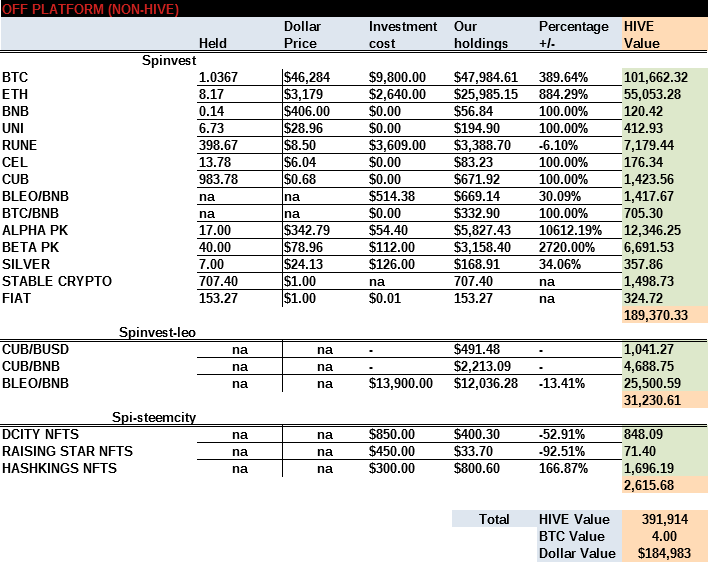

Added a new LP this week. I added $300 to the BTC/BNB kingdom on CUBfinance. The APY is plus 40% so enough said. Everything in crypto land is up a little on last week, not too much a few per cent. The big winner this week for us was RUNE as it's back up from $5 a few weeks ago. We are still losing on the investment but we are closer to break even and then fingers crossed profit.

Our bLEO/BNB LP has exploded this week as both LEO and BNB are up. If LEO can reclaim former glory days of 80 cent and BNB $600, this LP will roll past $20,000 with no sweat. I bite the bullet and moved 5 ETH to beltETH so now it's earning some CUB for us. I have been very tempted to move 0.5 BTC to CUBfinance but we dont what to many funds on 1 platform so we resist the APY.

Let's hope these balance explode as we continue into the 2nd half of the bullrun.

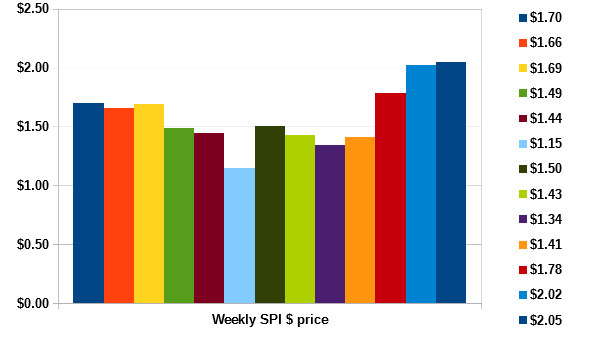

2 weeks in a row at over $2 is great to see. Please remember that each SPI is backed by the assets shown above. 60% of these assets can be liquidated with a few hours which makes SPI the most liquid fund token on HE. I understand that people want to cash out when they make a profit so SPI is built ahead of this and this is what makes SPI so unique. We built a token on a liquidation value instead of a paper value like most others.

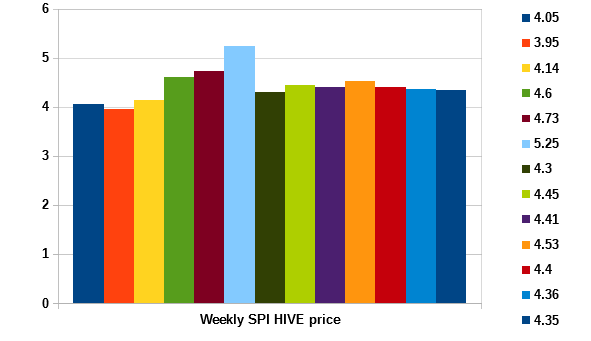

We've finished the first quarter of the year and below are a few charts to show a few stats. Im very happy with how things are going, we've not broken any records yet but the SPinvest year started around the same time BTC was dropping from $60k. Either bull run is still on are it's a huge dick tease. Could HIVE still go to $2+, BTC to $200k+ and ETH to $8K. If yes, we'll be worth $500,000. Remember SPI is 60% built of liquid assets that can be sold somewhere around the top and converted to stables and then when the market is in full bear market mode, we can buy back in 4x stronger. Projects built on paper valuations perform very well during bull runs but can't release profits and then get wrecked during bear markets. Liquidity is king and I think underlooked and undervalued.

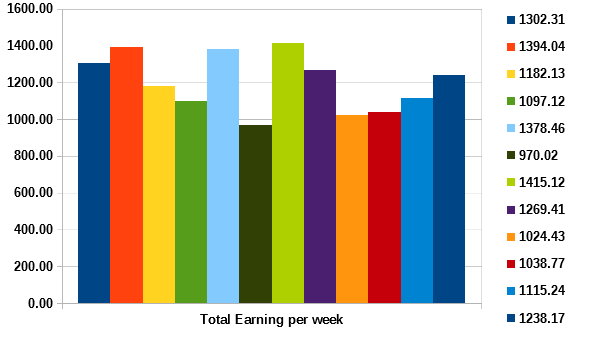

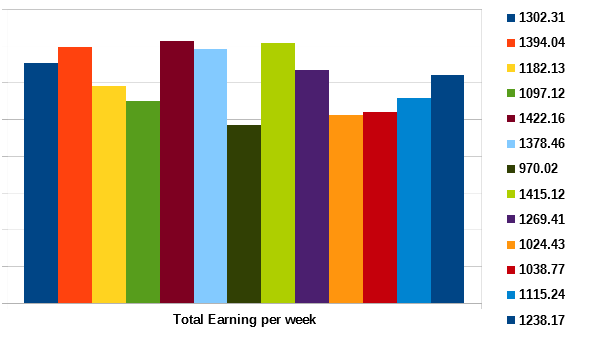

Charts for 1st quarter of year 2

(Earnings breakdown for 13 weeks)

(Weekly earning for 1st 13 weeks)

(SPI HIVE price for 13 weeks)

(SPI dollar price for 13 weeks)

(Weekly dividend pool for 13 weeks)

Thank you for taking the time to read through this weeks SPI earnings and holding report. We post every Sunday to keep our investors up to date so please follow the account if you would like to track our progress.

Posted Using LeoFinance Beta

Nice set off numbers. As usual, thanks for taking the time to put these reports together. Looking forward to continue working on the Spin-leo funds now mostly on cub farms to build the asset base and income flow.

Posted Using LeoFinance Beta