Decentralized Finance (DeFi): Baffling To Regulators

Long term proponents of cryptocurrency and the push towards decentralization understand what power the technology wields. It is something that is often discussed, bringing to light the potential disruption.

Of course, those who are on the other side of the equation are not very impressed by it. Their world is about to be forever altered, a fact that does not sit well with them.

We see this across the board. Over the last few years, the FUD that came out of individuals in industries that face massive disruption due to this shift was enormous. However, over time, the battle they waged was proven fruitless. Cryptocurrency is not going away. In fact, it is expanding, growing, and getting stronger.

This means that what is in motion now will have orders of magnitude more impact down the road. It simply is how technology works. Once started, the effects do not decline, at least not during the growth phase. Until something else, usually another technological advancement, replaces it, we see a version of Pac-Man™, gobbling up whatever is in the way.

Source

Decentralized Finance (DeFi)

We know finance is a huge industry. It is at the core of all we do. What cryptocurrency did was create competition for the existing monetary structure. Government control was suddenly thwarted in this area.

Naturally, as development continued we saw the evolution of things. Not only was the monetary system undergoing massive change, so was the financial arena. Suddenly it had to deal with Decentralized Finance (DeFi).

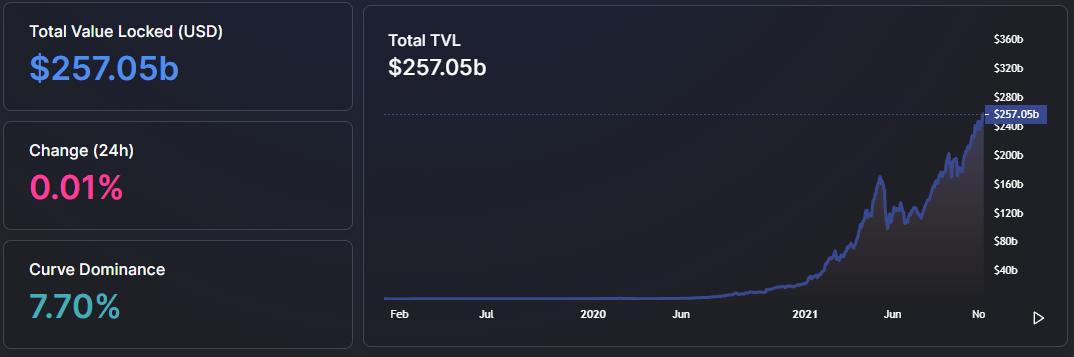

As we can see from Defillama, the total value locked in DeFi is now over a quarter of a trillion dollars. This is a number that is likely to top $2 trillion in 2023.

This cannot be positive news to regulators. While the system is still leaning in their favor, it is a situation where they are quickly losing control.

The challenge for them is the word decentralized. It is not an environment they are accustomed to operating within. In fact, we can make a case that it is completely foreign while being one they cannot excel within.

Decentralized Finance is looking to end the utility of banks along with their financial instruments. The new arena provides better returns, lower fees, and round-the-clock access. This makes savings accounts, CDs, and other types of accounts obsolete.

It is also, if done properly, outside the realm of regulators. Here we see people like SEC Chair Gensler very worried. He already called DeFi "The Wild West". This caused him to promote the idea that "middlemen" need to be instilled.

In other words, Genler wants someone to hold responsible. Of course, this going counter to the idea of decentralized in the first place. The entire concept is to eliminate the gatekeepers, something our present financial system is littered with.

The Battle Is Over

Here we see an idea that is very presumptuous. However, it is in keeping with ongoing technological trends.

Governments have failed to adequately control the financial sector for a simple reason. The minds of the regulators simply could not compete with those on Wall Street. When it comes to financial matters, the latter are geniuses.

Another factor is the way the system operates. The regulators openly put out the rules. This determines where the road is. What Wall Street does is take this and build around it. Whatever the regulators say (laws are passed), they come up with new things that are not covered. It also doesn't hurt that bankers are also very willing to bend the laws that are in place, usually receiving a slap on the wrist for their actions.

Therefore, this concept is nothing new. The difference is that, instead of Wall Street, it is the DeFi developers who will do the "road building".

We know there are a lot of bright minds involved in cryptocurrency. This provides the resources to code around what the regulators implement. By utilizing decentralized technology, it is easy to create a venue which makes regulation impotent. Gensler's idea of reigning in the Wild West is a pipe-dream.

Nevertheless, we should expect them to go hard after this entire sector. They are not about to sit back and watch it evolve. The challenge is that action will only cause their demise.

Heavy-handed regulation will create an environment where the build around concept takes hold. Developers all over the world will get to work creating protocols and applications that fall outside the reach of any regulator. As we stated many time, government, as constructed, is simply not designed to excel in the digital realm.

For this reason, it is evident the battle is over.

Sector Merging

The biggest challenge for anyone who is trying to control what is taking place is that we never witnessed anything like this. What we are referring to is the fact that a massive blending of industries is about to happen.

Regulators like things in their place. They put different industries in categories. It is obvious that the financial world is its own entity, something that a number of government agencies monitor. That is ending.

Presently, we use the term DeFi as an alternative for the decentralized financial model. This is only a temporary situation. Down the road, DeFi will not be a separate entity.

The reason for this is DeFi will penetrate everything. We are not going to see a separation. It will be in gaming and social media. All online interactions will have this component to them. Communities will be economies since there will be tokenization. Fungible and non-fungible tokens (NFTs) will be the mechanisms throughout the entire virtual world. Transacting with take place at the local level, without the need for centralized entities such as exchanges.

Also, every component, in terms of business structure, can be decentralized if desired. It is likely that nothing will be established in a centralized manner. The risks simply will be too great. At the same time, we will get to the point where something will not be trusted unless it is decentralized. Centralized entities are going to have a stigma attached to them.

There is great probability that the regulators and other controlling entities add to this while hastening the transition.

Ironic that the more they try and control decentralized finance, the more incentive they provide to develop something that just eats up the entire system.

Personally, it looks like this is already taking place. The trend already started.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

Today I was thinking about automated contracts and algorithms. What struck me was it is actually possible to implement tax in a coin or service. and you wont be able to avoid it because it would be collected at the lowest level.

On the other hand, amount of disruption it would cause - whole industries would go bust instantly. If we are talking about mass adoption then most of the accountants would be unnecessary.

Posted Using LeoFinance Beta

You can bet the governments are looking at programmable money with the intent of getting their taxes. Do not think they wont put that into the equation with CBDCs.

Posted Using LeoFinance Beta

I like that place you say that Crypto currency is not going anywhere and it have come to stay. So many people don't know that one, even the politicians,is only the intelligent one knows that Crypto currency is the game now,no one can stop it instead the government will look for a way to extort tax from them by legalizing it for them, if the government like they accept Crypto,if they like, they reject it.Just that nobody will stop us from doing crypto currency.

Posted Using LeoFinance Beta

There are some politicians falling all over themselves to support cryptocurrency.

With that happening, it is not going away.

Posted Using LeoFinance Beta

Yes because most of them have invested on it secretly

Posted Using LeoFinance Beta

https://twitter.com/taskmaster4450/status/1456626969953587200

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Would the dark web be a good example of what we can expect. Not the illegal pieces of it, but the fact that you know the government would love for it to be shut down, but it is still there running and they don't seem to have much control over it.

Posted Using LeoFinance Beta

Could be. I like to use the analogy of illegal music sharing. They can see it, know it happens, but are powerless to stop it.

Posted Using LeoFinance Beta

So if centralized entities have a stigma attached to them, are people going to start shying away from even Grayscale at some point? I guess it does make a little bit of sense since they can be targeted by a bunch of people for various different reasons.

Posted Using LeoFinance Beta

At some point the markets will be decentralized I envision. In the near and medium term that isnt going to happen.

Posted Using LeoFinance Beta

Defi might as well stand for disintemediated finance.

Basically we all cast out vote to fork the banks out when we bought our first crypto asset.

This is baked into the cake. They can kick and scream all they want but this train is going to one place only.

LOL good one.

Posted Using LeoFinance Beta

Congratulations @taskmaster4450! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next payout target is 152000 HP.

The unit is Hive Power equivalent because your rewards can be split into HP and HBD

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Check out the last post from @hivebuzz:

View or trade

BEER.Hey @taskmaster4450, here is a little bit of

BEERfrom @pixresteemer for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.Crypto is so good that it’s the worst thing that happened to the government and regulators

Well it is a piece of the puzzle but certainly a big one.

Posted Using LeoFinance Beta