Hive Bonds: The Collateral The World Needs

There is so much potential with the use of the Hive Backed Dollar (HBD). As we delve further into the topic, we can see more use cases appearing. There are some valid monetary use cases. From there, we can see the formation of an entire financial network. Here is where it is likely we can solve some major needs.

Before getting into the idea of collateralization, we need to comment about a recent change to the HBD placed in Hive savings. A couple months back, the medium of the consensus witnesses was 10% interest paid. This was changed overnight.

As we can see, the interest now being paid to HBD placed in savings was increased to 12%. This is a good step in the right direction to organically produce more HBD. If that is going to serve as a legitimate stablecoin, one of factors that is required is to get more of it on the open market. Simply put, we do not have enough to engage in commerce of any magnitude.

Another aspect of the project that likely needs altering is the conversion time. Arbitrage is a vital component of keeping the peg. Unfortunately, the risk associated with a 3.5 day turnaround is too great for most. People who arbitrage are looking to scoop up a quick percent or two. For this reason, we see the conversion time actually being a hindrance in that regard.

Hive Bonds As Collateral

The other day, we discussed Hive Bonds: The Next Step In HBD Evolution. A fair portion of this article will take from that, so it is best to read that as a primer to what is being covered here.

When it comes to collateral, there have been two problems that plagued the system. These have caused some of the biggest collapses in noted institutions such as Long Term Capital Management. These issues are what we seek to solve.

They are:

- The value of the collateral

- The ability to turn said collateral into cash

Here is why we see US Treasuries listed as pristine collateral. Neither of these is a problem when it comes to that asset. Everyone knows the exact value of a Treasury Bond. At the same time, it is a liquid market where the swapping of Treasuries for currency can occur.

The same is not true when the collateral is a Eurodollar Interest Rate Swap. Determining the value of the collateral is difficult and conversion to currency is impossible. These are basically bank instruments that get collateralized.

A major problem with the entire process is when collateral is not as valuable as was presented. When an entity thinks it is sitting on $11 billion in collateral and it turns out there is only $7 billion, we have a problem. Now, other entities end up with counterparty risk. The entire system which was "greasing the wheels" is now entering the stage of default as collateral calls are being made.

Numerous times we saw this. During the LTCM crisis, Japanese banks were exposed. Without adequate collateral, their positions were in jeopardy of failing. Of course, this is no different than the United States housing crisis that originated in the subprime market. That followed the same pattern, spreading throughout the system.

Hive Bond Solves This

The idea of a Hive Bond solves this. Here we have the situation whereby the collateral's value is always known. We have the par value which is paid out upon redemption. Thus, there is no mystery as to the return that one is receiving.

At the same time, by tokenizing the bond, we establish the ability to have a liquid asset. Without the ability to sell, an asset has diminished value. When people are stuck holding assets, that can cause a major problem. Liquid assets are always attractive since they can be unloaded, especially at times of need.

Another factor potentially addressed is the elasticity/inelasticity debate. Debt is necessary for economic expansion. We all heard the term "good debt". However, how do you provide the elasticity to give an economy what it needs to expand while preventing the participants from overindulging and entering the greed phase? Human history shows people cannot help themselves.

One solution is the idea of fixed money. The problem with this is there is no room for expansion. Inelastic money supplies hinder growth rates. After all, engineers, researchers, and computer programmers all want to be paid. Across an economy, when starved monetarily, growth disappears. Of course, an over indebted economy suffers a similar fate.

Here we have a possible solution to this issue. The fact that we are utilizing blockchain is providing a level of protection. Under the scenario described in these two articles, we can see how the HIVE/HBD link keeps things in order. The ability to massively expand the debt is tied to the conversion of HIVE-to-HBD. Outside the proposed interest rates, that is the major generator of HBD. This, naturally, has an impact on the amount of Hive Bonds created.

This is a serious subject. We are starting to see platforms pop up that utilize NFTs as collateral. It is easy to see how this might not end well. How can anyone reasonable put a sustainable value on an NFT as a collateralized instrument? Certainly it can be done yet it adds in another level of uncertainty. A NFT could easily be worth 50% less in a few months.

The concept of a NFT is similar to the idea of using Bitcoin as collateral. While the later is certainly with much less risk, the volatility is still an issue. Bitcoin can swing widely. While this helps traders, it does not provide a good basis for collateral. This is where entities could find themselves having to provide more collateral if the price drops. That is not a problem, unless more is not available.

And when things go back, this is often the case.

Expansion of the HBD Supply

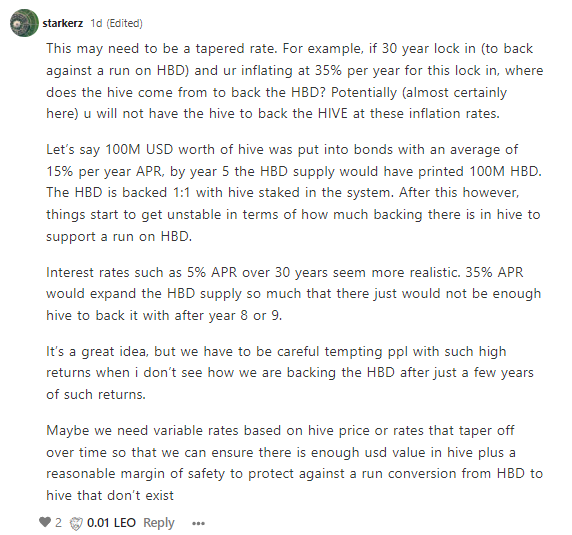

There was a comment that was left by @starkerz in the previous article that fits into this. We need to keep in mind that part of this is to assist HBD as a stablecoin. Therefore, according to the outlook on the stablecoin market, we need to internalize exactly how much is needed. The numbers are going to get into the tens of trillions at some point. Major players will need hundreds of billions in stablecoins at a minimum.

These are some valid concerns. However, it seems to be overlooking the fundamental tie between HIVE and HBD.

The idea there will never be enough HIVE to back the HBD during year 8 or 9 is impossible. HBD is always worth $1 worth of HIVE. Hence, the amount of HIVE can move up or down per HBD but it is always there. Why is that? Simple supply and demand.

If, for example, during year 5, the amount of HBD is massively expanded, how is that not backed by HIVE? When people start to trade HBD for Hive on the open market, what happens to the price of HIVE if there is a huge run? Obviously the price goes up. So if, using the example provide, $100 million was out there and everyone wanted to get HIVE, the buying pressure would explode.

Remember, HBD is a stablecoin. That means it is no different from Tether, USDC, or any other payment currency. If there is $500 million worth of USDC trying to buy HIVE, is there enough of it out there? Of course. The price simply goes up. It is easy to get caught up in the "backing".

We also know that not 100% of the HBD is going to be turned into HIVE. In fact, it is safe to say that much of what is produced will end up either reinvested into the funds or used elsewhere. The later will arise as more sinks for HBD are established. Not everyone takes a currency and turns it into a speculative asset.

We already see this in operation to some degree on Hive. How many people take all they earn and swap it into Hive? Do we not see the vast majority on Hive-Engine receiving payouts and buying whatever tokens interest them?

It only makes sense HBD payouts, regardless of the source, will follow a similar path. Some will reinvest in a bond while others might buy Bitcoin with it. Having a payout in a stablecoin means all purchases are on the table. Hence, it is likely very little of the HBD created will end up going toward HIVE.

As always your comments are welcome. We have the opportunity to develop a major financial platform at the base layer of Hive. Due to the relationship between HBD and HIVE, we can do something that nobody else can. The fact both of these tokens resides at the base layer is crucial. None of this is operating at the second layer until we get to some of the lending or exchanges. Consider how powerful that is.

Hive's ability to expand utilizing its own base-layer, algorithmic stablecoin offers something very unique. For this reason, it is worth a great deal of attention to expanding what is possible. The ability to collateralize means that an entire financial system can be built upon liquid and easily valued assets. Not much offers that potential in the cryptocurrency world from what I can see.

Let us know your thoughts.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

@pixresteemer(5/5) gave you

This is some serious hive tokenomics there, I use to actually believe we need a little above 10% to actually raise the interest of people on saving HBD, but from what I've gathered here, it's only the right proportion that would keep it as a stable coin.

Posted Using LeoFinance Beta

The bottom line is, if anyone wants HBD to be a true stablecoin, a lot more of it is needed and we need more focus upon it. One of the key ways is to get more distributed. Jumping the payouts to 12% is a help, but there is very little in there.

Yet it is moving in the right direction.

Posted Using LeoFinance Beta

Well, I guess there's a lot more to tweak to actually call it a stablecoin, but I think 12% is great, like it's better, not even from the dividends aspect alone.

Posted Using LeoFinance Beta

12% Hey!! This sounds better than a 6% annuity. Hmmm I like where this is going. Looking Good HBD! Looking good.

Posted Using LeoFinance Beta

Yes better the what a savings account at the bank pays.

Posted Using LeoFinance Beta

12% is very good news!

The inflation in US is about 15%

We should have savings percent more than that!

http://www.shadowstats.com/alternate_data/inflation-charts

Vote for @good-karma He has it right

Didnt you say below that if we print it, HIVE will inflate to the moon and that we cant just print it.

Yet that is exactly what you are doing?

Posted Using LeoFinance Beta

Yes, but I think there is difference between 15% and 35%.

There is a point somewhere, between those numbers, when the more percent makes more harm than good.

Listening fresh CTT now. If there will be a requirements to stake HIVE for bonds somehow for 30 years. It should work.

If I understood it right, it should be great.

Agree it's has second layer with 0 txn fee just some fee for swap

The HBD is really a good investment for the future.

Not clear where from these bonds payouts came from. We can't just create it from air.

I think it is what @starkerz mean.

If we just print it, it will increase HIVE inflation to the moon.

We can just create it from thin air, however, it MUST be backed by an equal dollar value of hive which the community puts up as risk collateral in exchange for some HBD inflation. I just think these inflation numbers need to be very very low. Others may think they need to be high. It said inflation is high in not sure what we guarantee the HBD is backed with

No kidding! I didn't even notice that until you mentioned it. I kind of just tuck my HBD away in a set it and forget it kind of mindset. That is pretty awesome. It also adjusts my target. I will have to do some recalculating. My goal is to be pulling in at least 1 HBD per day.

Oh, the whole Bond thing is an awesome idea too. You should write a proposal, I'd vote on it!

Posted Using LeoFinance Beta

It's back down to 10% but I think that is a fairly realistic goal but I was thinking of adding more to my savings so it can be considered a good passive income source. Then again I am a bit confused if it's better to put some into the BUSD/HBD diesel pool to get BXT and get liquid HIVE everyday.

Posted Using LeoFinance Beta

BXT is very attractive right now for sure. I am trying to figure out how I can maximize my earnings of that token too.

Posted Using LeoFinance Beta

At some point that might be an option as a voting mechanism. Obviously, this is all part of the core development team's responsibility since they handle the coding. So we would need to get that in the funding.

But as a voting to show if the community wants it or not, with zero payout, I might do that.

Posted Using LeoFinance Beta

If you do that and it is on the weekend or something and I don't see it right away, be sure to give me a nudge. I will circle back around and vote on it for sure.

Well I think we would need to understand the system a bit more. I think the current system has a cut off limit for when HBD gets too high and we are nowhere near the current haircut limit. What happens to the interest if we are above the haircut? Would the bond return liquid HIVE instead of HBD?

Posted Using LeoFinance Beta

As it stands now, yes the payouts would be in HIVE instead of HBD as I understand the system.

However, the haircut would have to be raised, something that scares people. However, if you look at the numbers, there should be plenty of room to run. The simple fact is that the expansion of HBD would take 20 years to even become a fraction of USDC.

Posted Using LeoFinance Beta

Hmmm, you are saying if everyone wanted to exchange their HBD for Hive, the price of Hive would go up. But if right after that people sold their Hive, then they'll push the price down. And if there are tons of HBD, it means tons of Hive being sold. If people do sell the Hive.

But what if they don't sell the Hive? This could be interesting to think about. We could envision scenarios of HBD payouts, as you mention. For example, if people who stake Hive are given HBD as reward, this makes things pretty interesting because as a stable(-ish)coin HBD provides a guaranteed income. No matter bull or bear market, you get your HBD rewards if you stake Hive. And why would you sell your Hive if it gives you stable guaranteed income? The question is, can the income be independent of Hive's price?

That is true but if they are swapping HBD for HIVE, why sell immediately after? Why not just sell the HBD for whatever is desired? HBD is a token and can be exchanged for whatever people want. I know the exchanges carrying it now is limited but there are a few. If one wants Bitcoin, send the HBD to an external exchange and buy Bitcoin.

People do that now although not for HBD but for more HIVE. Power up and you get paid a but under 3% on your HIVE.

Plus what you describe could be a second layer solution. There is no reason why a liquidity pool cannot be started using HIVE and pay out rewards in some type of token. It wont be HBD necessarily but staking HIVE for a token is possible.

No reason that needs to be at the base layer.

Posted Using LeoFinance Beta

Well, even if you sell the HBD for something else, then the person who gets the HBD has to also sell it for something else rather than convert to Hive and sell the Hive. And yes, that would be great and I think we can have it with an internal HBD-based market for all kinds of goods and services.

Having an HBD-backed bond would create more liquidity because the bond locks in the HBD for a certain time period.

Is this different from a general liquidity pool, because a Bond has a maturity rate over a number of years, whereas a liquidity pool may only lock for 90 days or so?

I think that is a great feature, has anyone said how much coding it would take?

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

I was happy with 10% and now that it’s 12% I’ll be converting even more.

Posted using LeoFinance Mobile

What is the point of the 5% fee when you convert Hive to HBD? That artificially creates the cap at 1.05, but if the fee is removed, it should tighter the peg, no?

Had not noticed it moved to 12% it sounds like Inflation will be better shaded on the Hive blockchain...

Impressed to see that only a year ago, the medium of the consensus witnesses had raised drastically (nightly) and the interest then paid to HBD placed in savings was increased from 1o% to 12%, we didn't know that but we realize that now, a year later, it's at 20% min.

About the APR rates that might be too high/hives for HBD? Would regular campaigns of attracting ppl to the Hive with more examples of success like case studies of people starting and the possibilities of earnings through the hive and collaterals?

Let's say a user starts with a small amount of 90 USD value in Hives which goes up to 140 USD or more or less in less than a month.

That might attract some hive buyers like those who never heard about @steem before and @hive now, and it's true, it happens, anyone can do it, would just need to show and share it in proper recruiting campaigns as a social decentralized network that allows getting rewards, APR etc, make cash instead of FB and others whom enrich themselves with our same shares, comments and posts.

About "it is likely very little of the HBD created will end up going toward HIVE."

Isn't advised when the Hive is under the USD to swap HBD to Hive? and vice-versa? Sorry if my understanding isn't right! We are learning!

Posted Using LeoFinance Beta