The Crypto Market Cap Will Need To Be $100 Trillion By 2030

We entered a new era earlier. The total market cap of cryptocurrency, as monitored by Coingecko, crossed $3 trillion. This was the first time it did this and certainly is considered a milestone.

This is something that is very important for the future. We need to see this number keep growing at an accelerating pace. In other words, it is vital that the build out of this industry happen at a greater rate each year.

While most look at this as a way to enhance their wealth, since they view cryptocurrency like they do the stock market, there is an even bigger need. Quite simply, the money is going to be required.

Since money is a tool of collaboration, the rest of this decade is going to necessitate a lot of it. We are facing down a very power entity that cannot be avoided. For the present moment, it is hidden from most yet, by mid-decade will be evident.

Technological Era

Few would dispute we are in a technological era. This would be especially true for those who are involved in cryptocurrency since that, along with blockchain, is a technology.

Mainstream publications are filled with articles about autonomous driving, AI, robots, renewable energy, mixed reality, rockets, and global satellite. These are just a few of the technologies which will advance throughout this decade.

We also are seeing discussions about the impact of this on employment. Many are realizing that the push towards automation is increasing. Since the lockdowns due to COVID, companies selling warehouse robotic systems, RPAs, and in-store AI are reporting huge upticks in orders. Everything associated with these segments are seeing higher estimates sales forecasts through the middle of the decade.

For those who were paying attention, however, this is likely not something new. In the United States, the participation rate has declined over the last few decades. Even since the reopening, we see the workforce is seriously below where it was. In other words, we are a long way from full-employment which is one of the mandates of the Federal Reserve.

.png)

What is means is that a case could be made that the long-term impact of technology is being felt. The reduction in the workforce does not equate to the same in productivity. When we look at manufacturing output, we see the continued march to new highs.

.png)

This should come as no surprise. Technology allows us to do more with less. Simply look at an automobile manufacturing place in the 1960s and compare it to today. Back then, we saw a large plant employ 30,000 workers, operating 3 shifts. Now, most of the plant is robots with only a few thousand human workers.

The challenge is we are seeing this in the white collar world also. From the worker perspective, this is dangerous since it is moving at an even faster pace than what took place in manufacturing. After all, it is far easier to write a software program than deal with the dexterity issues of multiple robots operating on a line together.

We also know the impact of technology on personal items. Just think about what we use to spend money on yet are now basically free.

- Cameras

- Road Maps

- Music

- Video

- Long Distance Phone Service

- Stock Trading Fees

- GPS devices

- Music/Video Players

- Gaming Cartridges

- Camera Film

- Information

- Classified Ads

- File Storage

- Stamps

We also saw technological innovations such as Uber and Airbnb radically alter their specific industries. The rest of this decade will likely see radical advancements in construction, transportation, personal monitoring healthcare, and energy.

None of this works to increase prices.

More Money Is Needed

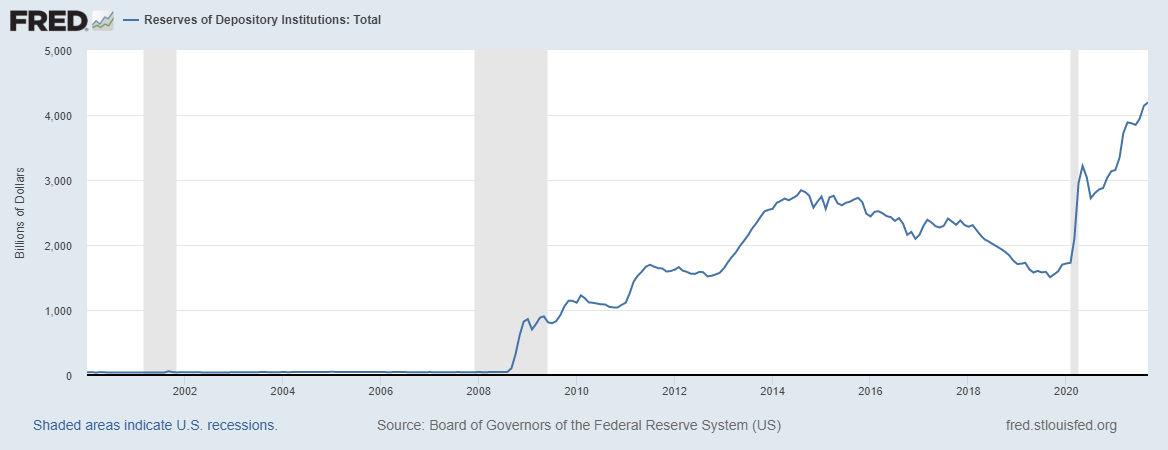

Quantitative Easing is a subject that is misunderstood by many, especially when it comes to the Federal Reserve. It seems counterintuitive to state more money is needed when the central bank is on its umpteenth round of QE. Yet that is exactly what happens.

The challenge is that the liabilities of the Federal Reserve are not legal tender. Thus, what is generated, even though part of the M2 calculation, does not operate in the economy. In fact, it is illegal for anyone other than depositing institutions to even have this on their balance sheets. At the same time, the asset is resident at the Fed even though it is on the commercial banks balance sheet.

Since the Federal Reserve has been easing for a fair portion of the last decade, it is no surprise to see this "money" explode. Here is what it looks like.

.png)

At the end of September, almost $4.2 trillion was on the depositing banks balance sheets yet housed at the Fed. This is money that cannot be used for salaries, do stock buybacks, or pay taxes. It is no wonder the Velocity Of Money continues to fall off a cliff.

In spite of the recent announcement that the Fed is tapering, it is unlikely this will be for long. To start, they are still easing which means the above chart will probably keep growing. Even if it contracts in the near-term, the medium horizon is going to see expansion.

The reason: technology.

Technology Breeds More Technology

Quite simply, the most valuable companies in the world are all technology related. When we view at the most list, we see the likes of Microsoft, Apple, Google, and Amazon. These companies invest large sums of money in R&D.

At the same time, we have tens of billions of Venture Capital money in Silicon Valley and Austin. We also see the same thing in cities such as Seoul and Tokyo. Globally, technology investment is exploding.

The challenge is that technology simply breeds more technology. This creates a continuous loop. As people spend more money on technology, these companies grow in size. Their ability to invest in R&D expands. Ultimately, more is brought to market as a result of all the money floating around. This drives down the prices of things over time.

As we progress forward, there is one other thing for certain: the technology beast is only going to get hungrier. We are not going to see this arena take a step backwards. In fact, during the pandemic, when the global economy collapsed, who benefitted? Technology companies

This is a cycle we saw often throughout the last 100 years. During times of economic contraction, those the most technologically advanced ended up profiting.

How much money is required? The United States, in one of the spending bills put forth $52 billion for semiconductor subsidies. While this is a lot of money, consider the fact that Intel and TSMC are spending $30 billion on the construction of 3 plants in the United States. This does not include other projects taking place around the world.

When we realize that currency is a tool for collaboration, it is easy to see with the numbers that technology requires, things get very big. We also can see how the will is not there to fund it all.

This is where cryptocurrency is going to have to step in. We are likely to see the need for $25-$40 trillion used by 2030 for the funding of technological projects. There will be massive opportunities for returns that investors are going to want to partake. However, it is going to require a great deal more liquidity than is being offered up.

Today, most are focus upon yield farming. By the end of the decade, we will see cryptocurrency used to fund rockets, fusion energy, build solar farms, study cancer, and advance our communication systems. This is a beast that will just keep growing.

In this era, more money equates to expansion of technology. For that reason, the market cap of cryptocurrency will need to be $100 trillion by 2030.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

Blockchains simply brought freedom in the technology space and empowered end-users through decentralization in the form of cryptocurrencies. I think we are just in the beginning of things and after many projects will find their ways (after multiple tries and protocols changes or adoption), we will see things truly taking shape.

Posted Using LeoFinance Beta

I agree. We are only at the beginning of this adventure. There is still a ton of development left to take place. I dont think people realize how early on this truly is.

Nevertheless, it is all going to change things completely. The time to 2030 is a long time in the development world. To think, 8 years ago was the end of 2013. Where was the industry then?

Posted Using LeoFinance Beta

Someone on Hive used to say: try and fight technology at your own risk 😁.

Just saw on twitter that Bitcoin is the sixth largest asset by market cap in the world.

Bitcoin is technology...

Posted Using LeoFinance Beta

There are all different ways of looking at it.

I believe however, that is misguided. We will get to the point where we start to compare cryptocurrency values to countries.

These platforms have their own economies. We should compare them to other economies.

And yes fight technology at your own risk because you will likely lose. The track record of those going against it is not good.

Posted Using LeoFinance Beta

Recently even https://www.coingecko.com was down. I use it instead of CMC. They are getting so much attention. Crypto is pretty much mainstream now. There's no doubt about that. We just have to wait for some adoption :)

!PIZZA

Posted Using LeoFinance Beta

Perhaps Coingecko needs Intel and TSMC to speed up their production of chips. Perhaps it is not enough processing power. 😁

Posted Using LeoFinance Beta

They need to be hosted on decentralized way with P2P data transfer to handle high volumes. It'll be like torrents. More people try to use the site - easier it'll be to load fast :)

!PIZZA

That is way beyond my technical understanding but it seems logical to me. Host your site like torrents.

Posted Using LeoFinance Beta

PIZZA Holders sent $PIZZA tips in this post's comments:

@d-zero(5/10) tipped @taskmaster4450le (x1)

d-zero tipped taskmaster4450 (x1)

Learn more at https://hive.pizza.

https://twitter.com/taskmaster4450/status/1457735585976786945

https://twitter.com/Hivebull/status/1457820919389429766

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Many companies are now investing in Crypto currency. In upcoming year, company will be funding by using Crypto currency. Many things will be easy to buy with crypto currency.

Posted Using LeoFinance Beta

How long do you think it will be before automation starts finding its way into commercial kitchens? With the massive shortage in restaurant staff, it will be interesting to see how long it is before my steak is seared to a perfect medium by a robot.

Posted Using LeoFinance Beta

It will be a rather rapid, albeit evolutionary, process. I think fast food gets automated first since it is a lot of repetitive stuff.

We have heard about "dark kitchens" for years. Perhaps with the labor situation companies will make that a reality.

It is going to be interesting to see how quickly then can convert it over. IBM and McDonalds are teaming up to automate the drive through with AI.

Posted Using LeoFinance Beta

Very interesting. It is crazy to think that one day a bar burger cooked by an actual person might be considered artisan and cost a pretty penny!

Posted Using LeoFinance Beta

LOL that would really be an appreciation of low end skills.

Perhaps that burger could become a NFT also.

Posted Using LeoFinance Beta

Muy interesante tu artículo es sorprendente como la tecnología influye e impacta cada vez mas en nuestro estilo de vida

It would be nice to see blockchain and crypto funding everything but I think it will take a while longer. After all the governments are doing everything they can to block crypto from being more main stream.

I think I heard that the tapering was being offset by the treasury bills being issued but I could be wrong.

Posted Using LeoFinance Beta

It's crazy to think that we NEED a market cap of $100T, and that need has nothing to do with greed or artificial scarcity. We need abundance within an economy of abundance, that much should be obvious.

However, it's even more crazy when I realize we will probably surpass this target by x10 and have a Quadrillion dollar market cap before the end of the decade. In fact, even Bitcoin alone may hit this target, as the doubling curve allows us to go x1024 (2^10) every decade and we are already firmly at $1T market cap with BTC by itself.

It could although it depends upon how much a lot of other asset classes end up tokenized by that time.

For example, will the SEC and other government agencies screw around with security tokens and prevent them from becoming a part of the financial system? If so, that might delay them until the decentralized infrastructure is in place, and then unleashing them during the second half of the decade.

Plenty of wonderful possibilities in my view. We will see a lot of appreciation along with a great deal more added.

Fun times ahead.

Posted Using LeoFinance Beta

it might be more than this

It could be if there are a lot of other asset classes tokenized.

Posted Using LeoFinance Beta

agree and it's possible to do

What a helpful article. Thanks for sharing this. ☺️

im new at this(crypto) and this seems pretty awesome.

Welcome @Layfon.

Leofinance is a great place to learn and get your feet wet with crypto.

Posted Using LeoFinance Beta

ohhh thanks. ill follow hope to read lots of article from you guys

I still think we are at the beginning of this new market. So many possibilities with crypto, blockchain, and smart contracts.

Posted Using LeoFinance Beta