The HBD-HIVE Connection: There Is Nothing Like Hive In The Blockchain World

Hive is a unique system that is not duplicated anywhere else. Even Steem, the chain from which is was forked is out of date compared to Hive.

When people look at price, the compare it to other blockchains that are out there. We need to make this clear: there is nothing like Hive in the blockchain realm. For this reason, the coin is going to see levels unimagined by most.

In this article we are going to lay out the basic features that make Hive different as compared to all other systems and how this is designed to keep driving value to the main coin.

Access Token

This is something we discussed on a number of occasions but we can go a bit deeper.

To engage with the blockchain, the coin needs to be staked, or powered up, to create Hive Power. Through HP, we get resource credits, which is a non-tradeable, virtual currency is part of a system that quantifies activity on-chain.

It can be thought of akin to a transaction fee. That said, there is a basic difference. Coins used to pay fees like on Bitcoin are part of the free floating circulating supply. With HP, those are coins locked up with a full power down taking 13 weeks.

Here is the key: as the activity on-chain increases, requiring more Hive Power, there will be less of it on the open market.

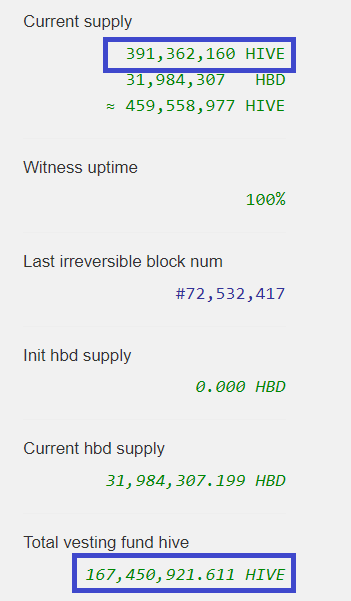

Pulling the data from Hiveblocks, this is what we see:

At present there is 391 million $HIVE in total. We are looking at 167 million staked, or 41%. This is obviously more than enough, at this time, for everyone to transact. The addition of Resource Credit Delegation means that larger accounts, especially applications, can provide other users with the RC they need.

However, there will come a time, if activity keeps increasing, where the amount of $HIVE powered up, as a percentage, will keep increasing. This naturally means there is less in the floating supply.

It is the basic mechanism of the blockchain. Unlike a coin that can be sent back and forth, RCs, once spent, are gone for a period of time. For example, on Bitcoin, the fees can be send this moment to the miner. Once that transfer is complete, the miner can use the fee to pay for a transaction it has.

That is not the case on Hive. If I send HBD to a wallet, it uses some resource credits. For the other person to give it back, he or she needs to use some of the RC tied to that wallet. Hence, both are down that amount until it recharges.

Take this concept and push it across tens of millions of transactions.

Here we see why some took to calling Hive digital real estate. Hive Power is what allows one to add to the database. If this becomes something that people want to utilize, we can see how scarcity starts to enter the picture.

Hive Backed Dollar

The Hive Backed Dollar (HBD) creates an interesting situation.

This is Hive's stablecoin that is backed by $1 worth of $HIVE (as long as the ratio is below the haircut rule). It is created through 50/50 payouts on comments or posts, conversion of $HIVE, and interest paid in savings.

We have 31 million HBD in total yet 20 million are locked up in the Decentralized Hive Fund (DHF). This means we have an effective floating supply of 11 million. For the moment, this is not much of a problem but it could be in the future.

Over the last few weeks, we got work of a couple interesting projects unfolding. One is the ability to pay for one's electric bill in Cuba using HBD. Another is the more than 1 dozen businesses in Sucre, Venezuela that are now accepting the currency for payments.

In other words, we are seeing use cases being generated in different parts of the world. The free float is actually less than 11 million because the amount in savings keeps growing. This is technically on the market yet many are using this as a fixed income instrument and not truly as a savings account.

Therefore, we have only a few million HBD truly floating on the open market. If there are more demand either through addition use cases (more businesses in Sucre) or more people using it, we will need a lot more HBD.

Here we start to tie back into the value of $HIVE.

Like was discussed, any transaction on-chain requires Resource Credits. Thus, any payment using HBD requires HP in the wallet (or RC delegation). Here again, we see the potential for demand as more people utilize it.

The other characteristic is that, to create massive amounts of HBD, the conversion mechanism has to be used. Putting HBD in savings pays 20%. Even if 10 million was in there, that would only be 2 million HBD created in a year. What is the market demand was for 5 million HBD? That is a 2.5 year process.

With the conversion mechanism, that can be created in a few days. The key to this feature is by converting to HBD, $HIVE is removed from the market. This means whatever the unstaked amount is, we will see is decline.

Please take note of this relationship. The connection between HBD and $HIVE is not duplicated anywhere else. Recent attention to HBD has made it rather stabl-ish on the open market, something SBD does not have. Of course, if we look at ETH, there is no correlation to USDC other than the fact the former is required to pay for transactions on-chain.

Thus, any success of HBD is going to translate over to $HIVE. As things grow, there is guaranteed to happen since it is inherent in the design.

New Metrics

People look at the inflation of $HIVE and worry about that. To me, this is missing the bigger part of the picture.

Instead of worrying about the inflation rate of $HIVE, determine the rate of staking versus the total. This changes the equation to focusing upon the growth rate. If Hive is growing at 25% per year in terms of the activity, that means we are going to need 25% more RCs (roughly) than the year before. If everything is equal, this is 25% more HP.

This far outpaces the roughly 7% inflation rate of $HIVE as coded into the blockchain.

What happens when demand is increasing while supply decreasing (if being converted to HBD)? Obviously there is only one direction the price can travel. Of course, this is an advantage because, as that happens, more HBD can be created from each $HIVE coin.

Suddenly there is more opportunity to penetrate different parts of the world with our stablecoins since more will be available.

All of this will help to fuel the Hive economy.

And it all starts with the network effect generated by on-chain activity. Here we see the kickoff of a circular feedback loop that allows for everything to expand and grow.

It is also something that is not duplicated in the cryptocurrency world.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

https://twitter.com/1331330355513745413/status/1628398487988580352

https://twitter.com/1884771912/status/1628428244604055553

https://twitter.com/494429019/status/1628529277376385030

The rewards earned on this comment will go directly to the people( @taskmaster4450le, @shiftrox, @successforall ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

https://leofinance.io/threads/@globetrottergcc/re-leothreads-2y7hkgezu

https://leofinance.io/threads/@adambarratt/re-leothreads-s4jut8kn

https://leofinance.io/threads/@bradleyarrow/re-leothreads-24pb7b

https://leofinance.io/threads/@shiftrox/re-leothreads-2wps6xtwm

The rewards earned on this comment will go directly to the people ( @globetrottergcc, @adambarratt, @bradleyarrow, @shiftrox ) sharing the post on LeoThreads.

Hive is a whole new level!

Seems like a very efficient ecosystem between Hive, HBD and RC, each one provides value to each other and cant live without the other one at the same time creating demand by not letting users go wild in activity within the network without having HP or RC depending on the situation, is there a place where someone can see all this metrics like HP locked, chain activity or all this has to be pull from the blockchain by running some scripts?

There is an interconnectivity that is very valuable. We are going to see the feed back loop continually moving up in my opinion.

It just starts with getting transactions going. Activity is what will spring it all.

Posted Using LeoFinance Beta

My second ...

Posted Using LeoFinance Beta

As always, very educational and informative 👍

Thank you.

!BBH

!CTP

@taskmaster4450! Your Content Is Awesome so I just sent 1 $BBH (Bitcoin Backed Hive) to your account on behalf of @bradleyarrow. (8/50)

Do you have any idea how many more transaction the chain chain handle at the current levels before RC scarcity becomes a thing? I know it is complicated but just a ballpark?

Posted Using LeoFinance Beta

Hard to figure exactly because as the chain gets busier, it is likely the cost of RCs head up.

Plus there are different transactions. For example, claiming accounts uses up a lot of RCs as compared to a comment. That is the equivalent of about 7,500 HP.

So not all transactions are treated equally.

Posted Using LeoFinance Beta

I haven't really seen the RC market blow up like I thought it would. Is it just because we still have so few users? The way it was touted I thought RC delegation was going to be a huge source of passive income. It just doesn't feel that way yet though.

Posted Using LeoFinance Beta

There were adjustments during the last HF. Some things actually went down but custom JSON prices did move higher.

I think the gist is correct, not enough activity on chain.

LeoThreads should help to start the process of eating up some RCs.

Posted Using LeoFinance Beta

That would be cool. I am more than willing to rent out some RC's, but it has to be worth it for me.

!PGM

!LOLZ

!MEME

Credit: pirulito.zoado

Earn Crypto for your Memes @ HiveMe.me!

I think the RC mechanism is rather unique on the Hive blockchain and as more dapps are built on it, the underlying asset will eventually increase in value. Applications will scoop up most if not all of the free floating Hive.

It is unique and very powerful. We can see things moving higher over time because of it.

Posted Using LeoFinance Beta

Great simple breakdown of the mechanics

Posted Using LeoFinance Beta

There is nothing like a hive and it is obvious that development on blockchain like a hive is just out of this world. The future is bright let's just keep accumulating

Posted Using LeoFinance Beta

Activity is going to be key.

Posted Using LeoFinance Beta

Users should not be afraid of inflation, which is only a few percent per year. Any active user increases his stack much faster.

It looks great for HBD and HP but I wonder if account creation tokens will be very useful in the future or not. I am still collecting one each week or so but I don't know if it will be that worthwhile. I do think RCs will be more important in the future and there isn't anything else I need the RCs for right now.

Posted Using LeoFinance Beta

Inflation is never an issue to one's currency or token, I heard many people got corner on the inflation before Hive forked from Steem but obviously they only think about how to grab quick money in short term and never think about build up their portfolio on Steem in the past. Just look at the US dollar, their inflation is bloody high in the past 10 years but with the Dollar Hegemony in the world, US dollar is still the most popular current in the world.

Same theory applying on hive, when more and more people get involved and using Hive and HBD in their real life, who care about the inflation of the Hive?

It's exciting to seeing many people move to here Hive from Steem and more newbie directly join Hive, well, at least I invited some of my friends and family members to join, some of them don't write blog daily but Hive has come to their attention which is a good starting on crypto currency world.

Above is personal POV on the hive and the crypto current, hope you don’t mind if it’s too stupid as I am in crypto world for less than 3 years only.

This job is so good, it deserves TWO Booms

.

More info why you see this.

Posted Using LeoFinance Beta

I think, until there is more adoption of $HBD as a form of payments in the real world, we won't have to really worry about the supply outstanding of the stablecoin. However, if there were to be a concerted effort, much like what Strike has done with cross-border payments, within Latin America (and Africa), $HBD and $HIVE could absolutely explode in tx volume and necessitate an expansion of the supply.

Posted Using LeoFinance Beta

All Hive needs now is just a little bit of mainstream acceptance but going against the tide is not a mainstream idea so it will take a while.