The Hive Financial Network - A Proposal

Please keep in mind this is not a proposal for the Decentralized Hive Fund. Instead, it is an idea to discuss and to illustrate some of the future paths for Hive. At this point, much of the infrastructure for something like this is still being built.

There is a lot of news of late regarding Kraken and Coinbase. Both those institutions are now determined to transform the financial system. Obviously, they are seeking to put themselves at the center of it, basically replicating the centralized system yet using cryptocurrency.

On Hive, we have a different viewpoint. We are believers in decentralization and, for the most part, distribution. While a revamping of the financial system makes sense, few of us agree that the primary focus should be another centralized system. Therefore, it is crucial we start to consider how we can build the required features on Hive.

Much of this article stems from Introducing The Hive Financial Network.

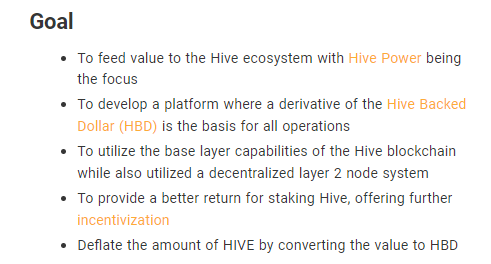

Hive Apiary

Placing decentralized finance at the center of what we do is not a bad idea. Hive has a powerful system in that the social media side of things can be a feeder into the world of DeFi.

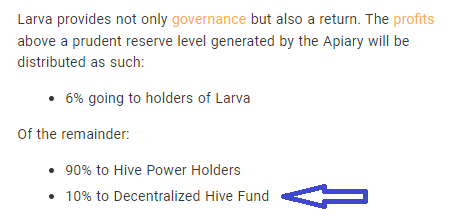

At the core of this is the Apiary. This is the DAO that would be established from which all could spring. It is a profit center that was funded by the DHF, provide a return to Hive Power holders, along with continually feeding the DHF with a portion of the profits.

If you haven't figured out by now, Apiary is being used in lieu of another term. However, it is no much different than what Kraken and Coinbase are proposing. We are looking at provide valuable financial services in a decentralized manner. This includes the ownership by utilizing a DAO. Hive already exhibits how this works with the DHF.

A New Business Structure

Coinbase is proposing building a DEX in response to the collapse of FTX last year. This is interesting since this is what we are doing with Honeycomb. While it is starting off limited, the idea is that we can keep growing these at time passes.

Of course, the headline of the article tells us all we need to know: Coinbase and $20,000,000,000 Hedge Fund Backing New Decentralized Crypto Exchange.

A DEX that is funded using venture capital money. How is that decentralized?

What the Hive Financial Network is the idea that all that is being proposed by the likes of Coinbase is possible within this. Hive can construct all of it in a decentralized manner with the community, Hive Power holders, being the beneficiaries. At the same time, the DHF can have a revenue stream as it partakes in the profits of the Apiary.

Larva is just the name of a token that is airdropped to HP holders based upon a snapshot. This is the governance token applied to the Apiary. It also entitles one to a percentage of the proceed from that entity.

Super Charging The Circular Flow Of Value

$HIVE is a value capture token. That means whatever is create tied to Hive should be captured by that coin. Naturally, markets aren't perfect and we can see price will not always match.

Nevertheless, when looking at a system like this, we can see how financial services benefit the users but the proceeds are directed towards Hive Power. This will enhance the return while also providing incentive for people to hold it.

Why should mega-venture capital companies extract the value from the formation of these services? That is exactly what will happen. Under the scenario they propose, the application might be a DEX but the value flow is anything but. It is going into the hands of a small group of people.

With the Hive Financial Network, those with Hive Power benefit. Of course, unlike VC firms, anyone can get involved. Simply being rewarded in HP or buying it gets one in the game. Here is where distribution is crucial. Hive, through the PoB mechanism has a way to continually distribute coins to newer people.

Driving value to $HIVE opens ups a host of possibilities. One of the keys is the value is the backing for the Hive Backed Dollar (HBD). This means we have a more resilient system with higher priced $HIVE.

Of course, this is a major feather in the system.

HBD As The Core

HBD would be at the core of the Apiary. Actually, it would be a derivative of this since much of this operates at the second layer, at least initially. If the community decided to integrate the Apiary to the base layer at some point, that could be done.

The HBD derivative would be the pair for any token exchange along with the one used for any financial services. This would be handled by the Apiary as HBD would be locked, creating the wrapped token. In the last article, we called this sHBD.

Having a 1:1 backing means the availability is constant. The value is split between $HIVE and HBD, with sHBD being the transaction token. This helps to create a layer of defense for HBD. If sHBD is attack, the base layer coin is still safely tucked away in savings (or a time vault).

What happens if we need a billion sHBD for financial funding? This might seem absurd but it is not.

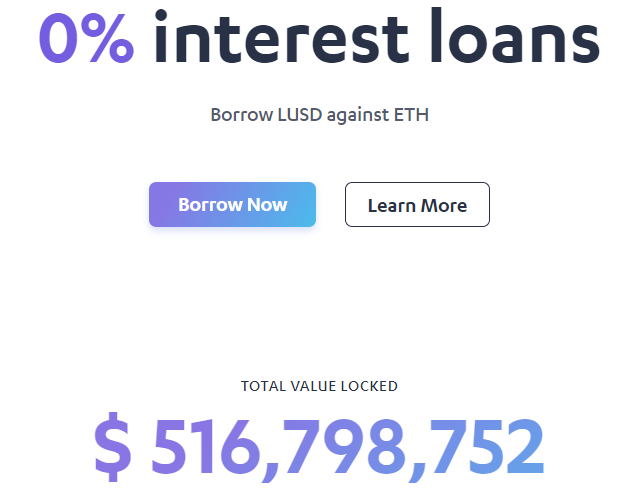

Did you ever hear of LUSD? This is a stablecoin tied to a staking project on Ethereum. It seems relatively new. Here is the total value locked in that lending platform.

Source

This is not necessarily to advocate that project as much to illustrate how the numbers can get large rather quickly.

A billion dollars in lending is nothing. That is where the utility for HBD is much greater in the financial realm. While commerce is vital, and having HBD (or derivatives) as a medium of exchange is of greater value, the numbers for finance far outpace those of payments.

With HBD, we want to focus upon both.

What does a financial network that has HBD at the core do for the value of $HIVE? To look at it another way, we actually need the value of $HIVE to go up significantly due to the haircut rule.

To match the amount of LUSD, if we were using HBD, the total market capitalization of $HIVE would need to be $1.7 billion. That is if we use the 30% level where no more HBD is created.

Do you see how financial services of this nature could really accelerate the value of the entire Hive ecosystem?

It is a positive economic feedback loop on steroids.

Of course, we have under 30 million HBD. How would we get 516 million? The answer is obvious.

Time To Give Serious Thought

It is time for everyone on Hive to give serious thought in this direction.

We have an opportunity to really alter the way finance world. By using assets on Hive, both the ones now and what we create in the future, we can see how a DAO type can replicate what is being built by the VC firms yet completely changes the ownership structure.

As stated, we are still awaiting infrastructure being built. However, it is never too early to start working in this direction.

Please give any feedback in the comment section below. Discussions like these have to take place. We know the need is out there and even the likes of Ethereum is not filling it in a way that aligns with the industry.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

Hive is an ideal base and has all the basic tools for the future "Facebook of crypto".

The company that will be able to mix the social interaction of hive blog with a marketplace and an advertisement system will break the bank, period.

Accumulate followers by posting engaging content and then sell them merch. The model works perfectly on web2, so why not on web3.

However, the question is : do we want that ?

A combination between my socials + business + marketplace would be amazing. Hive already has people who are pretty proficient in what they do be it coding, cooking, manufacturing etc. giving them an option to sell their services or products in HBD would be a boost in getting HBD to a point of economic relevance as a substitution to the negative real rates of savings we get by transacting in fiat.

There are a ton of possibilities. We simply need more people to look at what is on Hive and approach it with some business sense.

We see many opportunities with these different communities and applications.

Posted Using LeoFinance Beta

I think it actually goes beyond that although I dont disagree with your assessment.

Due to the coins we have, Hive can construct an entire financial network complete with lending, DEX, swaps, collateralization, and a host of other features.

All of this can be structured in a decentralized manner and benefit those holding Hive Power.

Posted Using LeoFinance Beta

I don't understand those zero interest loans. I mean, they seem too good to be true. I'm assuming you can borrow more than you have to put down as collateral? What's to keep someone from taking a zero interest loan, buying a ton of HBD (if it's available on the market), moving it into savings and then making 20% on it. Like I said, the mechanics just seem too good to be true.

Posted Using LeoFinance Beta

What is preventing you from doing the same thing with your house? If you have equity in your home, what is preventing you from taking out a mortgage at 6% and then turning around and taking that money, buying HBD, and depositing it into savings.

Same premise.

The difference is the bank is making money off your loan. With these types of situations, the protocol isnt looking to do it in the same manner.

In fact, by doing this on the second layer using a HBD derivative, you could actually offer negative interest rate since the HBD in savings backing the derivatve is generating a 20% return.

Posted Using LeoFinance Beta

Right, I understand that, but I am failing to see the downside. Especially with a zero interest loan. Even if the witnesses dropped the rate down from 20% you would still be ahead. Is the only negative the chance that HBD might depeg or is there something else I am missing?

Actually, the Least amount of collateral you can put into Liquidity is 110% of the amount you want to borrow. The recommended collateral is 150% at the low end and up to 300% is best.

While there is No Interest at Liquidity, there IS an issuance fee of 0.5 to 5% of the LUSD you borrow, paid when you borrow it. Further, there is a 200 LUSD Liquidation Reserve Charge but this is returned to you when you repay the LUSD you borrowed.

Also - this is on Ethereum so there are those high gas fees involved in transactions. And LUSD trades in a range of 95 cents to $1.05 (similar to HBD) so you could gain or lose a little there when borrowing or repaying.

PulseChain is an upcoming full state fork of Ethereum and will have a fork of Liquidity called Liquid Loans. It is said that fees will be much much less on PulseChain than on Ethereum so Liquid Loans may be a better option to do the same thing you can do on Liquidy.

Sources

https://docs.liquity.org/faq/borrowing#what-is-the-minimum-collateral-ratio-mcr-and-the-recommended-collateral-ratio

https://coinmarketcap.com/currencies/liquity-usd/

https://pulsehotlist.com/pulsechain.com

https://pulsehotlist.com/liquidloans.io

Sounds too confusing to me. I will just keep being poor.

Besides powering up more $HIVE, what is a tangible next step a Hivean can do to help bring this project forward?

I'd also be interested in learning about the risk management strategies or tactic that are (or should) surround an endeavour like this. A common criticism I hear from crypto skeptics goes something like: "TradFi spent many decades learning very hard lessons, resulting in some of the regulatory systems that exist today. Crypto has recklessly barged onto the scene, ignoring a lot of the lessons, and is needlessly learning the same hard way."

I assume some of that can be refuted via "crypto's a new system so the old lessons don't apply," but I hardly believe that all of it could be refuted. :)

Either way, it is very cool to read about the concept. The initial post was awesome, especially in all the various potential services described.

My answer is TradFi still ends up in a car wreck and regulation does nothing to prevent it. In fact, it probably makes it less stable.

The key is to think these things through and to put safeguards in place. for example, UST blew up, a stablecoin similar to HBD. Even without getting into the use case for $HIVE, we do have some safeguards that UST didnt have like the haircut rule. It is probably a good idea to not have your backing coin worth LESS than what it is backing.

As for what you can do, hive needs users. Keep diving in where you can, add more to the discussions, and keep spreading the word.

Hive is not fly by night.

Posted Using LeoFinance Beta

!PGM

!LOLZ

!MEME

Credit: crossedmat

Earn Crypto for your Memes @ HiveMe.me!

lolztoken.com

A cartridge in a bare tree.

Credit: reddit

@taskmaster4450, I sent you an $LOLZ on behalf of @uveee

(8/8)

Thanks for supporting The LOLZ Project. We !LUV our users!

@uveee, @lolzbot(2/4) sent you LUV. | tools | discord | community | HiveWiki | <>< daily

HiveWiki | <>< daily

https://twitter.com/905866971157217280/status/1634220171878604800

https://twitter.com/494429019/status/1634580896350191617

https://twitter.com/1415155663131402240/status/1634926185259094017

The rewards earned on this comment will go directly to the people( @mcoinz79, @successforall, @rzc24-nftbbg ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

I like the theory of this, but at the same time I think we have to exercise a bit of caution in offering too many "something for nothing" options, like cost free loans.

Human psychology tends to confirm that people people are more invested in those things where they are somewhat "at risk."

Whereas I recognize that Web3 brings a new paradigm to prosperity, we still have to deal with Human Nature, and perhaps with the broader fact that those who typically seek "money for nothing" are a diffetrent "caliber" user than those who are accustomed to ventures where "something for something" is expected.

Maybe my caution is born out of too many examples of idealistic projects cratering horribly because human nature overruns the underlying ideals.

=^..^=

Posted using Proof of Brain

If you want, you can look at my other reply to this post explaining how Liquidy and Liquid Loans do have a fee for their loans and you do have to over-collateralize your loan.

As for "something for nothing" when I talk to people about crypto and tell them all the free airdrops I have received over the years, they are incredulous because "there's no free lunch". While it is true that many have gone on to fail or cease to be worth much or become illiquid, I think about how having ST..M and some St..mMonsters cards 4 years ago has turned out. A free Hive for each ST..M now worth 2x ST..M. Free SPS and VOUCHERS and GLX from St..mMonsters.

So of course you are right, many projects crater horribly but some work out, and we have to keep trying new things, in my opinion. :)

You're absolutely right about the airdrops, Splinterlands "1.0" and "Hive 1.0."

The significance here is that you weren't "lured into" $t33m with the promise of "lots of free airdrops!" as a talking point, you received those as a consequence of already being invested; they were an unannounced bonus, not a "feature."

=^..^=

Good point. Framing is important. It's good to present projects as honestly as possible to avoid unfulfilled expectations.

Thanks for the interaction here! :)

It doesn't sound like a bad idea and I wouldn't mind it being funded by the DHF. If it doesn't work out, then cutting it off then doesn't seem like it would impact us too much. I just think Defi/Tradefi needs some more work and I understand that people are wary due to all the scams.

Posted Using LeoFinance Beta

Pondered this question; Stick with contracts rather than heading into futures which appear to be too unstable at the moment, (historically since inception onto cryptocurrencies).

Keep savings attractive watching bottom line, never veer to close to a point of collapse, when interest could be lowered to safeguard HBD.

Opportunity for innovation, investment and economic growth factoring into Hive, it will be interesting moving forward with ideas you present.

https://leofinance.io/threads/@successforall/re-leothreads-2tncwzd1e

The rewards earned on this comment will go directly to the people ( successforall ) sharing the post on LeoThreads,LikeTu,dBuzz.

I am here for the long haul, Taskmaster. I want a parallel economy to exist, based on $HBD. I think the value proposition for the Hive Financial System is too large to ignore at this point.

Posted Using LeoFinance Beta

Terms are really subtle and deceiving. Everybody loves to use popular terms like DEX, Web3, Metaverse, DAO, etc. to catch people's attention, but the reality is far from what is being sold.

Posted Using LeoFinance Beta

Let's roll, it'll take a while but we'll get things rolling.