The Road To 10 Billion Hive Backed Dollars (HBD)

Stablecoins are turning into a very interesting discussing. There is a lot that is going to change in this realm, especially with regards to regulation. It is likely that we see some type of government intervention so now it is a only a question of degree.

At present, we are looking at $120 billion for the top stablecoins, an amount that is going to keep growing. Here is how the top 3 look at the moment:

As we can see, the be a serious player in this realm, billions of tokens are required. This makes sense since we are dealing with medium of exchange. To fulfill the global commercial applications, some big numbers are required.

In this article we will discuss:

the uniqueness of HBD

how HBD is generated

HBD and HIVE correlation

DeFi 2.0

This is a topic which requires conversation. For so long, the Hive Backed Dollar was overlooked by the community. Fortunately, some attention started to be paid so as to improve it. HBD Stabilizer was one of the major moves thus far, assisting in tightening the peg.

Source

Blockchain Based

One of the main characteristics of HBD is that it is resident at the blockchain level. This is not a second layer solution unlike the others. Here we see how the entire construct of HBD is coded into the blockchain, fully transparent.

Hive is a blockchain that has two tokens native to it. This means we can see an interesting correlation between the two. We will cover that in a moment. However, since both are operating at this level, no single entity is behind them. Instead, we truly have something that is blockchain based.

We also understand how upgrades, at this level, require a hard fork. This is a measure that protects the integrity of HBD. Change is slow along with being done per the backing of the community.

How HBD Is Generated

There are a few ways in which HBD can be "printed".

- as part of reward payouts (50/50 option)

- when HIVE is used to convert to HBD

- through the interest paid on savings

One of the keys to this is the generation of HBD is all market based. The community decides how much is created. There is no foundation or centralized company who determines when more is produced. With HBD, it is a fluid situation as users make their individual decisions.

For example, each time someone puts some HBD in savings, that person is deciding to increase the amount "printed". The same is true when another individual opts to convert some HIVE to HBD. Here we also see an increase in the circulating supply.

HBD-HIVE Correlation

The last action shows how linked HBD and HIVE are.

When we look at the base essence, we see the Hive Backed Dollar (HBD) is backed by $1 worth of HIVE. This is not tied to the US Dollar like Tether and USDC. Instead, the dollar is simply a unit of account.

The coding has a few features pertaining to this relationship. To start, there is a "haircut" rule which directs the blockchain to stop producing HBD when it becomes more then 10% of the total of HIVE. This was a safety mechanism that, in the opinion of many, is way too low.

Nevertheless, since it is driven by the community, the blockchain does have some protective measures in place to protect against "Hivemind insanity".

Another factor is the fact that, due to the conversion mechanism, the amount of HIVE outstanding can be reduced as HBD is increased. Of course, the reverse holds true also. However, as we will see, our need is for more HBD, not less.

This concept is different from a burn in that the HIVE is not actually destroyed. Basically, it takes a different form since each HBD can be converted to HIVE at any time. Hence, the HIVE is still there, just in different form. It is akin to swapping a physical US dollar for 100 pennies. The amount you have is still the same and, at any time, the pennies can be converted back into the former.

DeFi 2.0

This is garnering a lot of attention. Certainly, there are more projects than will be discussed here and we are seeing experimentation operating at a deeper level.

However, OlympusDAO and Tokemak are starting to get some people genuinely interested in the potential. Projects such as these seek to enhance the capabilities of Decentralized Finance (DeFi) beyond liquidity mining and simple lending platforms.

One of the areas that has potential with DeFi 2.0 is through the use of bonds. El Salvador made news with the announcement of their "Bitcoin Bonds". This is not DeFi since it is going through the traditional system yet we are now seeing the interest of cryptocurrency as a tool of collateralization.

What we have is the fact that Hive already as DeFi 2.0 built in. HBD is resembles a convertible bond simply due to its structure. Even though it can act as a unit of exchange like a stablecoin, it is also convertible to another asset, HIVE, at any moment. This instrument yields interest payments (presently at 10%) for a pre-determined amount of HIVE ($1 worth based upon the USD price of HIVE).

Thus, HBD is backed by the value of HIVE as assigned by the market.

Keep in mind, everything mentioned is at the base layer. We have not seen much built using HBD at the second layer. So far, things such as liquidity pools are not set up using this token. That is something else that will help to overcome some of the present issues.

Challenges Facing HBD

There are a number of issues that need to be confronted. They are as follows:

- unable to hold the peg

- use cases

- availability

A few of these issues are solved simply with liquidity. One of the challenges to the peg is the fact that the coin is not very liquid, nor widely distributed. Only a few exchanges are offering it, most of it resident on Upbit.

At the same time, as mentioned, we do not have liquidity pools where holders are incentivized to create more HBD and and stake it at that level. We need more layer 2 development incorporating HBD into the mix. This will help with the availability.

We end up with the chicken or the egg scenario. To have more use cases, there needs to be greater liquidity. Of course, without use cases, there is little incentive to increase the amount of HBD.

Quite frankly, both areas need attention.

Expanding HBD 400X

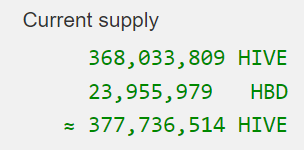

This sounds absurd but to be a major player in the stablecoin realm, we are going to require a lot more HBD. At present, here is what the supply looks like.

As we can see, just over 23 million HBD are in circulation. The challenge with this is that includes the 9 million HBD that are locked in Hive Developer Fund. Thus, we truly have only 14 million HBD on the open market.

The potential of this token harkens back to the start of this article. We have a stablecoin that is resident at the base layer of a blockchain. Since there is no foundation, laboratory, or group of individuals behind it, regulation is impossible. The only way to attempt that is to focus upon the top Witnesses, a move that even if accomplished, would likely end up with them simply shutting down their servers. Hence, a new set of validators would instantly step in. This truly becomes a game of Whack-A-Mole.

How important is this to the industry? A case could be made it is essential. We also see token distribution which is completely dependent upon the market. Outside the haircut rule, which is also driven by market forces, the amount of HBD is entirely up to the userbase. They are the ones who decide when they create or destroy HBD.

Also, for those who understand the correlation, we can see how the value of HIVE is going to be affected. If we have 10 billion HBD in circulation, the present rule means the value of HIVE, in total, needs to be $100 billion. Changing this level is being discussed so we can expect it to increase to 20%-30%. Going with the later number, even then we are dealing with a market cap of $33 billion. Try and digest that for a moment.

We are in the unique position where the value of the HIVE token can increased by greater use of the Hive Backed Dollar (HBD). The correlation is never broken. Whereas other DeFi 2.0 projects are using a basket of other cryptocurrencies, HBD is backed by HIVE, adding value to that token.

Increasing the haircut rule needs to coincide with a corresponding move in the interest paid on savings. Remember, this is one of the main mechanisms for generating HBD. Since we need to grow it, this needs to accelerate greatly. Fortunately, this is done without a hard fork, by the Witnesses (block validators), via consensus.

The Hive Backed Dollar (HBD) can bring incredible value to Hive and the main token. We have a unique correlation that can be leveraged for more overall value. At the same time, it is a unique offering that the market does not have.

Finally, HBD is the perfect hedge to deal with wild swings in the price of HIVE. Want to take a little off the table and wait for a pullback? Simply move some HIVE to HBD. This will serve as a hedge against a major pullback, allowing for re-entry at a lower price point.

We already have some use cases for HBD in place. As DeFi 2.0 expands, we can take advantage of this to further the value of HIVE.

The potential here is truly amazing.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

View or trade

BEER.Hey @taskmaster4450, here is a little bit of

BEERfrom @pixresteemer for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.Now that the HBD is actually being pegged and has some new mechanisms, I would love to see billions of HBD.

I was initially saying there's no point in having HBD as these other stables are used much more and super reliable. But now that Hive price is up, more users coming on, more things happening like NFTs/Splinterlands growing, we need a stable coin on here that has 0 tx fees.

Ethereum's 150 USD fee to swap from one coin to another is insane.

Yes that is all true. I also think we are going to be in for some surprises with some of the heavily used stablecoins.

I believe we will see regulation, it is just a matter of how much. Regardless of what, I am sure audits will be part of it. That is where I feel something like Tether could blow up. Do they really have that many USD behind it?

We will see but that could be an "Enron moment".

HBD has the transparency that it is all on the blockchain. We do not need to question the amount out there or what it is backed by. Anyone can see it.

Posted Using LeoFinance Beta

If HBD will be equal to $1 in the future, what about selling it when exceeds $1, then buy below $1?

That is where the arbitrage opportunities reside and, frankly, is how the peg is held. HBD stabilizer is doing that same thing right now. The problem is that it requires more help.

If HBD grows and expands, we certainly could see major arbitrage players looking to scalp a couple percent either way. That is a tremendous way to make money.

We also could see it vary between exchanges. There people buy on one exchange, for say $.99 and sell on another for $1.02.

Posted Using LeoFinance Beta

Very interesting. I am definitely starting to give HBD more than just a passing glance. For so many years I simply ignored it or just used it as something to move into something else. I really appreciate the way the community tries to police it. All you need to do is look over at that other chain and see SBD sitting at $7.00+ to realize how much better things are over here.

Posted Using LeoFinance Beta

You werent alone. That was all of us as a community. The introduction of the HBD stabilizer was a big step forward. Now we are likely getting a change in the next hard fork with the haircut rate. Finally, we should see the witnesses start to move their interest payouts up.

We just need a few sinks put together to get the thing rolling. I really hope Cubfinance adds a HBD liquidity pool along with a bridge from Hive to BSC. That would help a lot.

We need bHBD.

Posted Using LeoFinance Beta

That would be totally awesome if they did that. Maybe that is why Khal has been so quiet lately! Working on all these great things... A raise in the interest rate would be an unexpected surprise for me.

Posted Using LeoFinance Beta

I am sure that Khal is working on a lot of stuff. What is the question? He has a full plate so we will see what rolls out.

Yes the raise in interest rate will be discussed at some point in my opinion. It can happen anytime since that is in the hands of the witnesses. They can opt to increase (or decrease) at any moment.

Posted Using LeoFinance Beta

I like the way that HBD is more stable even after hive pump, This is so good.

Stablecoins are not suppose to be pure speculation like other tokens. They are for exchange and commerce. The returns comes from the projects utilizing them, not necessary the token itself.

HBD needs to follow this. So while there is still volatility, too much for a stablecoin, it is a lot less than HIVE.

Posted Using LeoFinance Beta

Many user asked me to convert my HBD holding to Hive....but I remain rigid of my choice and keep adding it to saving....now I have over 1000 hoping for a better return on the coming day.

HBD is more stable now so I used to convert my Hive coins to HBD instead of sending it to external exchange for USDT..

You can convert or use the internal exchange.

For me, I use the internal exchange more than convert at this moment since I think we need more HBD on the market.

But you are doing the right thing. HBD is meant to preserve the price in a much tighter range than HIVE. If you want to protect some of your profits, HBD is a good place to do it.

Now the goal is to make it a much better place for that.

Posted Using LeoFinance Beta

We’d start to be seeing stories about @freedom being the first Hive billionaire. 😎

I havent looked at the stake in that wallet in a while but, yeah, add a couple zeros and it is possible.

A 3% stake of a $30 billion entity is in that range.

Then the world will be asking who freedom is along with Satoshi.

Maybe they are the same person.

Posted Using LeoFinance Beta

https://twitter.com/taskmaster4450/status/1466770089643020294

https://twitter.com/rutablockchain/status/1467201465731198984

https://twitter.com/shortsegments/status/1467343112024379394

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

The real question for me is what is the purpose of HBD, it boils down to

I was thinking about this earlier in the week and first thought it would be great to have hbd on multiple exchanges so i could use it instead of usdt but then in that scenario its economics change. If use d much wider and bigger, then then the economics of it breaks down because the market cap of hive is just not big enough to support it. The greater that you increase the 10% the closer its volatility will be to that of hive.

I agree hbd is a usp of hive but i see it as something that is valuable as long as its used in the hive ecosystem more smaller scale for the benefits of hive members not necessarily on the open market.

Certainly it would be great to have it with a much wider use case than just on Hive. In fact, to have 10 billion needed, it would have to extend far outside this platform.

Of course, we have to start somewhere. To get exchanges interested, we probably need activity ourselves. That is where first building here can help. There are a few exchanges that already carry HBD.

The other option is liquidity pools. A couple of them set up on BSC or polygon might help.

We will see where the ideas take us. It all starts with getting a few use cases going.

Posted Using LeoFinance Beta

I may need to digest this a few more times before I even begin to comprehend the nuances of this discussion.

To walk it back a country mile for just a moment: if HIVE is worth $2.25, I would receive 2.25 HBD per HIVE token, right? I feel like the conversion calculator is messing with my head.

Correct... @thatcryptodave plus if you convert Hive into HBD and put the HBD into savings it gets 10% interest at current time.

Step 2

If/when Hive drops in price we can buy back the Hive at the new lower price. It's a solid hedge. 👍

and... this kind of tokenomics is one of the many awesome features of Hive blockchain!!! are there any altcoins out there that can beat Hive on this?

HBD is really incredible and I think it still needs some improvement: greater stability at the $ 1 value (although it is very much improved, it needs to be tight in the 0.99-1.01 range) and a shorter time to convert HBD to HIVE and withdraw HBD from the Savings

I think we will see a shorter time on conversion discussed. Could the system handle a one day conversion and still maintain the security while avoiding price manipulation? Perhaps especially if the float gets a lot bigger.

The move from savings is not something I heard discussed although I am okay with the slow time. Make people commit to getting the interest, especially is it is at an increased APR.

Convertible bonds often had time frames associated with them. This one is rather short in comparison.

Posted Using LeoFinance Beta

So one needs to have more amount of HBD available in different exchange and in use to assist its peg. That way it would be more stable

Larger markets tend to reduce volatility because it takes a lot more money to move things. With different exchanges, arbitrage opportunities arise that will be taken advantage of by traders. That is what helps a peg.

If there is a quick 2% to be made on a trade, with enough liquidity, traders will jump at it. The problem is that will not happen without liquidity.

Posted Using LeoFinance Beta

What if we have a in chain liquidity pool for Hive and Hbd where people can earn incentive for their pooled assets.

I would think that is something that is better suited on the second layer. A Cubfinance could do something like that very easily.

Hive already offers the internal exchange whereby people can swap between the two tokens. With the savings, there is a return that is generated.

Not sure we need to add more to the base layer in this regard. But it would be helpful to have that at the second layer in my opinion.

Posted Using LeoFinance Beta

TEN BILLION!?!

Just trying to figure out the implied market cap of Hive if HBD is ten bill.

Thinking something like $50B after pumping up the haircut percent.

Easy $130 Hive price :D

I think we can get there in 5 years.

Posted Using LeoFinance Beta

If you are putting a 20% haircut out there, yes we would be looking at $50 billion.

The time to get there is interesting from this perspective. How quickly can we produce HBD if things go down this path? Even using 100% interest, with what comes out of the reward pool, it is not going to amount to much.

We would need a whole lot of HIVE converted to HBD. That would send the amount of HIVE out there downward.

And no burn; just a different version of HIVE.

Posted Using LeoFinance Beta

It's going to be a long road to get towards $10 billion. I think the peg has been holding quite well. I like that the internal market allows you to exit out to a stable coin with zero fees. I have noticed we have a lot more listings of HIVE but not HBD though on exchanges.

Posted Using LeoFinance Beta

No HBD was overlooked for so long, there arent many listings. In fact, it is a lot less than Hive. That is okay. We should be looking at liquidity pools and DeFi.

Yes the internal exchange is great. It allows for swapping without zero fees. That is something that is unique also.

Another on-chain feature that can be leveraged by many once liquidity increases.

Posted Using LeoFinance Beta

Quite happy to see hbd retain decent level during the pumps and after. It's gradually living up to truly becoming what it was originally created to do

We are getting closer. There is still too much volatility but it is much improved, even from a number of months ago.

It is a process and adjustments are being made.

The next two I would like to see is:

Couple that with a liquidity pool built somewhere and I think we will take another step forward.

Posted Using LeoFinance Beta

So increasing interest would be the fastest way today to increase HBD supply.. And what would be the cons in doing so? Hive price coming down?

I am not sure it is the fastest way but it will cause more to be produced. To get it, people will have to buy it and convert it.

So that will reduce the amount of HIVE out there so it would likely have the opposite effect, the price of HIVE will run up.

The correlation is there between the two.

Posted Using LeoFinance Beta

Ok ok I see..

thks for bringing light on thissss

👳

🙏

I am still at the point where all of this is just amazing me. Reading articles like this really gives me a much deeper understanding of the Hive Blockchain.

I have to admit that Jon's claim of making an income from blogging without selling is the main feature that attracted me to Hive.

Now that I am here, it is important that I am a good contributing member of this blockchain.

The only thing I thought of HBD as a way to get liquid Hive without powering down hive. After reading this article I am going to make saving HBD more of a priority rather than just something I hope to do some day :-)

I am taking my video rewards in 50/50 payouts. That helps to increase the supply. All that I get goes into savings.

It is a great baseline financial program plus it helps the blockchain in a small way.

Collectively it will add up. Glad you are finding Hive to be a valuable place for you.

Posted Using LeoFinance Beta

It is funny that you say that, "Glad you are finding Hive to be a valuable place for you." I have crunched some numbers and if I keep up my current rate of activity and stay consistent for the next 18 months my Hive earnings have a very good chance of competing with my other online businesses income wise😀

BUSD should be number 3 in the top, most likely.

Summary :

The more use case of HBD increases, the more more the price of Hive goes up

As community , we all have the responsibility of meeting exchanges and wallets to adopt HBD,,…..

I’ll start by listing HBD in my own wallet for millions of Africans and Indians

Essentially. I think the more success HBD has, the more of it we need. The only to really ramp it up is to convert it, i.e. HIVE conversion.

Posted Using LeoFinance Beta

One other killer feature of HBD that I just realized: if HBD is below $1, instead of selling the HBD, you can always convert it to $1 worth of Hive. Meaning, if you have 1 HBD and HBD's price happens to be $0.95, then instead of selling for that price, you convert your 1 HBD to Hive, and you get $1 worth of Hive. So if you hold HBD, you are pretty much guaranteed to keep your dollar value. A really unique feature. And this hadn't occurred to me until now.

Due to how the conversion works, there is a slight possibility you will get less than $1 worth of Hive as measured by the Hive market price at the moment the conversion is completed. You get $1 worth of Hive as measured by the median price during the 3.5 days of the conversion. If there is a price spike, for example, the median 3.5-day price and the current market price may be different to a noticeable degree. People taking advantage of the conversion function should have some understanding of it and keep in mind that there is a slight chance they will get less than $1 worth of Hive as measured by the market price at the moment the conversion completes (it will always be exactly $1 as measured by the 3.5-day median price). Depending on whether they want to sell the Hive right away or hold it for some time, they may be happy or unhappy with how much Hive they got. Long story short, while it should be understood this is not an absolute guarantee that you will get $1, it comes really close to a very good guarantee. Mainly an upward spike in the price of Hive will cause you to get less Hive (but it'll be worth more), and then if there is a sudden drop in the price, the less Hive you got will be worth less. So, an unlikely but possible scenario. And even if it happens, you don't have to necessarily sell your Hive right away, you can wait for a better price if you are not under pressure to sell.

That is true although it is completely guaranteed.

The conversion mechanism does put some of what is being converted at risk of a price spike (or decrease depending upon the direction one is going).

But it does provide some insulation and an opportunity to scalp a few percent.

Posted Using LeoFinance Beta

So this is like some strategem? I do understand now why HBD seems to be a little lower and could this really work?

Not sure what you mean.

Posted Using LeoFinance Beta

The turn around plan...or did i get it wrong? About printing more HBD.

Yay! 🤗

Your content has been boosted with Ecency Points, by @molometer.

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more

A solid primer for understanding how this whole economy works. Many thanks.

Posted Using LeoFinance Beta

That is a very good explanation of HBD, I learned more on it. Thank

You

I hope the community is paying attention to you.

!BBH

Posted Using LeoFinance Beta

I hope people are starting to realize the potential and thinking about this topic a lot more. There is so much benefit this can bring to Hive.

The correlation between the two tokens, at the base layer, is amazing.

Posted Using LeoFinance Beta

I want to add my 2c to this.

More on challenges facing HBD

In terms of Hive Backed Dollars (HBD)'s inability to hold the $1 peg, I don't see this as a huge problem going forward.

Literally 1 or 2 more exchange listings for HBD, featuring a USD trading pair, will fix this problem in an instant.

If there are opportunities to build bots that will collect free money from arbitrage, then someone is going to do it.

Even though BeeSwap's SWAP.HBD:SWAP.BUSD pool doesn't use the native tokens, it in theory will still help.

Getting HBD listed on external exchanges outside of our Hive bubble should be the absolute priority.

I fully share your view that HBD has the potential to send the Hive price into the stratosphere alone.

If Hive wasn't already a sleeping giant on its own, HBD certainly is!

Posted Using LeoFinance Beta

Certainly more exchanges would help a great deal.

It will help to create even more arbitrage opportunities. So it is another reason for more HBD to be created.

Posted Using LeoFinance Beta

Congratulations @taskmaster4450! Your post has been a top performer on the Hive blockchain and you have been rewarded with the following badge:

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

I listened to you and other smart people and started to accumulate HBD.

I am filling my wallet (savings) with it.

Posted Using LeoFinance Beta

Reading your post get me to think having more HBD is a benefit for Hive in the long run.

It is like a way to keep Hive deflationary.

I have not think of that at all.

Within the blockchain Hive could become a $50 billion marketcap just by creating more use case for HBD.

This is another reason to hold and create more HBD.

At the same time if the interest to create more HBD goes up like 15% or more, it will push more HBD creation, changing more Hive to HBD.

Interesting factor!

!BEER

Posted Using LeoFinance Beta

Yes and then take it one step further:

What is someone built a layer 2 application that used HBD along with some other token in a LP and paid 50% or something on it?

The possibilities start to spread out.

Posted Using LeoFinance Beta

!PIZZA

PIZZA Holders sent $PIZZA tips in this post's comments:

@nastyforce(1/9) tipped @taskmaster4450 (x1)

Learn more at https://hive.pizza.

I concur.If HBD can be introduce to other Crypto exchange. It will make the token to be well know and they should create an avenue were one can Stake it,to get More of it, that's what can makes the token to be stable.

Posted Using LeoFinance Beta

The part about regulation is genius. A server could be set up anywhere in the world. In particular, in crypto friendly nations. It would be extremely difficult to shut down multiple servers in multiple crypto friendly countries 🙌

There is also the fact that the blockchain is run by multiple servers. We have 20 consensus witnesses and their a rotation of 100 more.

Posted Using LeoFinance Beta

That would be a challenge for any evildoers :) .... And I expect if things got nasty, this would be made even more decentralized 🙌

!ALIVE

Because this is such an awesome post, here is a BBH Tip for you. . Keep up the fantastic work

. Keep up the fantastic work

https://diamondapp.com?r=P5jxTMLK 25$ instant pay . Deso Decentralized social network is looking for new users and they have ask us the old users to invite people to join. they will pay you 25$ for registering and doing a KYC on secured net verified process. #Airdrop #Crypto İnstant pay

Posted Using LeoFinance Beta

lately I've been trying to put all the HBDs I earn from blogging into the savings section, and I think this thing will give me some advantages in a few years.

Best 8 minutes of reading I've had this week.

I like the vision you present, of course this comes with some good well crafted marketing work as you have to give people the reasons to use HBD.

Also as the HIVE market grows the HBD market will grow as well, as for now it is limited to the community and a small percentage outside.

Posted Using LeoFinance Beta

I mostly understood that the Hive Backed Dollar, our native Stable coin was valuable to our community as a hedge against volatility, as you mention. It's nice to finally learn more about its generation and market forces determining its interest rate and its market circulation.

I wonder if it is possible to list it on PanCakeSwap as a token, a BEP-20 version would require someone to mint the new token and set-up a swap site so people on Hive could trade into Binance Smart Chain to deposit into a liquidity pool, and give Hive Backed Dollar and Hive some BSC exposure. I will look into how one qualifies for Cake interest payments on PanCakeSwap, I guess the same way we qualified on Uniswap, but significant liquidity would be required to make a go of it.

Posted Using LeoFinance Beta

This is interesting and this is not a big quantity that means we are going to have much more valuable HBD in future.

Posted Using LeoFinance Beta

This type of informative article is what we need in the community because most users find difficulty getting their head around the correlation between HIVE&HIVE Dollar.

HIVE Dollar is a coin that presents all the pros of stable coins avoiding all their cons. That's why it's great and like you've said it's a topic that needs more attention

Posted Using LeoFinance Beta

Me gustaría adentrarme más en estos temas y si quiera llegar a entender un poco más. Siento que estoy en pañales 😐

Aside from all the multitudinous other reasons to love Hive, the sheer technological elegance of our ecosystem in regards to Layer 1 and Layer 2 decentralized finance is both exciting and breathtaking at the same time. I have far more faith in HIVE/HBD as an investment than anything fiat. 🙏 💚 ⚡ 💥 🔥 👣