The Sustainability Of HBD 20% Interest

Many question if the Hive blockchain paying a 20% interest rate on Hive Backed Dollars (HBD) placed into savings is sustainable. There are some who feel this is not possible.

In this article we will take a look at the mathematics of it and see how it compares to other currencies. Ultimately, sustainability comes from the building of economic productivity, ie the economy, surrounding the currencies.

With the "Get Rich Quick" mindset that is so common in cryptocurrency, we see how this is lacking. Nevertheless, through development, Hive is starting to have the foundation in place for sustained growth.

Here is where we can see HBD as being an important piece in this economic engine.

Before going into the discussion, there are a few key presumptions made that have to be detailed:

- All free HBD outside the DAO is in savings, earning 20%

- The only HBD creation is from interest, no conversion or post payouts

As we will see, these actually counter each other.

Source

HBD Starting Point

It is first important to see where we are. Thus, how much HBD is available for savings?

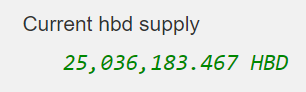

Look at Hiveblocks, the total currenct HBD supply looks like this:

From that we deduct the HBD that is in the Decentralized Hive Fund (DHF).

Source

From here we can do some simply subtraction and we see the circulating supply of HBD is 7.648 million.

This is the number we will use.

HBD In 50 Years

Again, going back to our presumptions, what will the circulating supply of HBD look like in 50 years? That ought to be enough time for sustainability.

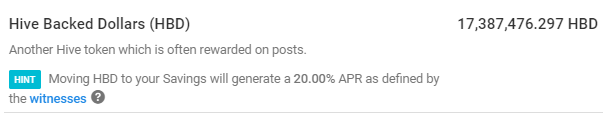

Here is where we simply compound out at 20% annually.

The totals look like this:

Thus, by 2072, going by this model, we will see the HBD supply grow to 57.9 billion.

That certainly is a big number. Or is it?

50 Billion In Comparison

How does this compare to other stablecoins we see on the market?

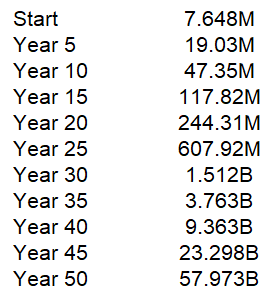

It is interesting to see this from Coingecko:

The present supply of USDC is 54 billion, near the number of HBD in 50 years.

For what it is worth, Tether's supply is listed at 65 billion.

As this shows, in the stablecoin world, 58 billion in half a century is going to be a drop in the bucket. Using the formula in this article, it will take 30 years for the supply to hit 1 billion.

By the way, as an aside, to bring things into real world currency, how would 58 billion HBD compare with some fiat currencies?

The two closest national currencies are:

That would put HBD in the same category as the Rufiyaa and Cordoba. Not exactly household currencies.

It's Economy Stupid

If an expanding money supply was enough to make a country wealthy, then we would see a lot of evidence of nation's printing their way to prosperity. Unfortunately for the citizens of these countries, we see this is not the case.

Currency is dependent upon utility. How is it factoring into economic production? What commercial and financial activities are built around the currency?

Obviously a lot can change over 50 years. In the realm of the Internet, a major paradigm shift can occur in less than a decade.

It is also difficult to compare companies and economies. However, if we think of Hive as a decentralized network-state, we can get an idea of the potential.

The two nations we looked at, Maldives and Nicaragua, have estimated GDPs of $5B and $15B, respectively. To contrast the power of the digital world, Facebook has annual revenues of over $100 billion.

Which brings up to the multi-billion dollar questions:

- How much is a decentralized database with immutable data worth?

- How valuable is a ledger built on distributed ledger technology and not controlled by banks?

- Is it imperative to have a digital asset that can serve as a medium of exchange that is outside the reach of both governments and central banks?

- Is an account management system that provides sovereignty to each individual as the precursor to Digital IDs important?

And most importantly, what applications and use cases are developed around these attributes to provide utility to not only the users, but HBD also?

From this will stem payment systems, investment opportunities, collateralization for lending, and derivative creation. All of this would provide greater depth and sophistication to HBD and the activity on Hive.

The Hive blockchain allows for transactions to occur in a permissionless manner. The only contingency is whether the user has enough Resource Credits or not. If that is attained, anyone can write to the blockchain.

This is something businesses can build on. There is no threat of their enterprise being shut down because the terms of service of some major technology company was used as an excuse to close an account.

All of this is leading into the value of Hive. Ultimately, with use cases and utility, the coins at the base layer will reflect that value.

For a thriving and expanding economy, there needs to be enough currency in circulation. As these numbers show, we have a lot of room for growth in HBD if the development continues.

What are your thoughts regarding the Hive economy and HBD?

Let us know in the comment section below.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

I noticed the part about HBD not being paid out to posts however I do earn HBD from my posting on Hive. It's currently Powered up hive and HBD that is liquid. Or is this pulled from the pool somewhere and not inflating the number? Thanks!

I would like to know this as well, maybe/probably the answer is there already, it's just easier to ask here today.

I think he forgot to explain there are two false assumptions here that cancel each other out. In reality, more HBD is created through rewards, but on the other hand, less HBD is created as interest, since not all available HBD is in savings. A lot is on exchanges, I think.

Yes and that was the two presumptions. Only focusing upon HBD through interest yet using the entire supply (outside DHF) as the baseline for interest, which is higher than it actually is.

Posted Using LeoFinance Beta

Yes that is part of the inflation but was omitted since I dont know how much is produced. Also, we have nowhere near 100% of HBD circulating in savings. It is more like maybe 1/3 is in savings.

So there were some liberties taken with the presumptions since we cannot know exactly what people opt to do.

Posted Using LeoFinance Beta

UST at one point, has a market cap of $18b, which is like 700 times the market cap of HBD. Considering the use case and ecosystem of HIVE $25m really is nothing.

Great post, btw. I've read both of your previous posts too

https://leofinance.io/@taskmaster4450/hbd-20-interest-is-sustainable

https://leofinance.io/@taskmaster4450/where-the-value-of-hbd-resides

Posted Using LeoFinance Beta

Thank you.

The key with UST is there was little to no use case for LUNA, let alone UST. That is why it is imperative to build the Hive economy.

Posted Using LeoFinance Beta

2072 is much bigger, probably even than the most of us. I mean it is not even sure that we will live to see this big number. If I will still live in 2072, then I will be 80 years old.

It is better to focus on real use cases, which we can use nowadays, or in the upcoming years, and not 50 years later. Of course some people think about their families, and they may open a HBD savings account for their child/children. I understand that. But the real use cases are still much more important than these big numbers.

How do we even know that the Hive blockchain (or even the human population) will still exist 50 years later? Anything could happen. It is better to focus on the present and on the near future. Live and enjoy life. Any day can be our last day on Earth.

At this point it is nearly impossible for anyone to shut down hive, it would have to be the result of an attack of some kind. I do believe that hive is more resistant to these attacks as a result of the hostile takeover of steem. I do understand the concern of the 20% interest, but the people that made the decision to increase the interest seem pretty confident about the resiliency at this point and they know more about this stuff than I do

From an operating standpoint, I agree. There are 100+ people running the software, all unrelated for the most part. Over time, we might even see more people running infrastructure.

This will only increase the resiliency.

Posted Using LeoFinance Beta

I love the way you're creating links through the leo glossary and using it as a tool...I will be setting myself up to do the same. Great work. !PIZZA !PGM

Posted using LeoFinance Mobile

Absolutely. It is a tool to optimize content on Leofinance as much as possible.

This has the potential to really put Leofinance and Hive in a different place with widespread community effort. I have the Main Menu for Leoglossary open and simply click on the link I want to get the URL to link.

At some point the search engines will catch on.

Posted Using LeoFinance Beta

Yeah, I totally see how to use it... it's really just a matter of keeping the main menu open and referring to it to create keywords in your posts. Simple but ingenious concept.

Over time as Hive continues to exist it gets stronger by the day, this alone excites me and very fortunate to be part of the community here. Being less than 3 years old it is way ahead of the parent chain STEEM.

Posted using LeoFinance Mobile

I absolutely agree, I love the hive community. I admit I do feel a little sheltered from the uncertainty and doubt other investors are facing.

It is possible for the Hive blockchain to outlive the human population as long as people keep the servers running.

Posted Using LeoFinance Beta

This is funny. Can the servers, the electricity, and the whole infrastructure run and maintain themselves? Probably not for long. But this is certainly an interesting question.

I’ve got an HBD savings account set up for my son! Been trying to drop at least 2 HBD a week in there for the last two months. Sometimes have been able to do more which is great. Going to enjoy watching it grow into the hundreds and thousands!

Posted Using LeoFinance Beta

I don’t think the issue is really the growth of the supply as long as it is backed but the value generation. The issue is the sustainability of a 20% interest

This blockchain's currency is HIVE, not HBD. That is where the value generation resides. Hive state's PR office is trying to sell you HBD. They probably even believe holding/using HIVE outpaces sticking your HBD into savings at 20%.

If they are right, they can laugh as you sponsored their HIVE earnings. If they are wrong, noone is laughing. That includes you as your HBD is not properly backed and no longer worth 1 USD. Lose-lose. For some.

That is only partially true. Both are base layer coins. The problem with $HIVE is that, like most cryptocurrency, it is a poor medium of exchange due to the volatility. As a store of value, it doesnt hold up.

A peg currency like HBD offers a better medium of exchange. Commercially applications are not going to accept a currency as payment or short term collateral that can swing 10%-15% overnight.

Posted Using LeoFinance Beta

I admit mildly lazy wording on my part in the quote. Anyway, my point is that while noone (outside the core maximalists) is going to do their pricing in HIVE (they will show dollars), accepting HIVE payment is as easy as accepting a foreign debit card. If the business really needs stables, they can swap instantly (instead of just hedging when the numbers get too big). Noone cares if the conversion happens just before the payment or after.

The silly part is "we need a large supply" (sitting in savings accounts).

For payment system, we just need a smooth HIVE-HBD market instead. That means wallets with both coins eager to play. HBD hoarding does not help that (although it has other complex consequences).

Collateral is more tricky as an excuse to print but the more HBD is printed out of thin air, the weaker collateral HBD is. Not because retail says: "50% sounds like scam and 20% does not". It is because the value of the backing assets (value of the network if you wish) has to keep up.

Of course it is the value generation. That is what I said about the Hive economy. As more value is built on Hive, it makes the entire ecosystem more resilient.

Posted Using LeoFinance Beta

There is an order for HBD in BUSD on Ionomy.com. The order is to buy HBD at 0.99 BUSD. The order has been sitting there for two months! Nobody wants to sell HBD that price. It took a lot less time to sell HBD at a 1% profit with BUSD on the same exchange.

Wow this has been interesting, I didn't think that my country (Nicaragua) would be used as an example because we are not an example of anything good.

YOU are an example of something good, YOU are on Hive! 😁

Hahaha well most countries in Africa are far from good when it comes to being referred to for something good. More reason am hopeful for decentralized network states

Posted using LeoFinance Mobile

the HBD at 20% of an interest rate is good since we would have our savings in a safe way. Also, if I am sure of something, it is that if someone can maintain these bases to continue developing us in the future, it is the #Hive block chain.

Aprecio sua postagem, gostaria de entender melhor o ecossistema hive. Me parece que os 20% são apenas impressão de moeda, corrija-me se estiver errado.

I only came here to say that this article is the almost PERFECT example of how LeoGlosarry should be used, it should be pinned somewhere in the (future) LeoGlosarry Tutorial section?

But now that I'm here, I'll say that I'm not a fan of HBD because it still surpasses my general understanding of how it works on one hand, and on the other hand I think that if some "attacks" were to happen, maintaining the HBD price would damage Hive. This is something that should be explained in more depth for the simple user.

How would there be attacks happening?

Posted Using LeoFinance Beta

That I don't know, is HBD so well thought out and protected that no attacks are possible to destabilize its price and that of Hive?

reading this post reminds me of bad decisions, when the SPT boom started I accumulated 10,000 dollars which is a lot of money in my country and I thought of selling everything and betting on HBD but I didn't and I regret it

Hindsight is 20/20.

We all have examples like that in our lives. We cant be spot on all the time.

Posted Using LeoFinance Beta

%20 interest rate for a stable coin is just great! I wish we could recieve HBD with curation rewards from the pool.

The code isnt set up that way so we are stuck on that end.

I have no idea why it was laid out that way but it was.

Posted Using LeoFinance Beta

HBD has transformed from the black sheep of the ecosystem to one of its main attractions in under 2 years. That's kind of a metaphor for crypto in general, things are hard to predict

It does have great potential but it does need to be built out. A lot have to develop around it. If not, we are just floating another stablecoin out there without much use case or value proposition tied to it.

Posted Using LeoFinance Beta

Looking at the numbers, HBD has a huge potential in becoming a very valuable currency in the Hive ecosystem and beyond.

I think building the utility will take some time, the 20% intereste rate is a great step in the right direction. It's clearly sustainable.

Posted Using LeoFinance Beta

Needs to have more utility other than simply creating more HBD.

This is where:

Posted Using LeoFinance Beta

The first time l saw this was simply amazing to see. Thanks for the share.

Let's make another comparison. The market cap of Waltonchain, Skey Network, Arsenal Fan Token, Lyra Finance and BitKan is around $7 million. Does that mean we can expect those coins to grow by 20% per year?

No idea what the inflation rate is on them nor what the use case is. We also have to consider what is backing that.

HBD is something entirely different. That said, it still requires more buildout tied to it.

Posted Using LeoFinance Beta

PIZZA Holders sent $PIZZA tips in this post's comments:

@cervantes420(5/15) tipped @taskmaster4450le (x1)

Please vote for pizza.witness!

Compare it to other stablecoins is meh.

Compare it to the underlying asset and future growth potential to give a realistic outlook.

And then it needs to add a variable for market swings, with that it can become easily unsustainable.

Because in a bad market environment time plays against the stablecoin and the underlying asset.

Burning hbd can help the stocks to stay in good health

I think HBD has potential but I honestly can't make a decision before seeing what is built and what additional use-cases are added. Of course, I also think the witnesses will adjust the interest rates accordingly if needed though.

Posted Using LeoFinance Beta

The other day I had to have a discussion about the merit of HBD with someone that felt it was a useless asset and destroying hive. I don’t think they’ve been around since the Steem days and remembered the destructive ability of an asset if it’s got a stablecloin that’s got no utility. I’m hoping that they adjusted their opinion on it but who knows.

I do see some potential issue if the big HBD holders decide to exchange their HBD for hive in one giant conversion transaction but not sure if that would happen. Could dump the price of hive hard.

Posted Using LeoFinance Beta

https://twitter.com/VersedMoney/status/1549386807934083072

The rewards earned on this comment will go directly to the people( @opinizeunltd ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

The approach I see with Hive blockchain, HBD and communities is truly mind blowing.

Hive could become the true version of Facebook, twitter, tik tok, etc... combined giving every investor, holder, user a place to come and build accordingly.

All you need to start Hive power and maybe running your own layer-2 space to push your vision.

This will bring extensive value to Hive and HBD.

I think this is coming to fruition in couple years.

!BEER

Posted Using LeoFinance Beta

View or trade

BEER.Hey @taskmaster4450, here is a little bit of

BEERfrom @pouchon for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.Great Post!

!1UP

Click the banner to join "The Cartel" Discord server to know more!

You have received a 1UP from @luizeba!

@leo-curator, @ctp-curator, @vyb-curator, @pob-curator, @neoxag-curator

And they will bring !PIZZA 🍕.

Learn more about our delegation service to earn daily rewards. Join the Cartel on Discord.