Vietnam #1 In Cryptocurrency Adoption For Second Year In A Row

The Vietnamese love their cryptocurrency.

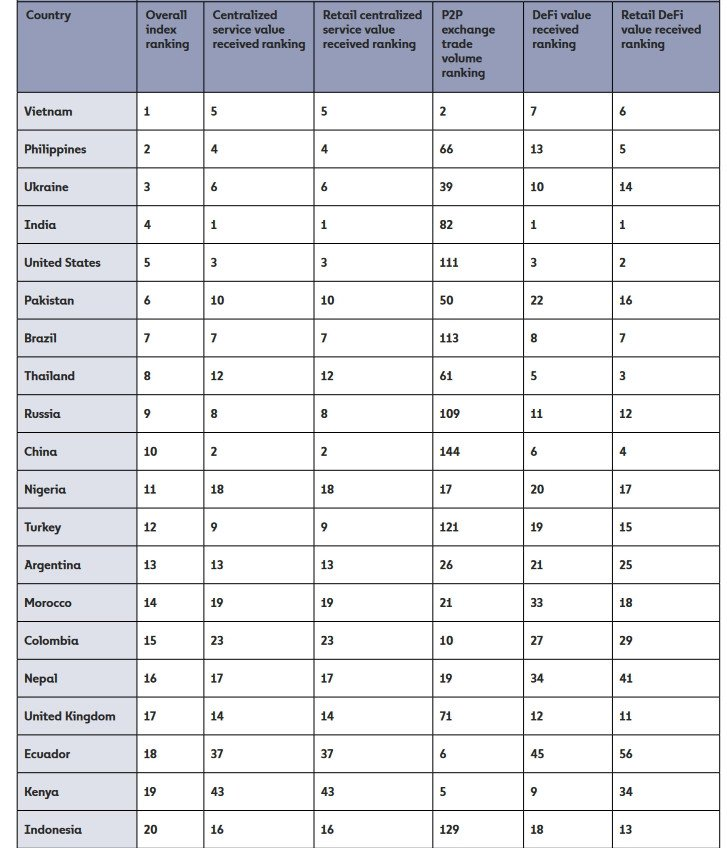

According to Chainalysis, the Asian country is #1 for cryptocurrency adoption. This might be a surprise to some who do not follow this but it is the second year in a row the small country was able to take the top spot.

This is the subject of great debate within the cryptocurrency and blockchain industry. When will mass adoption happen? What will it take to onboard billions of users?

At this point, we do not have the answer to those questions. What we do know is that bear market turned many people off to the new asset class. However, those who look at cryptocurrency as something greater than that are finding this is the ideal time to build.

Therefore, over the next couple years, the entire industry will be different as more applications roll out, providing users with what they desire.

Emerging Markets Leading The Way

What is encouraging is that emerging markets are doing very well.

Vietnam is not a wealthy country. That said, according to the survey, 21% of the population has been involved in cryptocurrency. As we can see the top 10 is filled with countries that fit into this category.

For many, this is not much of a surprise. When we consider the fact that these countries tend to have low purchasing power along with native currencies that are very volatile, cryptocurrency offers a way for them to get involved in the global monetary system, accessing a much larger economy. Even though crypto economies are still rather small at this point, it is often a better option than the one locally.

Another factor could be the banking system. These countries tend to have a lot of unbanked (or underbanked). Nations with banks that tend to be overtly corrupt are finding that digital wallets provide a great alternative. We can also couple this with the fact that stablecoins give people each access to USD exposure, reducing the dependence upon their own currencies which have not fared well in 2022.

“These countries also tend to lean on Bitcoin and stablecoins more than other countries.”

The impact that cryptocurrency can make in this countries is much greater than in the developed world. This is the case, at least, in the near-to-medium term.

Hundreds of Millions Are Going To Join

It is obvious that the numbers are down overall throughout the year. Cryptocurrency is no longer making headlines on the newscasts. Instead, due to the pullback in prices, many turned their backs. This shows how, to most, it is still all about price.

The emerging markets often have different incentive. We can draw similar conclusions from some other nations on the list.

Ukraine, for example, might be depending upon coins and tokens due to the fact the country is being ravaged by war. There is no telling how the banking system is holding up. Also, many donations have poured in from around the world for Ukrainian citizens who are affected. This has come in the form of cryptocurrency.

When people talk about buying cryptocurrency, they are missing the entire point. This is not meant to be another asset class that one buys, like stocks or commodities. Instead, we have a situation where the entire Internet, along with much of the financial system can be reworked. There are people who are looking to develop true DeFi applications that will give people access to financial services while also having full control over their money.

Financial sovereignty is not something that most value, until they lose it. With all that is going on in the world, it is not outlandish to think this could happen to many of us. Sadly, corruption appears to be more overt and spreading.

The development that is taking place is providing an alternative.

Let us look at the Chinese.

That nation came in at number 10 in spite of a massive crackdown by the government.

“[W]hile the ban initially caused a large dropoff in crypto activity, China’s market has bounced back in recent months, suggesting that the ban is perhaps ineffective or loosely enforced.”

The last part is vital. We really should try to delve into which one it is. Is the increase in Chinese crypto activity due to loose enforcement by the government or is it because bans are ineffective. We can presume that it could also be a combination of the two.

If it is a situation where the CCP is not even able to completely stop cryptocurrency, then we are looking at something completely revolutionary. If government policies are going to be completely ineffective, then the entire dance that is taking place is for naught.

We will have to see how things unfold. We know the governments of the world are pushing hard for cryptocurrency regulation. Will this stem the tide?

For now, it seems the developing countries are showing up strong when it comes to this. There is a need which is obvious to most and these populations are finding at least a partial solution through cryptocurrency.

Let us hope this keeps spreading.

Image from article linked

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

There is no European countries...

@pixresteemer(6/10) gave you LUV. tools | wallet | discord | community | <>< daily

tools | wallet | discord | community | <>< daily

HiveBuzz.me NFT for Peace

This is a really good move for the moment, we expect more subsequent years to come. Crypto to make waves soon.

Am sure Veitnam didn't make the mistake Elsalvador did. They had to carryout some education of citizens as regards crypto. With time when countries have not been able to cope up with the economy, there will be mass adoption. Thanks for sharing, do have a great weekend.

I think cryptocurrency will enable developing nations to 'jump' the traditional banking system. It's a better alternative for financial transactions and it's also readily available.

It does get them around the centralized financial arena that is controlled by a handful of banks around the world.

Posted Using LeoFinance Beta

Good to know that PH is # 2!!! 🤣😅😂

!PIZZA

!LOLZ

Posted Using LeoFinance Beta

lolztoken.com

He'll stop at nothing to avoid them.

Credit: reddit

@taskmaster4450, I sent you an $LOLZ on behalf of @rzc24-nftbbg

Farm LOLZ tokens when you Delegate Hive or Hive Tokens.

Click to delegate: 10 - 20 - 50 - 100 HP

(2/4)

https://twitter.com/1415155663131402240/status/1583477121896235009

https://twitter.com/1429415246129729538/status/1583508131182542850

The rewards earned on this comment will go directly to the people( @rzc24-nftbbg, @michupa ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Looking at the image, I immediately ran to check for the ranking of Nigeria. I'm glad we had a good ran regarding P2P trading volume.

Amid the unfavorable standpoint of the Central Bank of Nigeria which led to banks being disconnected from exchanges, a good number of Nigerians resorted to using P2P for funding their accounts as well as withdrawing funds.

Generally, crypto adoption is rising in Nigeria as many are coming to the light of the technology.

Posted Using LeoFinance Beta

Looking at the people on here, it seems like Nigeria is well represented. If that is an indication of what takes place in the country as a whole, it is a terrific start.

Posted Using LeoFinance Beta

!PGM

!PIZZA

!CTP

!LUV

BUY AND STAKE THE PGM TO SEND A LOT OF TOKENS!

The tokens that the command sends are: 0.1 PGM-0.1 LVL-0.1 THGAMING-0.05 DEC-15 SBT-1 STARBITS-[0.00000001 BTC (SWAP.BTC) only if you have 2500 PGM in stake or more ]

5000 PGM IN STAKE = 2x rewards!

Discord

Support the curation account @ pgm-curator with a delegation 10 HP - 50 HP - 100 HP - 500 HP - 1000 HP

Get potential votes from @ pgm-curator by paying in PGM, here is a guide

I'm a bot, if you want a hand ask @ zottone444

It makes you wonder if it is the large expat population that is driving that or if it is nationals. I am guessing since the number is so large, it is probably a fair share of nationals.

Posted Using LeoFinance Beta

I would believe it is the nationals. This is something we are seeing in other developing nations. They are well represented in the rankings.

Posted Using LeoFinance Beta

Very cool!

I think it's important to look at why people are getting involved in crypto and blockchain. Is it purely "to make a quick buck," or are they truly wanting to be part of the next iteration of global finance? If we were to remove the first category, just how many people would actually be interested in what we're doing?

In a sense, maybe the bear market is a good thing, just like the dot-com crash took a lot of the focus off the "where's my Lambo?" mindset and instead started people looking at how to actually use web sites and the Internet.

=^..^=

Posted Using LeoFinance Beta

I would say the developing countries are less about making a quick buck, at least from the speculation/investing perspective.

To me, they are without strong banking so it is a matter of utilizing better financial services.

In the developed world we live by the mooning and lambos. Those people just try to earn a little money and keep it.

Posted Using LeoFinance Beta

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

Most developing choose crypto because of it security towards bad government and bad economy. Crypto has been saving grace for many over the years

Posted Using LeoFinance Beta

That is how I read it. Makes total sense to me.

Posted Using LeoFinance Beta

It just mystifies me how many people here in the United States still think that crypto is a scam and a joke. I know fiat isn't going away any time soon but I love knowing that I don't have to rely on banks completely.

!CTP

In the developed world, people are pretty clueless. They swallow what the media shoves at them, never looking outside their country.

You are right, the opportunities in crypto, even if just not having to deal with a bank is powerful.

Posted Using LeoFinance Beta

Pretty sad stuff. I am just happy I work at not being clueless. 😀

!ALIVE

!CTP

@taskmaster4450le! You Are Alive so I just staked 0.1 $ALIVE to your account on behalf of @lisamgentile1961. (2/10)

The tip has been paid for by the We Are Alive Tribe through the earnings on @alive.chat, feel free to swing by our daily chat any time you want.

Good Morning and Thank you, @youarealive! Enjoy your day.😀

And my country, Philippines second place.

I think, big Hive community project proponents should take a look at the Philippines for promoting Hive and other Hive projects.

So far, the most active community of Hive user in my country is the @HivePh

💪🏼

It's much easier for the less wealthy countries to live off of crypto so I definitely see it more appealing to them. I am kind of surprised that the US didn't place 1st in any of the categories though

Posted Using LeoFinance Beta

I gifted $PIZZA slices here:

rzc24-nftbbg tipped taskmaster4450 (x1)

@torran(2/10) tipped @taskmaster4450 (x1)

Learn more at https://hive.pizza!