Car Dealerships: Are They In Trouble?

Anyone who follows Tesla know the automotive industry is in a time of transition. This is an industry that really has not changed in the last 100 years. However, we are see a couple of forces that will completely change how business is done.

The shift to electric is underway. Countries like China, which is the largest market in the world, is seeing double digit market share acquired by EVs. This is similar to what we see in the EU. As for the US, while it is lagging, Tesla attained a 5% market share.

A key to this is that it did it without any vehicles in the two largest automotive segments: pickup trucks and low priced autos.

Tesla's product line is still considered premium.

There is another major shift that, at this time, is not so evident, but could circulate rather quickly.

It is the transition to direct sales. This has an impact upon dealerships and threatens the entire model.

Losing Sales

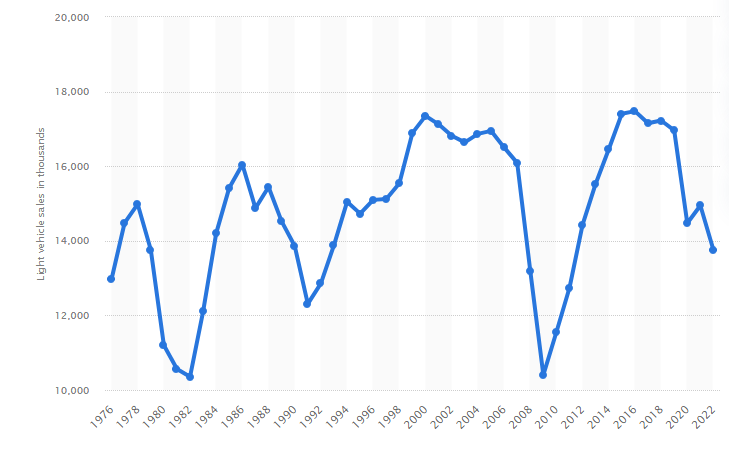

United States automotive sales are on the decline. The above chart shows how the sales have dropped since 2017. This is a very steady decline, from over 17 million in a year to just under 14 million last year.

This obviously is hitting manufacturers hard. However, what is often overlooked is the impact upon the dealerships. In the U.S., almost all cars are sold through a dealership. Losing 3 million in sales is a lot of revenue. At $20K or $25K per vehicle, this is a lot of money.

Of course, as the chart also shows is what we are seeing is normal ebb and flow of the industry cycle. We saw periods of major pullback. This is not uncommon.

We could conclude that most approach this simply as business as usual. After all, the previous pullbacks were met with rebounds. There is no reason to believe this time is any different.

Or is there?

Direct Sales

One things the newer EV companies bring to the table is a direct sales model. While Rivian is a small player by volume, Tesla is starting to gain some serious market share.

In the first quarter of 2023, the company delivered 163,371. These are all sales that are not taking place at auto dealerships. It is a marketshare of roughly 4.5% of the total car market.

We are also looking at the company delivering 640K on an annualized basis, as compared to 545K in 2022. Of course, Tesla is still scaling the Austin plant, a factory that might spit out 250K-300K this year. Couple that with Fremont, we could see more than 700K vehicles delivers in the US by Tesla without going through dealerships.

What happens to an industry when 5% of the revenues are removed? It doesn't crush everything but it does affect the profitability of many entities. Also, many companies simply cannot survive. In other words, there is bound to be contraction.

To make matters worse, the CEO of Ford has commented that the future of the industry is direct sales. Since it has a dealership network, the ability to break away is going to be difficult. Nevertheless, it does mention where the thinking is among many in the industry, at least at the manufacturing level.

It is questionable whether Tesla reaches its goals. However, if it reaches even a portion of the 20 million per year in 2030, this could be devestating to the dealerhsip networks around the world.

This would result in a great deal of consolidation.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

you mean truck dealerships. Nobody sells cars anymore here. Just trucks and SUVs and ruins the entire transportation system. #randomventing

How are we going to be able to test drive first before buying?

Tesla set up company centers where people can drive the cars. With that company, there are 3 mondels so not too hard.

Those who are trying to push out 30 different vehicles might find some difficulty.

Posted Using LeoFinance Beta

I just think car dealerships are useless now outside of test driving a vehicle. There just doesn't seem to anything worth the extra middleman fees involved though.

Posted Using LeoFinance Beta

If electric is going to compete long term they need to get different materials. There’s only so much lithium and it’s the horrendous mines and conditions in them that isn’t sustainable. The green obsession overlooks that information sadly.

Direct sales are definitely shaping up to change things quite a bit!

Posted Using LeoFinance Beta

Lithium is one of the most abundant materials on the planet. Most countries have it. In the US, much of NEvada is Lithium. The problem is refining. That is centered in China.

One of the reasons why Tesla is building a refinery in Texas. The US (and EU) need a lot mpre refiners of all materials.

Posted Using LeoFinance Beta

Huh I’ll have to do more research on it then! I guess I was wrong!

Posted Using LeoFinance Beta

I didn't realize the CEO of Ford said that - almost like foreseeing their own downfall. Just think about all the high-interest debt that Ford has on its balance sheet to finance the maintenance of their nationwide dealership network...that's a lot of dinero that is going to lose value to the new direct-to-customer sales model.

Posted Using LeoFinance Beta