China Following The Same Path A Japan

We are seeing a great deal of similarity between today and what took place over 30 years ago. At that time, Japan was the upcoming star that was going to eclipse the United States. Fast forward a few decades and people are presuming it is only a matter of time before China bumps the U.S. from the top spot.

Oddly, many are not talking about the striking resemblance between the two situations. Yet, it we take a bit of time to connect the dots, we can see how some of this has a very familiar feeling.

It is best to consider what things happened in the past to see if things align.

Real Estate Bubble

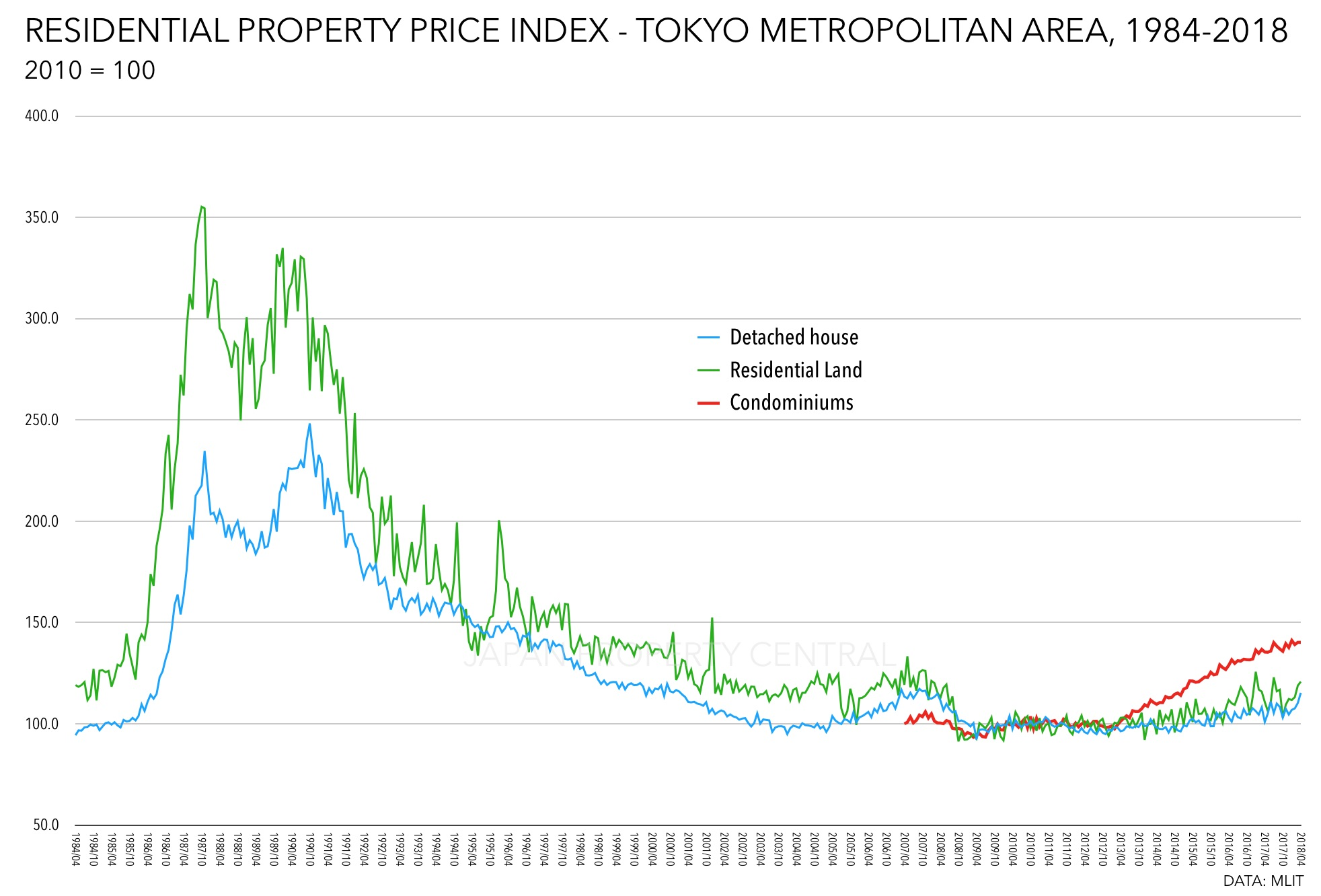

The first aspect of the analysis has to be the real estate market. This is where we see the exact same behavior. Unfortunately for the Japanese, this did not end well.

Everyone is well aware that China is in a housing bubble right now. The Central Government is doing all it can to slow down prices. For this country, GDP growth was of paramount importance. The easiest way to reach this end is to build stuff. China did that to the max. There are many "ghost cities" around the nation where few people live.

The danger here is that the it is estimated that 70% of the wealth of the Chinese people is in real estate. People bought second and third properties as investments. Unlike the housing bubble in the US 15 years ago, this was not done with liar loans and no money down. Deposits up to 50% were put down on the properties.

Looking back at Japan, they suffered a huge run up in housing prices. Sadly, when it collapsed, it took everything along with it.

Tokyo, the largest city in the world by population, houses near 1/3 of all Japanese citizens. It is an example of something that should recover, especially consider all the easing the Japanese government and central bank did over the last 25 years.

However, this is what things look like.

Source

As we can see, the market is still far below where it was. In nominal pricing, we are still looking at a 45% decline from its peak. We can conclude the money printing didnt help the real estate prices as many claim.

Will the Chinese be able to navigate the real estate dilemma any better than the Japanese? It is not likely since it is a tough problem to conquer. Turning real estate is like trying to maneuver an oil tanker. Any move takes a while to have an impact and it is very difficult to apply just the right amount of pressure. At present, many of the Chinese developers are finding themselves with debt problems. This is likely to grow as the inevitable slowdown in real estate (which is the government's goal) takes hold.

Demographics

Who can forget the demographic issues that plagued Japan for the last 25 years? The country suffered a great deal of devastation to its system due to the fact that the population aged rapidly. The demographic chart quickly became inverted as the population that was born in the 1930s started to reach retirement age. This was the first wave of global baby boomers, preceding other nations around the world.

Of course, when there are less children in comparison to the older segments of the population, there are severe social, economic, and tax impacts. Japan spend more than two decades trying to figure it out.

To their credit, their GDP is still near where it was 30 years ago. There are movements up and down but, overall, it is sideways moving. This is a testament to the Japanese considering what they dealt with due to the demographics.

The most recent census by the Chinese, which we can presume is fabricated to some degree to their benefit, shows that the one-child policy was very effective. According to official numbers, the nation eked out a slight gain over the last 10 years. Demographers outside the country doubt the validity of this.

At the same time, the government did cop to a fertility rate of 1.6. To maintain one's population, it needs 2.1. Again, those outside the country believe this to be inflated, with the number possibly coming in closer to South Korea at 1.0.

We will have to watch for signs that China is heading down the same path as Japan in this regard. There could be some indication by the middle of the decade. If that is the case, watch out.

The China Growth Story Is Over

China is no longer a growth story. It grew up. That took place over the last 40 years and now it appears we are in for a reversal. Compounding this is the apparent desire of the CCP to return to the Maoist Era in terms of the control. The recent clampdowns will have adverse economic effects but could help their power base. Either way, that does not bode well for surpassing the United States.

There is also the problem that China is still a poor country. It has a large GDP yet we need to factor in the 1.4 billion person population. Their per capital GDP is very low, ranking in the 70s on a global scale. As some are saying, China got old before they got rich.

We also have one major difference with the Japanese. Unlike the Chinese, they are well respected around the world and have the technological know-how to operate on a global basis in spite of the demographics. China does not have this. They have one ally in their region, Pakistan, with everyone else ranging from neutral to outright detesting them.

As for the technology, the infrastructure is not there. Most of what the Chinese have is reversed engineered. That said, they are lacking in one major area: semiconductors. The Chinese semiconductor production is 1-2 generations behind. This is understood when you realize that the most up-to-date chips carry the largest price tag. Hence, it is cost effective to manufacture in Taiwan or Japan. As new generations come out, the older ones have to be sold at a discount. This is where China and the ability to cut costs enter.

While it is a help to their manufacturing base, it does not give them access to the latest technology to reverse engineer. Thus, the Chinese are basically absent from the global semiconductor scene.

Not a good place to be in considering that Intel, not exactly an industry leader anymore, is building 5 plants in 4 different countries.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

You need to stake more BEER (24 staked BEER allows you to call BEER one time per day)

https://twitter.com/taskmaster4450/status/1457532534783369220

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Nominally, we might add the Burmese military government and maybe the Maoist-influenced Nepalese regime. Even if we did though, both of those are small potatoes.

Posted Using LeoFinance Beta

China's infrastructure is definitely not there. Their semi-conductor and chip businesses had a lot of money invested in but it all failed to play out. I think their only option if they want to catch up there is probably Taiwan but I don't want that to happen at all.

The only thing I wonder is whether or not their lead in AI is enough to offset things. After all they have a lot of data even if a lot of it was by stealing.

Posted Using LeoFinance Beta

Hard to be a leader in AI when you are trailing in the semiconductor game. Especially since we know specific AI chips are being designed by companies like Tesla and made by Samsung. This is not taking place in China.

Posted Using LeoFinance Beta

We live in such a paradoxal world for China to be In the space race while struggling with its tech industry. I think they are going to pay for the BTC mining ban, even if they reverse it promptly which is a big if. Graphic cards are easier to get rid of than to acquire in an age of peak... everything!

Posted Using LeoFinance Beta

Personally I think the BTC mining move was a huge misstep. They simply gave up what many thought was a dominant place in that arena.

Now it spread throughout the world: good for Bitcoin, bad for China.

Posted Using LeoFinance Beta

Congratulations @taskmaster4450le! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

Yes, I believe and hope that China have severely overextended themselves. Something about a massive power hellbent on global dominations scares me...

To be fair, China is far from the only entity that has those aspirations.

Hell Zuckerberg even goes one step further, seeking domination over the end virtual world.

Posted Using LeoFinance Beta

That's right. Wait when all the manufacturing move to India, Vietnam or somewhere else. That will be an inflection point.

Posted Using LeoFinance Beta

Japan started waning itself off Chinese manufacturing 15 years ago. Those companies have very strong operations in Vietnam to name one country. I expect them to populate the entire region with manufacturing.

Posted Using LeoFinance Beta

About the Japan case, I think is more because they hate China than economics 😂

Posted Using LeoFinance Beta

We get these US hegemony killers from time to time. All have gone the way of Ethereum killers so far. The global economy is not a zero sum game but in certain key areas technological the US and Japan are firmly in the lead.

Posted Using LeoFinance Beta

I would agree with that. I see the technology game as US #1 and Japan #2.

As for #3, it doesnt matter since it is so far behind the other two.

Posted Using LeoFinance Beta