Commodities, GSCI, and the Economy

It is easy to give into our emotions. This is especially true when dealing with things such as prices. No doubt increasing prices affect all of us. This is especially true in those nations where the currency is aversely affected by the rising USD.

Nevertheless, it is vital for us to keep those in check and deal with the facts. When we look at prices, we have to step back and look at things from a larger perspective.

We cannot deny the global economy was severely distorted the last couple years. Between the shutdown which completely upended supply chains along with government response via check distribution, we see the entire supply/demand equation affected.

Sadly, this is going to take some time to resolve.

That said, commodities are one of the things to look at long term. They are an important component in what takes place around the world. Naturally, there are many different ones, all that affect each of us. Nevertheless, if we can get a handle on things, perhaps we can gain some solace of where things are going in the future.

GSCI

The Goldman Sachs Commodity Index is one of the benchmarks for global commodities. Here is what it entails:

The S&P GSCI® is a composite index of commodity sector returns representing an unleveraged, long-only investment in commodity futures that is broadly diversified across the spectrum of commodities. The returns are calculated on a fully collateralized basis with full reinvestment. The combination of these attributes provides investors with a representative and realistic picture of realizable returns attainable in the commodities markets.

Individual components qualify for inclusion in the S&P GSCI® on the basis of liquidity and are weighted by their respective world production quantities. The principles behind the construction of the index are public and designed to allow easy and cost-efficient investment implementation. Possible means of implementation include the purchase of S&P GSCI® related instruments, such as the S&P GSCI® futures contract traded on the Chicago Mercantile Exchange (CME) or over-the-counter derivatives, or the direct purchase of the underlying futures contracts.

Naturally, if we listen to the mainstream financial media, we are led to believe what we are experiencing right now is the worst we ever saw. Actually when it comes to the overall commodity situation, we can see how this is rather average.

This is a long term chart of the GSCI. Remember, this tracks prices according to the global markets. It is how they price things.

As we can see, from the 25 years chart, we endured much worse situations.

There is another positive here. Since the peak just before the Great Financial Crisis, we saw a downward trend in commodity prices overall. The index was over 10,000 at one point and is now at just under 3,600. We are now at the point where we were many times in the past.

So why are prices continually on the decline?

In my view, this can be summarized by technology. The simple fact is we get better at drilling, growing, and mining things. Over time, as technology advances in the different industries, it results in a price reduction.

We also have another component to this. Over the last 15 years, the global economy was rather sick. While the mainstream media promoted the idea of things on a tear, the cruel truth is we are far behind growth rates heading into the GFC. In fact, we are near $7 trillion in lost GDP since that time if we had only maintained the 70 year growth trend.

Call it a "silent depression".

Commodity Prices Can't Overcome A Poor Economy

From a price perspective, this is some good news. Unfortunately, there is a trade-off that we have to endure.

Commodity prices cannot withstand catastrophic economic conditions. Some might do well especially if there is scarcity. Most, however, will see demand drop which ultimately presents a problem.

It seems certain that we are in for tough economic times globally for the next 12-18 months. With many commodities still elevated, this means we will see a drop in many of them. So far, most have pulled back off their highs yet are still at elevated levels.

The industrial metals appear to be leading the charge down. This is another factor that makes sense since it is what goes into manufacturing and construction. If that is slowing, companies are not going to need as many raw materials.

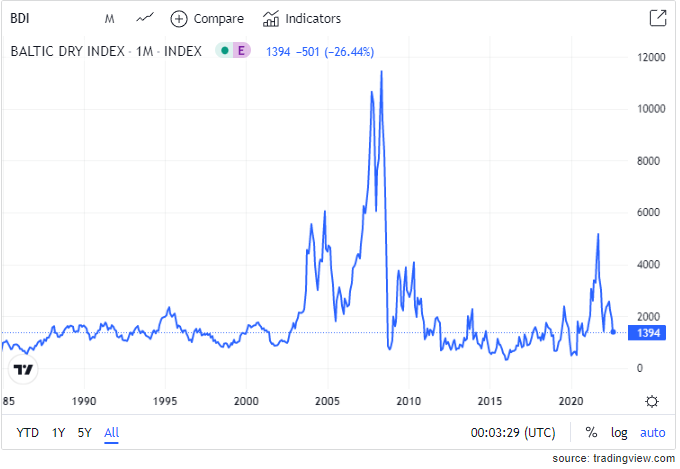

We also have the Baltic Dry Index (BDI) which charts commercial shipping rates for the different routes around the world. We saw it elevated in 2020 and 2021 only to see it plummet this year.

As the chart shows, not only have to crashed from where we were recently, but we are now back within the long term range.

A decline of this magnitude shows that demand for shipping is waning. This aligns with a slowing economy.

Have no fear, the destruction of the economy will take care of any of those pricing issues we are seeing.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

PIZZA Holders sent $PIZZA tips in this post's comments:

@pixresteemer(1/5) tipped @taskmaster4450le (x1)

You can now send $PIZZA tips in Discord via tip.cc!

What can overcome the poor economy? These days we are getting worried about price rising of everything and inflation too.

More money and collateral globally. Since the GFC, we saw the production of USD flat along with a scarcity of collateral for the banking system.

Posted Using LeoFinance Beta

Thanks for the kind reply, I understand now

All world economies have been experiencing problems with price increases, but in the last two years it has been more accentuated by the presence of COVID-19 and if it must be kept under control so that this excessive price increase does not continue.

Japan went through 20 years of the opposite.

Posted Using LeoFinance Beta

I think this was the expected result given the decline in orders for various different items (less discretionary income). Another thing people might be considering is the increased fuel cost as that also increases the cost of transporting goods.

Posted Using LeoFinance Beta

The way the prices of things here is Nigeria breaks the sky-roofs is alarming. (More) miserable it is that the percentage rise does not come in small proportions but as high as 100% at times.