Cost Curves And Network Effects

In this article we will cover one of the most powerful lessons I ever came across. This is something that is common sense when one thinks about it but we usually do not frame things in this manner.

Yet, when it comes to technology, this is crucial.

People often talk about cost curves. The price of a particular product is dropping x% per year due to the advancement of technology. On this point, most are familiar. However, there is another important factor which somes into play: the network effect.

These two, in combination, is why technology is often discussed as exponential. To fully grasp the concept, we have to shed our linear thinking.

The Smartphone

Regular readers know this is one of the best examples I could find to illustrate how technology works.

Throughout the 1980s, mobile phone technology was costly. This meant it was rather limited in the number of users. At the same time, the investment was rather constrained since the market was not fully developed.

This carried into the 1990s. We did see progress yet it was not astronomical. Networks did fill in but the numbers were rather small relative to what they would become.

We saw a major change when the cost of the phones started to drop under $100. This, combines with plans that were under $50, meant that people could start to afford them. Suddenly, the numbers skyrocketed. Mobile adoption was at hand.

Of course, there was another layer to this story. With the introduction of the smartphone, we saw another cost curve take a radical drop. This was that of computing.

While the smartphone did not take out computers, it did provide many, especially in third world nations, with the ability to get rather inexpensive computers. As time passed, the components improved so that a $50 smartphone today is more powerful than the $1,800 laptop I purchased in 2001.

Exponential Technologies

We see a number of technologies starting to play out along these same lines.

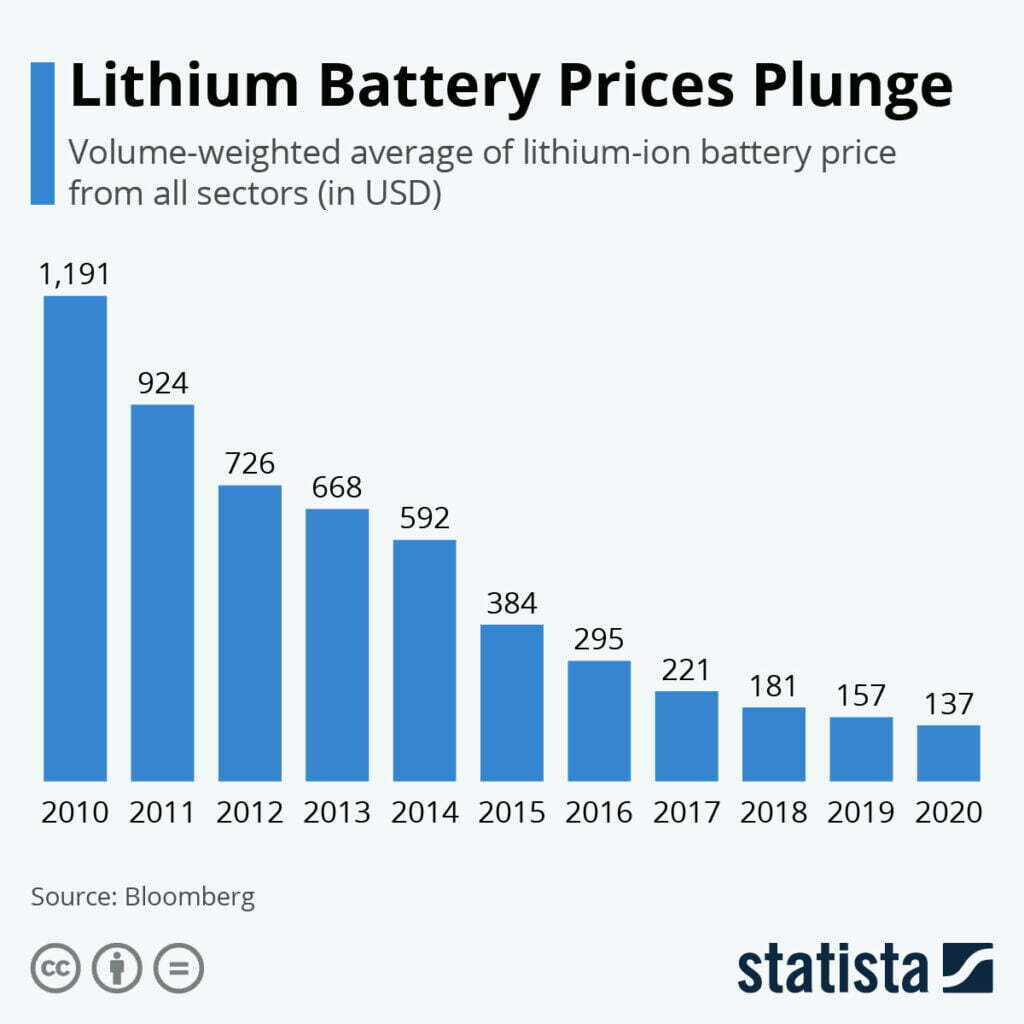

One of the biggest areas is with batteries. The cost is falling dramatically, in spite of recent spikes in commodities.

Notice the change over the last decade. Many are projecting that we will see this number sub 100 by 2024. While the past performance does not necessary means it will continue, the fact that so many are putting money into researching this areas says that it is a pretty good bet.

Now let us consider all the areas this could apply to. To start, it is why so many are excited about the potential of electric vehicles. Today, they are still rather expensive relative to what most people can afford. However, where will the price of batteries be by 2030?

Again, even if the pace slows, we can see how it is likely to be less than half of what they are today.

Here is where the network effects enter the picture. As prices go down, adoption increases. We commonly think of network effects pertaining to social media or digital applications. Yet it can easily be applied to areas such as energy and transportation.

This is seen in manufacturing via Wright's Law. It is an idea put forth by Theodore Wright who opined that when the number of units manufactured doubles, the cost decline by 20%. The basic idea is that competance starts to take hold as a firm increases the number of units output.

Here again, we see costs driven down which helps to increase adoption. For a new technology it is a powerful combination.

This is how the mobile phone could go from being a niche product to mainstream adoption in the developed countries in a short period of time. The path was even quicker in the developing world as the smartphone made computing inexpensive.

Keep all of this in mind the next time mainstream adoption seems so far away. Remember, technology has a way of changing the entire equation in only a few years.

It is something that is at the heart of FinTech and the massive expansion we will continue to see in that area.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

@pixresteemer(1/10) gave you LUV. tools | wallet | discord | community | <>< daily

tools | wallet | discord | community | <>< daily

HiveBuzz.me NFT for Peace

We discussed this exact concept during one of our small group discussions with George Gilder on campus today — discussing wealth, poverty, and super abundance.

The entire premise of advanced automation really provides interesting concepts about abundance, work, and society. What happens if the economy has near unlimited energy and labor (robotics/automation)? How does that alter things?

It is a radical proposition.

Posted Using LeoFinance Beta

I just finished reading an interesting book by J. Storrs Hall: Where's My Flying Car?.

He discusses lots of topics beyond aviation, including unlimited energy.

I would be interested in your take on some of the concepts discussed in the book — and I think you might enjoy writing about them.

Economies of scale, fixed cost in capital equipments, overheads, and R&D got divided per unit as number of unit sold expands.

Technological and process advancements increase productivity and often times the variable cost per unit is reduced. Fixed cost may be reduced as well.

Result: Virtuous cycle, until diminishing return hits or next disruption.

Hence the S cruves.

Posted Using LeoFinance Beta

https://twitter.com/904656441772007424/status/1588374731400818688

The rewards earned on this comment will go directly to the people( @joydukeson ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Congratulations @taskmaster4450le! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 59000 replies.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

Technology is improving very fast and it's kind of amazing to compare computers/laptops today to the ones ten years ago. However, it also lets a lot more people get online and I think that is one thing that will help crypto thrive.

Posted Using LeoFinance Beta

That is one area of the network effect. I am not sure of the pace but we can expect another 2 billion people joining by the end of the decade.

Posted Using LeoFinance Beta

This is really interesting, never saw it in that light.

Technically speaking, this could change the timeline for the adoption of a lot of things. How do you reckon this will affect blockchain adoption seeing there's no "cost" per se.

Blockchain follows information technology to a great degree. The components of processors, storage, and software all factor into the pricing.

For example, the latest hard fork saw the size of the hive database compressed to about half the size. That is a big step in efficiency and storage cost for the nodes.

Tokenization introduces a new concept since there is the incentive mechanism. Think about the fact anyone can post on Hive and use the decentralized database, only having to provide RCs to operate.

That is an interesting proposition.

Posted Using LeoFinance Beta

I believe by 2035 electric car should be a lot cheaper because the manufacturer should have detect a way to make it smarter and reduce the cost just like the early phone and computers. Time is a two side sword it's either make it better or worse

Posted Using LeoFinance Beta

There are a number of variables that factor into this. So yes I can see the technological curve applying to EVs also.

Posted Using LeoFinance Beta