Florida: Shows How Messed Up Things Really Are

We know the response by governments all over the world to COVID-19 screwed everything up. Now the hen has come home to roost and, contrary to what many are proclaiming, things are a total mess.

No place epitomizes that more than the State of Florida. The Sunshine State resisted a lot of the calls for draconian lockdowns, moves that crushed state economies. Places such as New York and Illinois are in serious trouble (although federal bailouts are saving them), something that Florida mostly bypassed.

That does not mean, however, that things are great. In fact, the state is making the same mistake as many others believing we are in for some stellar recovery. Sure, year-over-year numbers (YoY) look good. But we have to keep in mind that this time last year saw things falling off a cliff economically. The second quarter of 2020 was horrific by every measure.

The Governor of the state, like many other Republicans, is hearing the calls from businesses. Recently, businesses are screaming they cannot find workers since "it pays more to stay on one's couch" due to the federal unemployment dollars that are flowing into those without a job.

This amounts to an extra $300 per week, in addition to the $250 or whatever the state pays. It is a problem that is designed to run through August.

For those without a job in Florida, that will run out in the later part of June. The state is no longer accepting the money from the Feds. They are answering the calls of businesses, basically forcing people back to work.

Of course, the presumption is that business are not finding workers due to pay. While I am sure that is part of it, there is another piece to the puzzle: the jobs they offer suck.

Anyone who worked in a fast food restaurant knows what I am talking about. The conditions are awful and the hours tend to be equally as bad. The pay is abysmal leaving many below the poverty line. Of course, it ought to tell you something that when unemployment of $550 a week outpaces the pay an entire industry offers. On a 40 hour workweek, that works out to $13.75 per hour.

Certainly not in Elon Musk or Jeff Bezos territory.

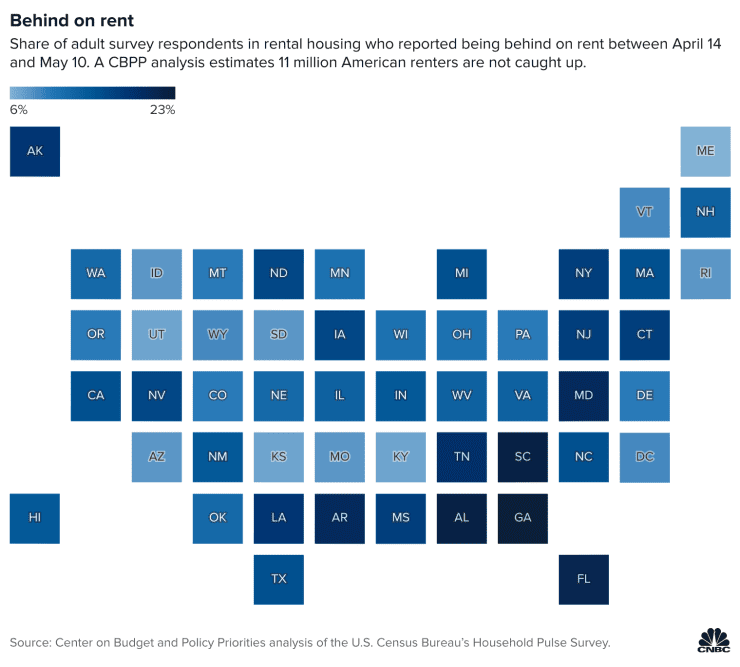

Now we are seeing the renter's moratorium ending. This was put in place by the CDC (how this was allowed to go through by this agency I will never know) claiming that evicting people could increase the spread of COVID. Well, that moratorium is coming to an end meaning that, according to CNBC, more than 11 million people could be evicted.

Isn't it interesting to see Florida on this list. It is one of the darker colors, placing it in the 23% category. That means that near 1 in 4 renters are behind on their rent as of the dates cited in the study.

So what gives?

Florida, even though they did not implement full lockdowns to the extent of some other states, did have its economy hit hard. The state depends heavily on tourism, something that was affected during the past year. While the hospitality industry has bounced back some, it is not to the point where it was before. In fact, executives in the airline industry, for example, believe it will take at least 3 years before they see the passenger traffic what it was pre-COVID. Foreign travel is still almost non-existent, especially from Europe where lockdowns still continue.

Who knows. Perhaps Floridians are just exceptional at bilking the system. Maybe they were taking their unemployment money and omitting paying their rent. Of course, if they were doing this, where was it going? Maybe some made it into savings but that is not typically how bilkers operate. Thus, we can only presume it ended up in other areas of the economy.

If that is the case, who benefited the most over the past year? That would be the likes of Amazon. Hence, if people are going to have to pay rent, in addition to losing their Fed money, they will not be buying crap off Amazon. Ultimately, the money has to go somewhere if it isn't in savings.

The bigger issue is what happens to these renters. With an eviction, many will not find new places since landlords will not touch them. That means shacking up with friends and family.

Taking 11 million people out of the rental pool could have an impact upon the real estate market. While these landlords are happy to get rid of them, that does not mean there will be others lining up to rent. Again, the market is only so big and if a large portion are removed, there suddenly is a surplus in rental houses.

This could force many landlords to proclaim they had enough and put the properties up for sale. Naturally, this could increase the supply on the markets, putting pressure on the demand side of the equation.

Couple this with a slowdown in the economy since people are jumping the gun, in my opinion, with their belief about the strength of the recovery. With stimulus diminishing greatly, we will see if it is able to stand on its own.

In the end, this is all a big mess and Florida epitomizes it. We will see how it all unfolds but my expectation is that it will not be great in a few months. People are going to quickly realize that calls for a strong recovery are way overblown.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

View or trade

BEER.Hey @taskmaster4450le, here is a little bit of

BEERfrom @pixresteemer for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.It's a complicated situation indeed... I think things can snowball big time.

I heard a lot of the strong global recovery, but I just don't see it...

Posted Using LeoFinance Beta

Florida will bounce back better than most states because they were not locked down and tourism pours money into the state.

It is not that fast food jobs suck, it is that they are competing against Santa Clause. Free money and no rent. You are right, though, there is real pain coming. Printing money is losing proposition for a long term recovery.

Posted Using LeoFinance Beta

Not sure that is what is happening even though the rhetoric is out there. We see the Fed easing which means swaps. That is not money printing but few seem to realize that.

Nevertheless, we will see how tourism bounces back. It is an advantage as are older people. That brings a lot of money into the "retirement" states via healthcare.

Posted Using LeoFinance Beta

I have a feeling a return of tourism to some level will go a long way to help in Q3 and Q4, may be a way to get some people back to work in those service industries. Florida may see housing rental rates reduced, that has certainly happened here in Toronto (5th most unaffordable city in the world), by as much as 20% in some neighborhoods. Perhaps things have just changed, and won't ever be what they were before. maybe for the better maybe for worse. people can be resilient sometimes when least expected.

Posted Using LeoFinance Beta

I would say as the flight out of urban areas takes place, city rents in Orlando and Tampa might drop (Miami is an entity all unto its own). However, I am not sure that happens outside the urban areas since people are moving towards the suburbs. This could keep upward pressure there.

As for tourism, you might be a bit optimistic but we will see. There is a chance people will start to travel again after being cooped up for so long. It bodes watching.

Posted Using LeoFinance Beta

haha yeah I think your post caught me in an optimistic mood!

Posted Using LeoFinance Beta

This is just one more example of the corporate government alliance sticking it to those already hurting the most. But don't worry the blockchain revolution is going to solve this.

#agorism

Congratulations @taskmaster4450le! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Check out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!

I didn't imagine things were that bad in the States, it will be very interesting to watch how the prices of rent and real estate evolve in the next months because where I live these are sky high and they don't look like they are coming down anytime soon

Posted Using LeoFinance Beta

Major cities are seeing price declines already; suburbs, price explosion.

The flight from urban to less urban is taking place. So there is a boom in those markets but we will have to see how long it carries on. We probably got another year to go before we see the price of housing hit.

Posted Using LeoFinance Beta

It definitely is complicated but I honestly don't know how they can really fix things. The lock downs and the disruption of the job market are things that will last us for years. Will we see all the rich and wealthy people/businesses buy up all the homes? I think its possible.

Posted Using LeoFinance Beta

"They" tend not to fix things since they tend to major in messing things up. Hence, those who are pulling the strings will end up collapsing things.

By the way, dont buy into the class warfare the media espouses. The wealthy are in the crosshairs now also. This is a select few who are in the inner circle. The average multi-millionaire is going to be slammed too.

Posted Using LeoFinance Beta

Still an awful lot of people who want homes in Florida. I know two people here in Minnesota that are buying/building homes right now in Florida. There are tax consequences and still weather-related reasons to own property there and those aren't going away. In fact, the pandemic has catalyzed it even more. As you say, it will be interesting to see what happens but I don't think property values will be affected too much. There anyway. As for the rest....?

Posted Using LeoFinance Beta

That is what smart people are doing. Those who listen to the mainstream media, well they will be left in the dark (or cold).

The challenge is that even though people are relocating, if the home prices up there drop, Florida feels it. When people, especially retirees, see their egg hit to the tune of, say, $100K, that is reflected upon the buying end.

Hard to escape the cycle when you carrying things all the way through, especially if people are going to have to live on that money.

Posted Using LeoFinance Beta

Florida has tourism - the cities will bounch back. Back water will another story.

McDonalds and other companies with employees living of food stamps are like failed business for me.

So soon cheap estates?

Tourism is very much up in the air right now. Europe, for example, is not sending people this way. Will that change? At some point, sure. But how long?

And there are a host of other issues that go along with this instead of just the state economy. How will a lot of that stuff be handled?

Posted Using LeoFinance Beta

EU is trying to re-enable the Schengen room with digital vaccine document. But I'm not sure if this will have the intended effects. Not sure if this will have the hoped effect.

Florida is too reliant on tourism and service industry jobs. Living here during the pandemic has shown me the importance of supporting local businesses instead of constantly eating out at chain restaurants.

Its very unlikely that businesses will close again (by authoritarian dictates from county council members) so I see the future of Florida positively.

Still very heavy on tourism except for a few pockets like where the defense industry is big. That is going to be a problem over the next few years as tourism might be slow to bounce back.

The problem is a lot of small businesses got blasted during the last year with a shift towards those who had the funds (and access to capital markets) to weather the storm. Small businesses could not do this.

We will see how it all unfolds. Right now real estate is doing a great job of doing the heavy lifting. Will that always be the case?

Posted Using LeoFinance Beta