Headwinds Facing Residential Real Estate Long Term

People are wondering if the bull run in housing is over. This is a question that is hard to tell. However, regardless of what happens in the near term, we have to step back to get a solid look at what is taking place.

Housing is undergoing a massive change. In this article we will not deal with the technological advancements, something we dealt with in the past. Instead, we are going to cover how the pricing mechanism over the last 3 decades is about over.

This means that we are about to enter a new era in real estate. This is something that is going to shake many in the market over the next decade or so.

Affordability

There is little doubt that affordability is an issue. We keep hearing how home prices do nothing but go up. For much of the last 30 years, this is the case. Sure there were some pullbacks, like in 2006. Nevertheless, in spite of the bear markets, housing keeps churning higher.

What is the cause of this?

For me, this is a simple equation. We saw a mass migration from rural to urban areas. People wonder why home prices keep going up. Look at the populations over the last 30 years for your cities and surrounding areas. What happened there? Obviously, populations exploded.

This means the demand, due mostly to the monopoly on the good paying jobs, was strong. It naturally sent prices higher.

Here is the problem we presently face: there is a massive affordability issue that was glossed over. Why was this covered up to such a great degree? Because people do not pay attention/

Interest Rates

What happened over the last couple decades to interest rates?

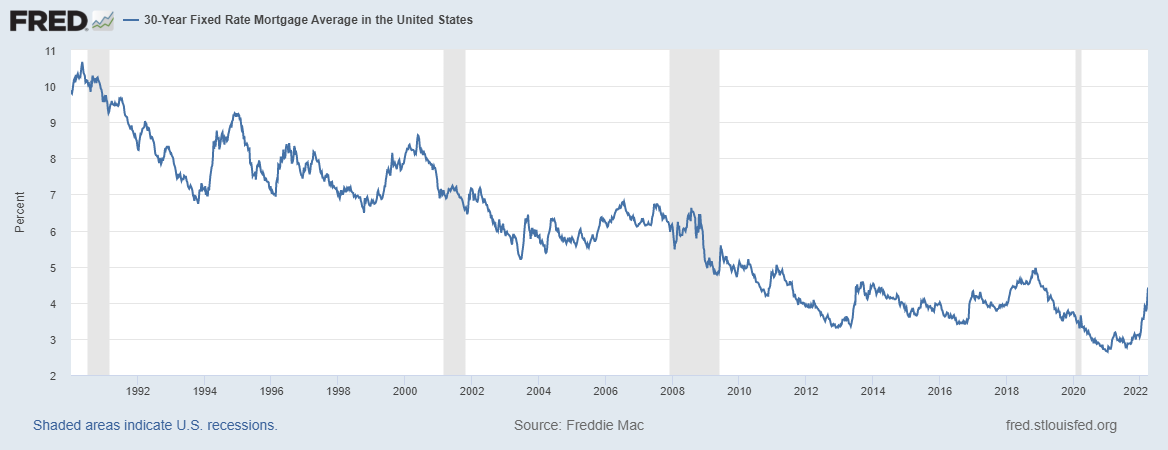

Let us look at the 30 year mortgage rate to see what the situation is.

This is a chart that doesn't take a lot of analysis to figure out the trend. For the most part, it is straight down. There are a few upward bumps along the way only to resume the longer trend.

Please take notice of what happening in 2013 and 2018. Both times we see rates heading higher only to resume their march south. Why are those two date important? In 2013 the Fed tapered and in 2018 it went to its tightening. Both times we were assured rates were heading higher only to end up reversing course.

What do you think will happen this time?

Not Enough Money

When interest rates go down, it is sign there is not enough money in the economy. This scarcity is why lending rates drop. Simply, there is not enough money to sustain growth. This means that banks have to lower the rates they charge to try and entice people to borrow.

Since it is a sign of slowing economic growth, we see challenges. It is the commercial banking system that expands the money supply. When they are not lending, economic conditions tighten. It is a situation that really became evident after the dotcom crash.

Rising rates show economic health. If they are consistently going up, the economy is getting stronger, allowing banks to charge more for money.

We obviously have not seen this.

Unfortunately, without banks lending at an aggressive rate, it is hard to get the output required. For the past 30 years, with declining interest rates, people could afford higher real estate prices since the payment was not appreciating as fast as the price. The lower interest rate allowed for people to incur a higher price. Since the payment was within their budget, people went with it.

However, how do you deal with affordability issues when there is little room to the down side for rates? Sure we had a bump here the last few months but, like before, things will reverse when the market realizes the Fed is wrong again. At that time, rate will start their move towards zero, a situation that does not leave a great deal of room.

In short, since there is little room to adjust the payments, long-term, we are going to have to see home prices come down. This could be led by the migration that is taking place which could affect some of the higher priced areas. However, even without this, the affordability issue cannot be overlooked.

If banks are unwilling to lend, the economy simply gets starved of the USD it needs. Here we see a prime example of how this is taking place.

Will it turn around? Not likely. As rates go up, it makes affordability an even greater issue. This will pull more wind out of the housing market. Nevertheless, the return to lower rates can be expected. Nevertheless, there is ultimately little choice but for home prices to head south for the next couple decades.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

PIZZA Holders sent $PIZZA tips in this post's comments:

@pixresteemer(1/5) tipped @taskmaster4450le (x1)

Join us in Discord!

@tipu curate

Upvoted 👌 (Mana: 11/31) Liquid rewards.

There is far too much "air" in the housing market, for my liking. That is, the GAP between the actual cost of a pile of bricks, wood, nails, wire, sheetrock, paint and pipes — and the cost to assemble them — and the final price of new construction has grown unsustainably large.

Around here, I'm watching more and more people choosing to build rather than buy, simply because the pricing on existing homes often runs about $300K higher than what is costs to just build from scratch on a piece of land. I'm not talking buying in a "new home neighborhood," I'm talking getting an architect and a contractor putting up your own house.

Something in that equation has to give.

Migration back to lower cost parts of the country? A burst bubble? I don't know. I do know that our house (current market value +/- $875K) can be purchased somewhere like Salina, Kansas for about $150K. Something is fishy...

=^..^=

Posted Using LeoFinance Beta

your posts are fantastic ... House prices have risen slightly in Italy, but in the long run the property has depreciated. Also in Italy we have many concrete houses, and these energetically are a disaster ... so this type of house is worth and will be worth less and less.

I agree that real estate sales won't really increase because of affordability. Do you think things like 3D printing will decrease it and help over time? Or do you just think the essential stuff like a room, food and etc will keep up prices while everything else is bound to decrease in prices.

Posted Using LeoFinance Beta

Peaks and troughs are what always see, so I agree a downturn is certain. Indeed, were it not for Covid-19, I reckon we'd be in a down cycle now. Here in Ireland the prices have been pushing higher and higher and higher which is not sustainable. Great analysis - there's lots of people who would get a serious land if we ended up with double figure interest rates like the 1980s, myself included!