Inflation And Prices

What is the inflation rate for $HIVE? Is this a question you can answer. Keep in mind you do not have to be exact.

So what is it?

7%? 6.75%? It's somewhere in there.

Is this something we all agree upon? The answer is obviously yes.

Notice how we asked the question, got a rough estimate on the answer and it had nothing to do with prices. This is a byproduct, not the root of inflation.

What Is Inflation

Perhaps the best way to answer this is that inflation is not an increase in prices. This is where the discussion about the Fed, money supply, and prices immediately goes off the rails.

Inflation is the expansion of the money supply. Notice how it says money supply and not monetary base. Things such as the M2 do not track the money supply since it incorporates more than just dollars.

Hence, when I asked the inflation rate of $HIVE, people thought about how much is produced on a yearly basis. Using that as the money supply, for Hive, we can see how it works.

People do not pay attention to what words mean especially when it comes to economic and financial matters. Yet, if we are to understand what is taking place, they are crucial.

What Friedman was referring to is that there are times when an increase in prices is due to the expansion of the money supply. However, price increases are not necessarily due to money.

For example, one of the most inflationary times is during wars. Here we see how supply chains are disrupted (this should sound familiar), rationing starts, and economic output is traditional diverted towards the war effort.

The last few years were not due to money printing although people mistakenly believe it. Amazingly, they must not have listened to any conference calls or CEOs on television when they mention supply chain disruptions. It is as if they are ignoring this entire piece of the equation.

Quantitative Easing

Japan starting this process in the early 2000s. They took the advice of Pual Krugman, the godfather of QE. Like most things in Krugman's world, the idea of theory and reality didn't match.

Perhaps on paper QE made sense, yet in reality it was a miserabe failure. To start, if it was successful, why did the Japanese understand 20 years and roughly 27 QE projects before they saw any life in prices. The country suffered from a lost decade, 3 times.

Along the same vein, the United States followed the Japanese with equal lack of success. At least the US didn't reach 27 QE projects but it did manage to get 5 in. Of course, all this easing actually tightened global economic conditions since the collateral was being scooped up by the central banks.

Swapping central bank reserves for securities does nothing for the banking system. A bank can collateralize a security. Having a bunch of reserves is why many of the larger banks find themselves balance sheet constrained.

Central bankers like to think they can control the business cycle and alter things. The reality is, if you step back their policies often fail. They are not in control of the economy. Hell, look at the yeild curve, they do not even control interest rates outside the very front end of the curve.

Price Escalation

The Fed is fighting price increases that have nothing to do with the money supply. This is why it became such a joke.

We saw the lockdown of the global economy. Economic productivity was basically stopped. During this period planting, mining, and manufacturing all were removed from the equation. The only think that happened was people watching Netflix and buying from Amazon.

When supply is stiffled, it is not hard to figure out where prices go. Of course, in 2020, the Japanese finally got some life in their economy, as prices awoke from the dead. Amazing the coincidence with the timing.

Perhaps that is the secret: for the next QE program, just shut down the global economy and it might work.

Of course, the Fed is still running full steam ahead. Interest rate hikes will continue until inflation (which really doesn't exist) is contained. Prices are going to come down at all costs.

Have no fear, we already see signs how this is going. The deflationary forces are taking over. There is a severe monetary crisis, something the Fed doesn't understand since it doesnt really do money.

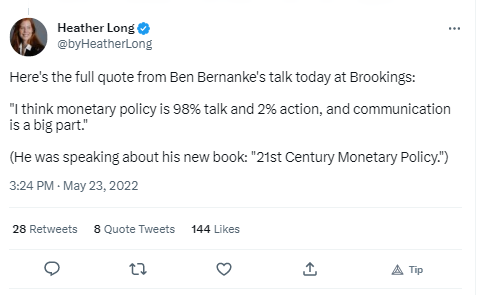

Good ole Uncle Ben getting honest as he gets older. I guess this is his version of a "tell all" book.

Ben's motivations aside, he does share what we need to know. The Fed is not in control of much and their policies have little impact. Without the forward guidance they provide, their success rate would even be worse than it is.

My prediction is that, by the end of the year, the Fed will be tripping over itself to cut rates. There is no way this persists with a monetary crisis going on and bond market yields tanking.

The flight to safety is in full swing for the moment. This does not bode well for the economy in the second half.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

!PIZZA

PIZZA Holders sent $PIZZA tips in this post's comments:

@tin.aung.soe(1/10) tipped @taskmaster4450le (x1)

You can now send $PIZZA tips in Discord via tip.cc!

Inflation (expansion of the money supply) puts an upward pressure on prices. Other things can affect prices as well. While an expansion of the money supply certainly is not the ONLY thing that has caused an increase in prices recently, it is a significant factor. On average, prices are NOT going back down despite improvements to supply chain issues though prices may be rising more slowly than before (slightly). COVID, more precisely various actions taken by governments around the world as a result of COVID, certainly triggered a rapid rise in prices due in large part to the resultant supply chain issues. All the government 'stimulus' in attempt to counteract the negative economic impact of those decisions ensures that we won't be seeing prices go back to what they were before.

Whether you look at M1, M2, M3, or M4, they are all pretty scary with 'Basic M-1' being by far the scariest and that is the one that covers the most liquid form of money (currency and checking accounts) and hence the most likely to immediately affect retail prices.

The chart below is from http://www.shadowstats.com/alternate_data/money-supply-charts and the scary gray line shooting to the moon is M1 (Basic M-1 which covers only currency and deposit (checking) accounts if I read that site correctly). The expansion of the money supply we have seen recently is literally unprecedented (in recent U.S. history anyway). Raising interest rates can't help if you continue to shovel new cash into the economy in other ways (and massive increases in the Federal budget year to year are a big part of that) and like you said, it is completely irrelevant when it comes to other causes of rising prices.