Sovereign Debt Crisis And Capital Flows

There is a lot of misleading taking place and, sadly, it is from the same culprits who were preaching the ole gospel for decades. Unfortunately, they overlook history nor how things work. In spite of that, they keep espousing the tired song in hopes that it will be right someday.

Let us be clear up front:

Never, in history, have everything turns to nothing. We never went through a period where the implosion meant that only one asset class survived.

Notice how it says "never in hisotry". That is a long time.

In lieu of that, how absurd is it to believe that all paper based assets are going to zero and only gold (or whatever commodity) will survive in value?

Does that mean we are without problems? Absolutely not. We are in a major period of transition and things will get ugly.

So let us take a look at some of this.

Sovereign Debt Crisis

This is one of the major issues that is outstanding. Sovereign debt is much different from private debt. Nevertheless, the tendency is to focus upon the US and the $30 trillion in debt. Along with this, people concetrate on the Fed and how it creates these cycles of boom-bust.

Of course, the presumption is that this is going to all burst.

The problem with this is that it shows a lack of understanding how the world works. We live in a global financial arena where capital flows based upon a number of factors. Complaining about the U.S or the Fed ignores how bad things are elsewhere. The rest of the world is in tough shape.

That means the sovereign debt crisis will, at worst, hit the U.S. last. It will not start with the crash of the United States government or the dollar. They are well insulated in the medium term.

Where is it going to start? My guess is the EU but Japan could also be part of the charge. We also are going to see a lot of smaller nations face huge problems.

That said, it doesn't mean that all is going to take at once.

Debt As An Asset

What people fail to realize is that debt is often a performing asset. The challenge is that most are in grade school when it comes to finance. The big money players are in the pros.

For example, when people focus upon debt levels, they fail to realize that often these are performing assets. What does this mean?

One such approach is to borrow in one currency while buying an asset in another. Here we have a situation where a gain is made simply on the currencies. If one is turning 15% or 20% off the currency, the amount of debt is not relevant. Major funds are doing this all the time when the conditions present themselves.

So while most of us see debt as a problem, to these players, it can be a revenue generator on the balance sheet. This is a game few of us play. However, those who are investing hundreds of millions at a clip know how to do this.

To the private sector, debt is often a revenue producing asset. When it comes to government, it is nothing more than a way to buy votes. Hence, when interest rates increase, it is not a deterant to stop spending.

Derivatives

Another area is derivatives.

Here again, people look at the $1 quadrillion in paper and say "it is all going bust". They fail to see how these are assets with a specific purpose.

Derivatives can serve two purposes:

They can either be used to leverage up a position or to hedge it.

Most only focus upon the former not realizing there are hundreds of trillions in derivatives that are hedge against other positions. This is not making the system less stable but actually increasing the resiliency. In the end, they actually reduce risk.

Looking at the total and then drawing conclusions is a mistake.

Collapse In Confidence In Government

This is a point that is starting to become evident. Confidence in government, i.e. politicans and bureaucrats, is rapidly decreasing. This is not uncommon since there is an ebb and flow to this. We see an ongoing period of transition from public to private.

For the rest of the decade, we will see a move away from government and its assets. Hence, most bonds are going to be trash. Politicans have been spending without any intent of paying it back. They have run the Keynesian model for decades. The challenge is that when John Maynard proposed his theory, governments had a balanced budget. What the establishment has done is preposterous.

As this collapsed, there is going to be major economic headaches. However, as stated, it is not going to hit all the same nor will it coincide. Capital flows, mostly, freely around the world. It also flows between private and public assets.

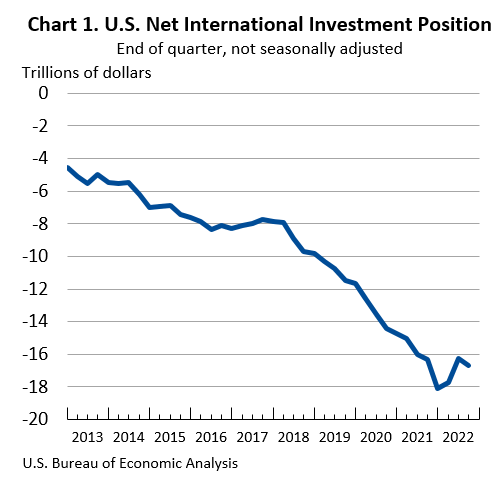

The Net International Investment Postion tells a big story.

Source

This is essentially the capital flow into the United States. As foreigner purchased more U.S. assets, the liabilities grew. We can clearly see the shift in capital is towards the United States. All the "dollar is going to collapse" people fail to apply supply and demand.

What happens when the world wants US dollar denominated assets? The demand for the currency skyrockets. This is aided by a disinflationary period which started with the Great Financial Crisis.

This does not mean it is all sunshine and roses for the United. There will be carnage especially if our political leadership learns nothing, which is highly likely. Nevertheless, there are going to be major pockets of opportunity, just like the last devesating (prolonged) crisis in the U.S, the 1970s. The early 80s singaled a shift into equities as the takeover storm became evident. When companies could be purchased for below book value, you knew stocks were cheap.

And so it goes. The ebb and flow. Do not buy the nonsense that everything will go to zip except for (fill in whatever asset you want). This is not now the world works, no has it ever.

While none of this is financial advice, watch Europe and the EURO. That is a hotspot for a lot of the calamaties we are talking about. At the same time, watch the flow of capital as it tries to flee areas that could be vulnerable.

One tip: capital always moves away from areas of war. If things keep escalating in that region in terms of the violence, money is not going to stick around.

Another tidbit: this is why stablecoins backed by the EURO make no sense. The EURO is likely to be one of the first fiat currencies to go.

Posted Using LeoFinance Beta

@taskmaster4450le There are serious socioeconomic problems estimated @taskmaster4450le example in Latin America the dollar skyrocketed and the currency of each country is dwarfed, for example in Venezuela the dollar is 24.30 bolivars and the minimum salary for everyone is 130 bolivars per month, that is, approximately 6 dollars, and the logical thing is that everything is dollarized in Venezuela but salaries are in bolivars, I imagine that this is happening, at least in Latin American countries, reasons for many people migrating to other countries, where they consider they can, for At least to be able to acquire basic products such as food, medicine and clothing, in this sense, the socioeconomic situation worsens every day. Thank you for motivating us to comment on these issues. successes.

Venezuela is one of the worst but not the only one when it comes to the destruction of the local currency. The USD appreciating is catastrophic. That is why HBD is so important in my opinion.

It provides a safe haven against the Bolivar.

Posted Using LeoFinance Beta

You are very right dear @taskmaster4450le In Venezuela our currency is the Bolívar as you say, to recover the wages of the workers it must be in dollars, but the government does not want it, however the Central Bank of Venezuela, businesses and public services all It sets it in dollars, therein lies the great problematic detail, that's why I trust Hive every day because at least as a cyber citizen I receive better rewards than in my work as an educator. Thanks to you, for your continuous visits to my publication.

It is an instructive article, thank you.

Posted Using LeoFinance Beta

People will naturally just move towards the dollar because it's the best fiat option out there. I don't see that changing and the shortage of dollars due to QE doesn't help either. I just wonder when the system will start imploding because there is only so much other fiats can do.

Posted Using LeoFinance Beta

They are basically forced into it. Since there is so much debt, as one example, entities are required to get a hold of dollars to make payments.

Posted Using LeoFinance Beta

financial markets are complex and often unpredictable more in war time. While it is true that political and economic events in Europe can have a significant impact on global financial markets