Tesla Energy: 10x Potential Of Vehicles

Everyone knows Tesla is a car company.

That is the mantra from many who are bearish on it. While it is true that most of the revenues are derived from the automobile division, viewing it through such a lens really can underestimate the potential.

If we step back and look at the potential of some of the markets it is involved in, we can see this could truly become a behemoth. One of those sectors is energy.

We know the automobile industry is enormous. Historically, some of the largest companies in the world were in this realm. Tesla is still a rather small player, delivering 930,000 vehicles in 2021. With an expected production of near 1.3 million in 2022, the company is moving higher but still a long way from the likes of Toyota and Volkswagon.

This could change in ensuing years as the company keeps it 50%+ annual growth in production going. However, it is still a number of years before they are in the top tier by sales volume.

Nevertheless, even this could only be a portion of the total revenues the company generates. In turn, we could see the future of Tesla be derived in large part to the energy division.

Tesla Energy: 10x TAM

When it comes to energy, that has a total addressable market (TAM) that is 10x of the automobile sector. As big as car companies tend to be, they are small when viewed against those in energy.

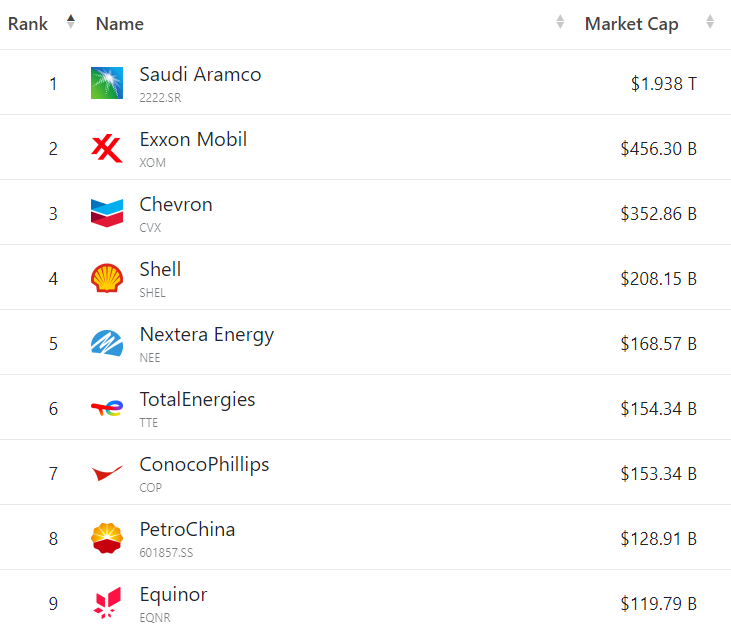

Here is a list of the top 9 energy companies along with market capitalizations.

These are obviously household names. As we can see, these are huge entities. In fact, when compared to the automakers, the #9 is largest than all but two companies in that industry (one being Tesla).

This means that an entry into this arena could be a major windfall for Tesla.

Of course, this is hard to envision at the moment considering energy division did a little over $1 billion in revenues last quarter. One positive was the jump was about $300 million from Q2. Since one quarter does not make a trend, we will have to see how quickly this moves.

However, on the last earnings call, Elon Musk reiterated that he believes the energy business could be as large as automobiles. He also stated that 100%-200% growth annually for the foreseeable future is not out of question.

When diving into a new pool, it is always good to make sure it is a rather large one. On this end, Tesla is right on the mark.

Energy is one of the largest in the world and the company is poised to disrupt it completely.

New Energy Model

The most interesting aspect of Tesla's energy's plans is the idea of a virtual power plant. Under this scenario, the company would sell stationary battery storage systems to homeowners. As more are constructed in a specific area, those would all be linked together. This forms the virtual power plant.

Once this is in place, the idea is to support the grid through the energy stored at the residential level. The company and homeowner would be able to arbitrage the energy system by buying electricity when it is cheap and selling it back during peak times (more expensive). This helps to remove the strain on the grid during times of high use.

We also have the Megapack installations. These are sold directly to the utility companies. For the moment, they are mostly being installed to replace the peaker plants. These are additional power capacity facilities, usually run on natural gas or oil, that are turned on during peak hours. When the grid requires more energy, peaker plants kick into action. Of course, the drawbacks are speed and cost. Apparently Tesla's solution is much cheaper.

The first major project went into Austrailia. It was a deal that was over $100 million. The return on the investment was achieved in only a few years.

Obviously, to make a significant impact in this market, they are going to need to do more than a couple hundred million here and there. To be a real player, the revenues have to jump into the hundreds of billions annually.

Here is the major opportunity for Tesla. It was battery constrainted until recently so we will have to see if they can expand the energy division. If so, we could see a $1 billion quarter in revenues quickly become $3B or $5B. This could be achieved in just a few years.

The market is there. It is up to the company to produce enough to access it.

This article is for informational purposes only and is not financial advice.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

Tesla energy is what the entire world needs now as fossil fuel is becoming a major threat to life. This implies fuel use should be limited as compared to virtual energy. It's a big plus for Elon though his price will sky rocket.

Posted Using LeoFinance Beta

Wouldn’t the battery required cause more environmental harm? Also the life span of batteries, their replacements and recycling.

I suspect the price for materials and the real carbon footprint are going to cause the increase in price. Feasibility is still to be determined.

It's a growing market and energy production isn't where we need it for daily life. However, I just wonder whether or not green energy and things like that are efficient enough to supply all of this energy? I still prefer it if they used nuclear instead.

Posted Using LeoFinance Beta

Hi Taskmaster, you are a very sensitive person to the topic of energy and so am I. As you wrote TESLA goes beyond just an automobile manufacturing company. Nice this list of companies working in the energy sector, half of them I knew, the others I had never heard of. I don't know if you know about the Powerledger project, a project you might like almost as much as TESLA.... I said almost, not as much as TESLA. I'll be doing a post right here on Leofinance shortly talking about Powerledger.

Posted Using LeoFinance Beta