Tesla Investor Day: Quick Recap

Tesla held its long awaited dog and pony show called "Investor Day". Here is where Master Plan #3 was released.

There was a lot of speculation leading up to the event, most of which was actually on the mark. Tesla team leaders were marched out over a number of hours, all detailing what they are working on.

Much like Battery Day, this was an events for geeks. There were a lot of numbers tossed around as the idea of sustainability was discussed. Since they bore most people (and I didn't take notes), we will skip the specifics.

Instead, we will hit upon some highlights.

4 Million Vehicles Produced

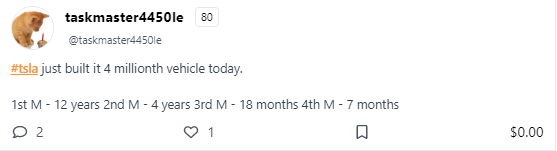

One of the highlights, in my opinion, was the fact that Tesla just produced their 4 millionth vehicle. More importantly, we see the timeline to get there.

This is what I put on Threads during the broadcast.

The time frame is vital. Notice the acceleration. Keep in mind the company forecast 1.8 million for 2023 although Elon Musk did say if things went right, they could do 2 million. That means they will go from 4 million to 6 million in about a year.

It is an important point since it feeds into the main emphasis of the event.

20 Million Vehicles By 2030

Here we have a point that was driven home repeatedly.

Much of the event dealt with the different issues surrounding the production numbers projected. To achieve this, manufacturing, supply chain, construction, and costs were all discussed.

The next generation vehicle is slated to be a competitor to the Toyota Corolla. That is the price range the company is seeking, one that will allow for a lot more vehicles sold as compared to the existing lineup. Thus far, Tesla is a premium automobile brand.

While the brand might not change much, the target segment is. Tesla is going after the mass market. Here is where costs enter.

The goal, as explained through numerous presentations, is to bring the cost from the Model 3 down by 50%. This will allow the vehicle to aim for the $15K-$20K price point (maybe a bit lower) in the U.S.

In short, the company seeks to sell twice the vehicles by the end of the decade as the top sellers now. This is a bold claim yet, if we look at the electric vehicle market, nobody is really competing with Tesla.

Of course, this raised the issue of materials, which was handled through other presentations. The bottom line is the company feels it has enough to successful produce this many automobiles along with stationary battery storage.

They did acknowledge there are some bottlenecks, mostly with refining of raw materials. This is one of the reasons why Tesla is building a Lithium refinery in Texas.

Tesla Energy

We could say the other big news was no news.

The energy division was discussed, with Megapack and Power Walls getting some attention. However, there was nothing new in regards to the scaling other than the general numbers previously tossed around.

Personally, I was looking for where this was going although it is not totally surprising that it was not thoroughly covered. This was a long-term, broad range event. Near or medium term timelines were not mentioned.

One thing that was discussed related to the virtual power plant they have in place in Australia. This has roughly 5,000 homes attached to it. The key is the price reduction.

If they paid for their power in the normal fashion, it was roughly $140 per month. With the power wall, this reduced it to $70. However, using the Tesla product that evolved from Autobidder, the net was $8 a month.

Tesla is seeking to establish energy arbitrage using millions of homes across different power grids.

The next area of focus is going to be Texas since they are already an authorized energy provider there.

Giga Mexico

The other definitive piece of news was confirmation that the next giga-factory will be in Mexico. To tie into the event, the next generation vehicle is going to be produced at this plant.

Elon did drive home the point that they are going to keep increasing production of the existing factories. The one in Mexico is going to supplement the numbers.

In the end, this is not going to do much for the stock. But it does lay a road map throughout the next decade.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta