The EU Is In Big Trouble

As I stated for a long time, the EU is screwed. We get news from investigative reporters who are digging through the New York Federal Reserve Bank data which shows trillions in Repo loans made by the Fed at the end of 2019 and 2020.

We see this headline which, I am sure, is designed to get all the cryptocurrency people up in arms. After all, they really do not know how this works. Here is an example:

Wow. Pretty insane stuff. The Fed handed out $48 trillion in funding. That is more than twice the entire GDP of the US. Where did they get all that money from?

Let me ask you a question, if you hand out a dollar, 48 trillion times, how many dollars do you need?

The Repo Market

Most people have no clue about the Repo market. Quite honestly, they have little clue about the Fed. When you see headlines like this, bet the ranch it is put together by someone who doesn't know what is taking place (or have an agenda).

So what is really going on?

The Repo market is short-term, interbank lending. This is what it was designed for. It uses a swap system which means there is an agreement in place when the deal is done. For example, the Fed might do a deal with JPM (Chase) on 10 year bonds. Here it might swap $25 million 10Y for the equivalent in reserves. Keep in mind these reserves are not USD. They are bank instruments that are kept at the Fed.

This is not necessarily an overnight process. It is something that is done during QE and the deal stays in place until the Fed unwinds by swapping the Treasuries (unloading its balance sheet) for the reserve. This is called "tightening".

The Repo market itself is what allows banks to borrow from each other. Here is something the Fed keeps an eye on simply due to the fact that when this freezes, major problems are felt. We saw this situation in 2019, something we will cover in a bit.

When the Fed going into the Repo market with cash, it does so to provide liquidity. Remember, the Fed is the lender of last resort. This is the entity that has to step in when things are locked up.

Due to the situation in 2019, the Fed went into the Repo market with more than $750 billion. Since the banks were not willing to lend, the Fed was the one who put up the money for it.

The thing with swap that banks do in the Repo market is they are mostly overnight deals. So the Fed was tossing in about $800 billion a day, but it was not cumulative. Whatever agreements went in place at night were unwound the next day (this is separate from the QE they were doing).

Why should anyone support this? The hell with it. Let them all fail is how some view it.

Let me ask you: do you trade stocks? Ever notice what happens when you sell some stock, there is a negative in your account. You sold the stock but the deal did not settle. This could take a matter of days. That is the reason for the overnight lending market. A TD Ameritrade might be down a few billion dollars. To make their customers whole, so they can trade the next day, it will go and take out a loan to fill the money markets accounts.

Without this, the money market system could collapse. In fact one of the things the Fed fought was money market rates going negative. Can you imagine if you went into your trading account and there was less money there because the rate on your money market account suddenly went negative?

So the Fed basically told the global banking system, if you won't lend to each other, we will do it for you. It provide the liquidity to ensure the market kept going.

But what was the cause of all this?

Deutsche Bank

The overnight lending market seized up in 2019 all because of Deutsche Bank (maybe even the entire European banking system). What happened is suddenly nobody knew who has exposure to it. Goldman was not about to lend to JPM if they has a large position put at risk if Deutsche collapsed.

Here we were seeing the entire banking system freezing up. One might ask how could the banks not know who had exposure. Why not just look at their balance sheets? Here we enter the realm where the international banking system truly operates: off balance sheet.

Nobody know what bilateral agreements are out there. Goldman could not trust JPM because maybe it has a $500 million loan out there that was collateralized by a Letter of Credit from Deutsche to some bank in Cyprus. If DB fell, that collateral obviously became worthless.

This instantly became a systemic problem. Therefore, the Fed has to step in and maintain liquidity. It tossed the money out there, in large part going to the primary dealers who are responsible for facilitating asset transactions. For this reason, it makes sense they got a lion's share of liquidity.

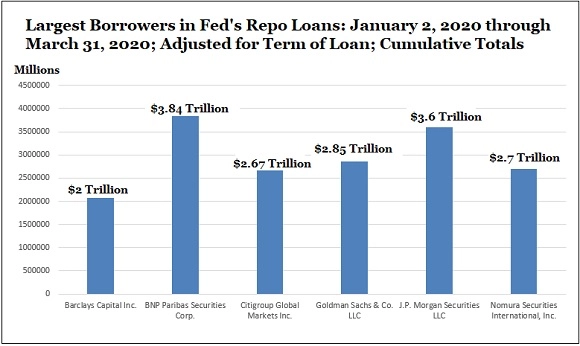

The Fed data released this morning shows that the trading units of six global banks received $17.66 trillion of the $28.06 trillion in term adjusted cumulative loans, or 63 percent of the total for all 25 trading houses (primary dealers) that borrowed through the Fed’s repo loan program in the first quarter of 2020.

This makes total sense. These are the institutions that have the most exposure. They are responsible for moving the different securities (derivatives) for their customers. Unfortunately for them, they are not able to choose the most opportune moment.

How does this work?

Let us say Goldman does a lot of business with a country moving securities in and out of their sovereign wealth fund. One day it gets a call from the customer saying it wants to unload $250 million in 7 year bonds. Goldman looks at the market and sees there is no liquidity on that day. So it is in a quandary: does it take the deal, risking getting caught in a non-liquid position or tell the customer no, putting the relationship in jeopardy.

Obviously Goldman is going to take the deal. However, with no market, how are going handle this?

The most obvious is for them to take a similar security and short it. This will raise the capital to pay the sovereign fund while also hedging the deal against loss. However, Goldman doesn't want to be in this deal to begin with. So how do you unload a security when there is no market?

Enter the lender of last resort.

Goldman simply turns to the Fed. It arranges a deal whereby JPM (a depository bank) acquires the 7Y from Goldman for cash (or whatever they trade). Since Goldman cannot hold reserves, JPM has to be brought in. Once it has the bonds, the Fed simply does a swap of the 7Y for reserves. JPM now has $100 million of reserves on their balance sheet, the Fed another $250M in bonds along with a liability of $250M, and Goldman is made whole.

European Bonds

Now we can see how the Fed stepped in and why it arranged swaps total so much. The liquidity really wasn't there since the banks were leery of each other. They still are.

We have another problem brewing. The New York banks, along with many around the world, will not touch European debt. The ECB cannot sell its bonds globally since they have been negative for 8 years. Many of the leading banking entities are well aware of the situation with the EU and how it is teetering on the brink of serious problems. The situation with Putin is just icing on the cake.

Since the ECB cant push its bonds globally, it is forcing it on the European banks and into pension funds. This debt is becoming very risky. If the EU were to default (and yes it can default), then major problems arise. The European banking system will topple. It has the double whammy of also still having toxic debt from the GFC. Due to the unwillingness of the north (Germany mostly) to bailout the southern banks, they did a bail-in. Basically this left the debt on the books.

And now more toxic debt is being added. It is no wonder that the Citigroups and Goldmans of the world won't touch it.

On Tuesday it was reported that German wholesale prices rose 22.6%, year-over-year. That is a good way to quickly through your economy into a recession.

What happens to this entire situation outlined in this article if the largest economy in the EU suddenly sinks into a recession? What does that do to the entire Eurozone?

The reality is things were a monetary and financial mess before this. Now, we are just adding fuel to the fire (at a costly price). Since the economy cannot handle those price increases, there is only one solution: economic contraction.

It is something we discussed a great deal at the end of last year. It seems things are starting to unfold as expected.

The EU now finds itself in big trouble.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

View or trade

BEER.Hey @taskmaster4450le, here is a little bit of

BEERfrom @pixresteemer for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.And not only are they in trouble, I think a large part of the world is also in trouble economically, politically and socially, added to the war in Russia and Ukraine, more are being added. Certainly a concern arises from where they get so much money to lend since they are amounts that are somewhat exaggerated.

The Russian situation is certainly not helping. Food and energy were already skyrocketing, especially in the EU. Not it is just getting outrageous.

Sad but things will likely get worse there for many people.

Posted Using LeoFinance Beta

Stocks are a big ponzi. The transactions of stock shares are actually pretty fast. Issue is retail investor/trader that buys the stock never really owns the shares. On top of that broker can override retail holdings as in sell them when ever the see fit like hitting a margin call. The game has a lot of rules and majority of the rules favors the banks even though they were meant to protect retail investors.

Regarding banks failing it will be very difficult this time for top USA banks to crumble. Reason being is they have a lot $$$ since fed started qe. However it doesn’t mean they won’t fail. I believe Europe and Asia banks are in worse shape than the US. The people in power have been reinforcing the US banks to try and create a facade that everything is running normal on the surface.

This locked the USD in the banking and financial system. It was actually fiscal stimulus that put the dollars in the banks to begin with, all funded through the sale of securities, which, ironically, the global banking system is desperate for since there is a major collateral shortage.

Posted Using LeoFinance Beta

If the situation is not looked in too in time there will be more problems and challenges faced that will affect the whole global system and this wouldn't be nice to experience at all

Posted Using LeoFinance Beta

I think you mentioned before, the central banks are struggling to keep inflating the fiat monetary supply. Is this signs of those problems?

In my places, wholesale price increases in Germany are between 50-150%!

Posted Using LeoFinance Beta

In the major economies and in the global economy, they are. The currency (USD, EURO, etc) are created by the commercial banking system. The central banks have a problem since they cannot force the banks to lend. So they have to use their different tactics to lure that to happen. In the end banks are going to end up doing what is in their best interest.

The main challenge is that the money creators and intermediaries are the same. They should have different priorities but in the end, since the same, it is money goes to where there is a profit.

Posted Using LeoFinance Beta

The entire issue sounds so complicated when they have to swap around so many different bonds in order to make themselves whole. What would happen to the Fed who takes the deal if the person defaulted on that bond? Would the person wanting the reserves to take the hit instead?

Posted Using LeoFinance Beta

If the Fed is the counterparty, it will get the collateral. However, in many of these, the Fed was the liquidity provider to the dealers who facilitate the settlements. This is what is known as a trilateral agreement.

Posted Using LeoFinance Beta

As I am a Forex and crypto trader, this article is very helpful to me. Thanks for giving such insights. Keep it up sir. Would you care to talk in your some next post about the JPY's economy as JPY was in a free fall! Thank you

Japan is nothing more than a leader for what is coming for the rest.

Their problem stems from the fact they have awful demographics. This means that they have a tough time overcoming their economic issues since their population is getting smaller.

So everything they tried the last 25 years really didnt have much impact. It is a situation nobody figured out how to solve.

Next up:

China

Russia

Germany

All are on the brink of the demographic issue.

Posted Using LeoFinance Beta

healthy correction.

I don't see any ponzi here.

Great post. I am not sure I understand all of it, but I definitely understand it more now than I did before I read your post! Have an awesome weekend!

Posted Using LeoFinance Beta

That is good. We are delving into it regularly. It helps people to understand what is going on.

Posted Using LeoFinance Beta