The Fed Is Going To Fight The CBDC

There is a lot of talk about a Central Bank Digital Currency (CBDC). Most countries are looking at it and politicians think of it as a way to amass more power. Of course, as bad as the bankers are at managing monetary policy, can you imagine what politicians would do? That, however, is the topic for another article.

Source

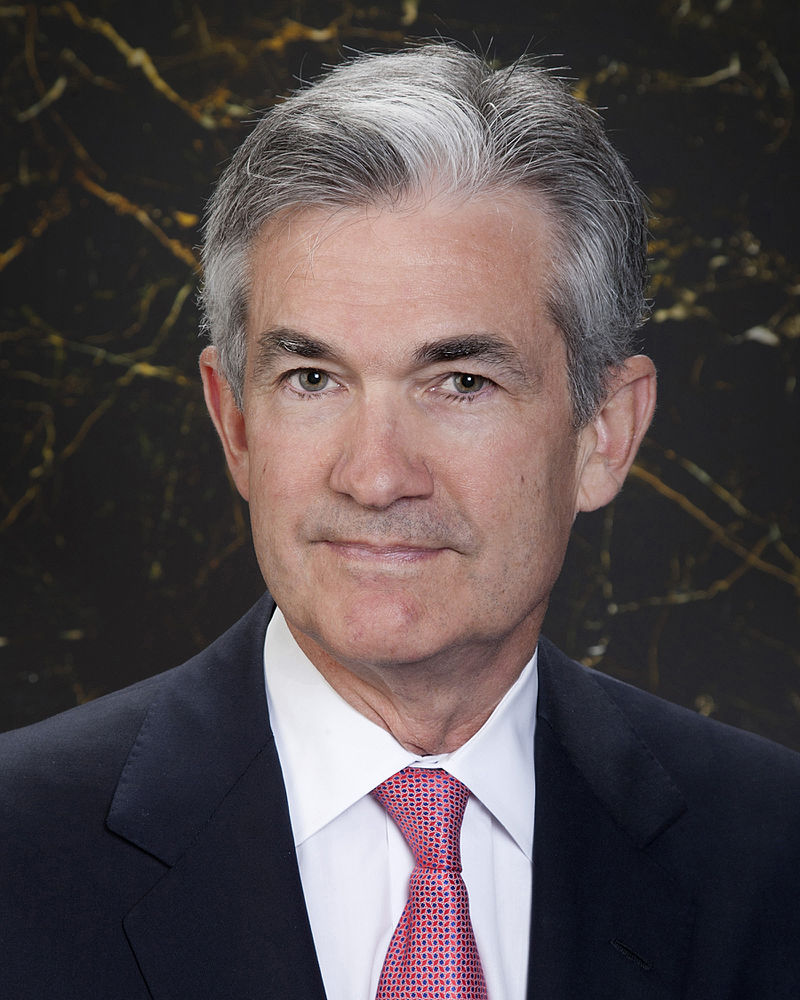

Herein, we are going to deal with the fact that Chairman Jerome Powell is playing the rhetoric game very well. He understands Washington and what it takes to appease the political establishment.

A lot of what he said of late is confirmation of a non-confirmation. It is really amazing how people jump to conclusions. The guy is very good at leaving the door open to reverse course. He does telegraph some of his moves but in subtle ways the establishment and the media miss. I guess when ones are driven by ideology, they miss a great deal.

CBDCs Are Not For Bankers

Central Banks Digital Currencies are not to the benefit of bankers. In fact, it is the demise of them if they go through. That is why, in the end, the Fed is not going to embrace this path.

So if that is the case, why does Powell keep talking about looking into them and how they are preparing a report?

The answer lies in the fact that his power is dwindling. His term expires early next year and he has to get appointed again. Thus, he has to ensure that President Biden puts Powell before the Senate.

If Biden does that, it will be a likely slam dunk through Congress. That is, unless Powell does something to screw that up. Therefore, he is not going to rock the boat whatsoever. He can play the rhetoric game for another couple months.

We actually are getting closer to the point of no return with this anyway. Time is required to vet other people if Powell is not going to be Biden's choice. With roughly 4 months until the next term starts, Biden would need to move quick if he is going in another direction.

Therefore, once he get a second term secured, he will have his power restored.

Make no mistake, Powell is a banker. He worked in that industry when he was not in government and made a fortune there. He thinks like a banker and is dedicated to them. His loyalty is not to a bunch of politicians.

Therefore, unless a CBDC favors the banking industry, Powell will do all he can to resist it. Once the political game is over, he will put forth an earnest argument against it.

Death To Commercial Banking

A CBDC is death to much of the commercial banking system. By now, most are aware that a digital wallet can replace the banking services for the majority of the population. Since most only use a bank for sending, storing, and receiving money, a digital wallet would suffice. This would remove a lot of money from the banking system.

For many this is a welcomed idea. The problem is it means jumping out of the frying pan and into the fire. While the bankers are bad, in my view politicians are worse. A CBDC is far worse than the existing banking system, even as bad as it is.

We also would see a situation whereby a CBDC would require so many regulations if there were protections put in place for the banking system. At that point, there would be a competition between the two, which would necessitate a lot of regulation. FinTech already did a number on the banking industry, something they are not about to overlook again.

A big part of this equation is going to be where loyalties reside. With the Fed, the Chair and Vice-Chair are really the only two opinions that matter. That is why it is tough to get a hold of the thinking when the Chair is playing politics. However, come February, if he still has that, the brass knuckles will come out.

Over the years, we know how the Fed chair has tolerated those on Capitol Hill. Each time the Chair goes in front of Congress, you get the grandstanding by a bunch of politicians who tend to have no clue what they are talking about. The people at the Fed are well aware of this.

Powell is reported to be worth in excess of $100 million. Money, he does not need. That is why he is fighting to keep his job. He is, presently, one of the most powerful people in the world. His goal is to retain power.

Of course, that will not be long-lived if he hands power over to the politicians through a CBDC. That would make the Fed pretty much impotent. Powell is smart enough to realize how fatal that would be.

So watch for reports, studies, and other forms of stall tactics to come out of Powell. He will keep stringing the politicians along until he gets what he wants: another term. At that point, I believe he will turn on them very quickly regarding a CBDC, although he will do it in a very political manner. The guy does know how to play the game.

In the end, watch for the Fed to pursue its own best interests, not that of those on Capitol Hill.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

https://twitter.com/taskmaster4450/status/1441570976316145667

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

You need to stake more BEER (24 staked BEER allows you to call BEER one time per day)

If we're being totally real, commercial banks are one of the most struggling business sectors. They all just puppets on strings, so this elimination would only be a death already detected from the beginning.

I figured these guys were really struggling to keep up and stay competitive in business when couple company names got wiped out of the system, some rebranded when sold off, this however also explains the reasons for their outrageous charges. It's not so much of a complicated puzzle any more, the pieces kept coming through.

Posted Using LeoFinance Beta

That is true. The banking industry changed a great deal over the last decade and a half. There is little doubt FinTech did a number of them. More than half the mortgage market in the US now originates outside the banking sector.

That is a lot of revenue lost.

Posted Using LeoFinance Beta

When you think about all the jobs that FIAT paper money creates at the moment and how little man power would be required for a digital currencies that's a lot more lost jobs and that means less money going to people and more money controlled by the government.

What we need is a system where people themselves are the banks and can loan out money and get a decent return on it not chump change. That's what really needs to change.

That would be nice. Any idea where we can find that?

Posted Using LeoFinance Beta

it is insane how good are people with interest could have several faces. They act in one direction but has some intention in the other direction.

Eventough CBDC is not fully decentralized like hoe cyrpto would but its use case can really making some banks went into a useless establishment.

And yes, how would dig their own graves? of course they will do their best to keep the money machine working.

Powell definitely wants to keep his job. Personally I am hoping he delays or blocks the CBDC. Then again the banks are screwed either way since FinTech is eating their lunch.

Posted Using LeoFinance Beta

Yes technology is making them obsolete, at least in their basic form.

That said, Powell is not going to want to rush the process by doing anything that puts more banks out of business.

Posted Using LeoFinance Beta

Edmund Burke Quotes. BrainyQuote.com, BrainyMedia Inc, 2021., accessed September 25, 2021.

A very well-researched and understandable analysis of the current political climate when it comes to the adoption of a Central Bank Digital Currency (CBDC) here in the United States.

You hit the nail on the head. When one has plenty of financial resources what do they covet the most? Power.

Posted Using LeoFinance Beta

they always do that but we are not stupid

Most definitely as they know the agenda they need to stick to. Banks are literally screwed and they are fighting for their existence right now and are trying to make themselves still relevant. Others outside of crypto have no clue what is happening and it is interesting to see the spinning happening and the angle being taken on their approach. Wish we had more pro crypto people in Washington.

Posted Using LeoFinance Beta