The USD Shortage Spreads

We had some bad news last week. It is something that should have raised some eyebrows. This is a sign that something is brewing.

Before getting into the details, it is best to explain the Fed's liquidity swap operations that is open with different central banks around the world.

Basically, the Fed cannot engage with any foreign company as a counterparty. For this reason, all USD (actually Eurodollar) must be acquired from the local central bank. Since the liquidity of USD dried up globally, the Fed, through the Fed Reserve Bank of NY, established liquidity swap operation to facilitate the spread of USD throughout the world.

As we will see this is really Eurodollar type operations.

So how does this work.

A central bank auctions of USD each week. If someone shows up, the central bank will work a currency swap with the Fed. Essentially, that currency is put in the Fed's balance sheet with USD going the other way. Of course, keep in mind, there is no USD actually involved. These are numbers on a screen tied to the holdings of each central bank.

Effectively, which is the case with much of the monetary system, money is simply changing form. These are bilateral agreements meant to ensure there is liquidity in dollar funding markets (i.e bank funding markets) to ensure credit is available to individuals and businesses.

Hence, we have the Fed, to its credit, trying to affect the Eurodollar system. The challenge is that it is a net zero in terms of the ability to grow things since the banking funding markets are all driven by collateral. However, from a liquidity standpoint, it is a swap arrangement designed to aid in the effort.

The Swiss National Bank Comes Calling

Last week, the Swiss National Bank took the Fed up on its offer. It decided it needed some USD since the banks there were suffering a shortage.

At that time, there was an auction that 9 banks were involved in. Since it is anonymous, we have no idea who was there or where they are from. Believe it or not, one does not have to be a Swiss bank exclusively to attend an auction held by the Swiss Bank. This is how things can be masked as to how bad they are. For all we know, these could be British banks trying to get their hands on some (Euro)Dollars.

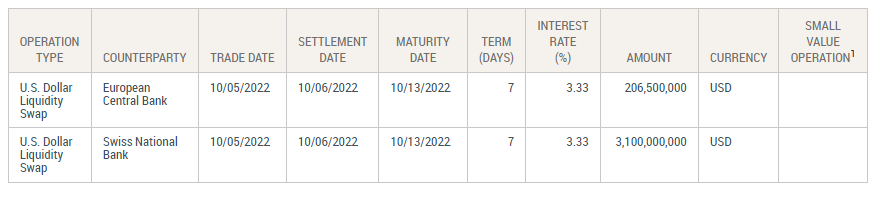

Here is what the numbers were last week according to the Federal Reserve Bank of NY.

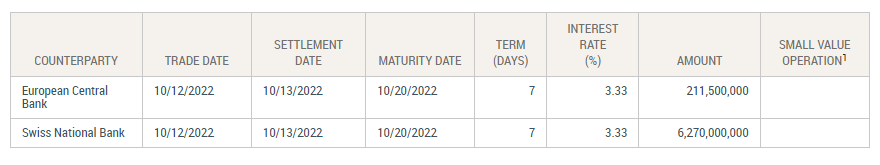

This is what the situation looks like today.

Obviously, Switzerland is a major global financial hub, especially for Europe. So these numbers are very telling.

This week there were 15 banks pulling $6.2 billion.

So now we have the Swiss National Bank swapping Francs with the Fed, then exchanging the USD for some other assets on the commercial banks' balance sheets in an effort to give them liquidity. Most likely, at the core of all this, is USD denominated loans. Companies simply cannot get their hand on USD to make the payments.

Symptoms Of A Dollar Shortage

Much of what we are seeing is a symptom of a global dollar shortage. As mentioned in other articles, the Eurodollar system has been devoid of the collateral (which is money) it needed since the Great Financial Crisis. With the passage of time, we are seeing events aligning with this outcome.

The rising USD against other currencies is a sign of a shortage. It is simply supply and demand. With so much USD denominated debt, the central banks cannot keep the commercial banking systems flush with USD. One solution was to sell US Treasuries. However, as we are seeing, that is all reaching its limit for some areas.

Back in August, Shaktikanta Das of the Reserve Bank of India had this to say:

EMEs are facing a rapid tightening of external financial conditions, capital outflows, currency depreciations and reserve losses simultaneously.

This sums it up. The capital outflows are getting overwhelming since they cannot keep pace without access to Eurodollars. This is tapping into the reserves which are further drained as these debts are coming due. Of course, the global inflationary pressures are not helping. As Das mentioned, the supply chain issues are slow to be restored, causing further impact on emerging markets.

It started with an oil shock. Then we saw many nations selling Treasuries. Of course, we were told it was because they wanted to divest themselves of the US. This was not the case. Countries do not sell the only form of pristine and high quality collater used in the banking system over geopolitical affairs. They were selling because it was the only way to get their hands on USD.

Then we have the Governor of the Reserve Bank of India telling us the same thing. Finally, the Swiss National Bank is auctioning off USD to commercial banks.

It is clear the evidence is mounting. With each "crisis" it points to the same thing. This has nothing to do with the Fed raising interest rates. In fact, SOFR, Japanese government bills, T-Bills were trading at very low interest rates further showing the dollar shortage.

This is starting to get real interesting.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

!LOL

!PIZZA

lolztoken.com

But not as fast as his brother Sudden Lee.

Credit: manuvert

@taskmaster4450le, I sent you an $LOLZ on behalf of @voltz-blag

Delegate Hive Tokens to Farm $LOLZ and earn 110% Rewards. Learn more.

(2/10)

PIZZA Holders sent $PIZZA tips in this post's comments:

@voltz-blag(1/10) tipped @taskmaster4450le (x1)

Learn more at https://hive.pizza.

Dollar is king again?.😎

This is indeed getting very interesting. I am happy to have a HIVE account. I can issue myself a prepaid card with USD on it with 1 lightning transaction. Note to self: therefore of course selling HBD or HIVE always be aware of that. Nevertheless I can buy USD with HBD and pay groceries. Might be that the shortage will raise the demand for USD even more makes my shopping cheaper, or to be exact, less expensive...

Posted Using LeoFinance Beta

Can you further explain this? Do you mean that market is not growing because equal amount of liquidity is being blocked as collateral?

What is the point of having anonimous actors in such big markets? It sounds like a mafia to me more than anything else.

There is something hard to understand for me. How can we have a global dollar shortage with the insane increase of supply that we have seen these last years? I sounds counterintuitive to me

Good blog as always!

It's going to be a hard decision to make but I do expect the dollar to continue going up. However, I wonder if the drop in fiat values in other countries will cause bad economic effects on the US eventually. I just feel that things aren't as good as the governments want people to think

Posted Using LeoFinance Beta

We cannot just keep the US dollar predominant as the main world currency. The shortage is not cool for the other central banks around the world.