The Velocity Of Money Tells The Entire Story

Why are the leading economies slowing? How come the Central Banks and Governments, in spite of throwing everything including the kitchen sink at the issue, cannot get their economies to take off? What is the problem?

While there are many different reasons, we are seeing this summed up in one chart.

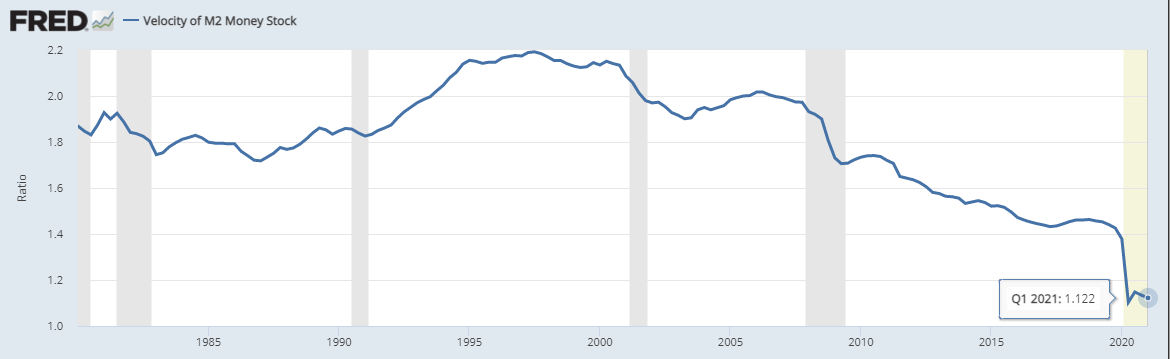

Here is the Velocity of Money for the United States.

As we can see, over the past 30 years, the Velocity of Money has slowed down to a crawl.

What is the Velocity of Money? A simple way to think about it is what is the payback in economic growth for each dollar invested, over a certain period of time. Essentially, it is measuring how often a dollar will travel through the economy.

Robust economies have high velocities of money. Economic activity is increasing, bank lending happening, and expansion is the norm.

A declining Velocity of Money is going to have the opposite effect. It shows a very unhealthy economy. This is the situation that the entire global economy finds itself in.

The US dollar is the world's reserve currency yet it is stalled. Other major currencies are even worse.

As we can see from the above chart, the Velocity of Money is slowing even during this recovery. It bottomed out in quarter 2, bounced back in Q3, and then resumed its downward trend over the past two quarters.

This is not something that screams robust economy. Yet that is exactly what we are told is happening. We now have the stimulus started to wind down in the United States.

Anyone want to venture a guess what will happen to this chart in the next couple quarters?

There is one major factor that we can look at pertaining to this.

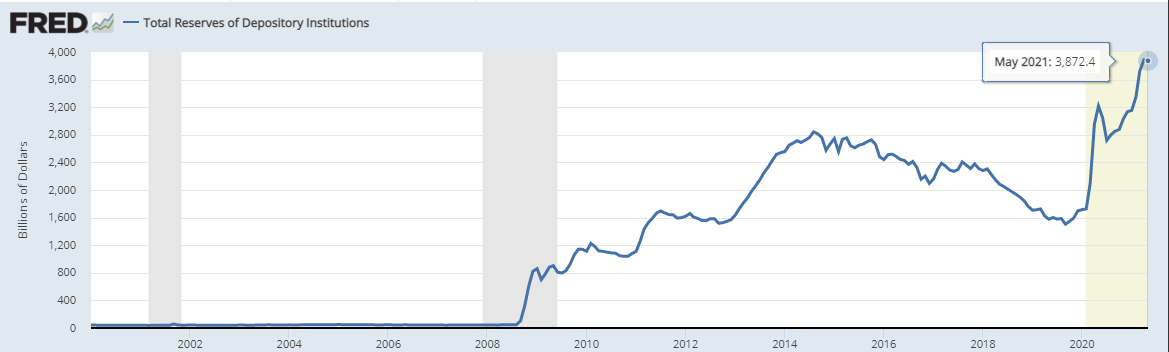

The Excess Reserve holdings of depository institutions at the Fed have exploded. Here is the latest chart on what this looks like.

As we can see, there was $3.87 trillion held at the Federal Reserve on behalf of the banking system.

So what is the excess reserve deposits and what does this have to do with the Velocity of Money?

Each bank is required to have a certain amount in reserves. Anything above this can be used for banking activity to try and garner a return. Bank often put excess reverse on deposit with the Fed which can be used by other banks as a short term loan to cover shortfalls in their reserve requirements. This is where the Repo market comes in.

Here we see where the banking system is getting overwhelmed with cash. All these reserves are basically locked into the banking system. The funds move back and forth between banks either in the form of cash or as a note. This is what the Fed creates when it is "money printing". It will often give banks reserve notes in exchange for the securities that is seeking to hold.

This is a lot more involved than what we list here since it is overnight assets in exchange for longer dates securities, making it a cash equivalent but not cash. It is also done on the Repo market, often involving a couple parties in a swap arrangement. We will keep it simply by ignoring some of the mechanics of what the different institutions do.

The important thing to understand is that this is part of the M2 Money Supply. As such, it has an impact upon the Velocity of Money. The challenge is that here we see close to $4 trillion tied up at the Federal Reserve that basically does not go anywhere. It is traded back and forth between the member banks yet never leaves the Fed.

Notice how, before 2009, there was very little in Excess Reserves. Why is this?

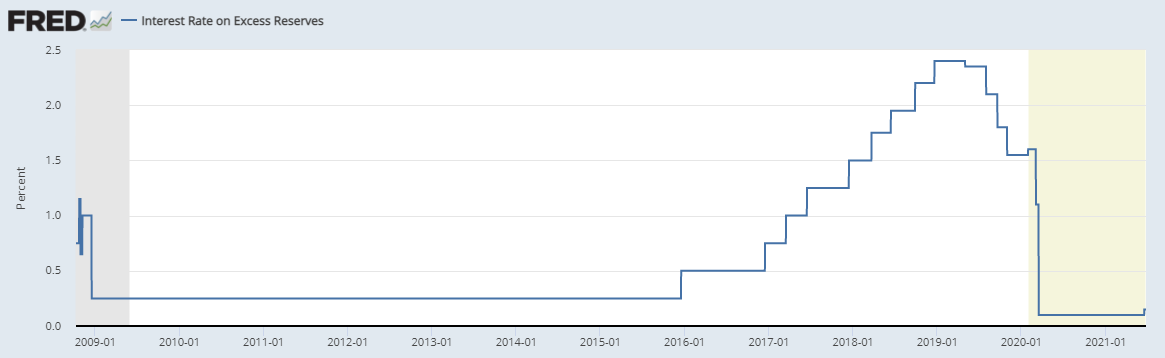

Simply put, because IOER did not exist before then. In other words, that was when the Fed stated paying interest on those reserves.

Now we can see why the interest rates on money market accounts suck so bad. It is all tied to what the banks can get for their money short term.

Nevertheless, all of this resulted in an explosion of the Excess Reserve funds. This has a direct impact on the Velocity of Money and a reason why people feel there is too much money in the banking system. This money does not escape to get into the economy and stimulate economic growth. Instead, it just is used to settle overnight shortfalls by the banks.

As more money is locked up in the banking system, the first chart is going to see another decline. This is going to keep having a downward impact upon the economy. It is impossible to have a robust economy without money flowing through at an accelerating rate.

Since this is the case, and the Fed is going to keep easing which only makes the situation worse, economic conditions will tighten. This means the growth rate will likely head down. A rate below 2% in 2022 is likely if we simply extrapolate this path forward.

In spite of hitting it with the kitchen sink, the economy is stalled. It was ill for a long time. Now it is only getting sicker.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

So, the economy keeps getting worse. Companies begin laying off and unemployment goes up as stimulus boosts to unemployment start to dry up. Will the gov re-instate stimulus or cut it off faster? What does this meant for folks on the ground? Are we looking at another transfer of wealth as even more people lose everything all over again? What is the solution to this problem other than just take the money from the banks and let them default? What are the odds that will ever even be considered a legit option by anyone with the authority to make it happen? I'm sick to death of questions like these.

I understand evolution is slow, but it doesn't have to be anymore. I'm glad I'm alive to see humanity developing the tools needed to ensure such concerns such as these won't be, sooner or later.

The answer to all those questions is history will repeat itself. These entities keep going to the same playbook even though it is not working.

Economically, growth is abysmal. This cant be denied. It dropped over the last few decades and the growth rate is only going to keep slowing. When the President was cheering the US economy when it grew at 3%, that shows how pathetic things are.

Personally, I feel the present system will just keep going down the same path. The economy will keep slowing overall, the Fed will keep easing, more money will be in the hands of the wealthy, and the middle class will be sucked dry. This might alert the politicians at some point that a change is needed but it will be too late.

It is why I feel crypto has to step in and take over.

Posted Using LeoFinance Beta

The velocity of money just can't seem to increase at all. Do you think the CDBC (a matter of when) will help fix this issue? The economy itself needs a way to force people to start moving money out of the excess reserve funds.

Posted Using LeoFinance Beta

CBDCs wont make a difference if the system is still the same. The big problem is money is not getting out into the economy. Instead it is locked into the banking and financial system. This slows the velocity way down especially when the Fed is easing. There is so much locked up right now between the reserves, the cash in the banks, and the capital Wall Street is sitting on.

It is no wonder that money flows very slowly. Crypto could change this but it isnt going to come from the government I dont believe.

Posted Using LeoFinance Beta

Exactly

I think this is so important.

When money is sucked out of a community never to return,it stays poor. But when you look at Bitcoin Beaches, their money stays in their village and travels from person to person rewarding people, giving their work value and uplifting the community economically and by really showing people their work or talents have tangible value!

Posted Using LeoFinance Beta

Do not be fooled by crypto. Just because it is not part of the present system does not mean it is free of this same pitfall.

The velocity of crypto is pathetic too. Crypto is not moving from hand to hand for the most part. People are speculating so you have a lot of holders. The crypto that is moved is from one bettor to another.

We still have yet to see a massive amount of commerce taking place where economic activity is funded and utilizing crypto. When that happens, then we truly have an alternative. In the meantime, we are just replicating the stock market with a different asset.

Posted Using LeoFinance Beta

I agree with you, that’s why I am excited about Bitcoin, Bitcoin Lightening, and Bitcoin Beach communities. What they represent is Bitcoin moving all over a community, used as a store of value for commerce and trade, and i powering people to be their own banks. In these instances it is not being hoarded as an asset by investors or speculators, but actually being used.

This is also the potential of DPOS, to be a store of value, to circulate widely and spread amongst the community.

Posted Using LeoFinance Beta

Is so shameful almost all the Countries economy is not stable and rather the keep crumbling.

Government is not taking adequate measures to effect a steady means to stabilize the economy.

Very interesting article, i wonder why economy is so bad recently, funny that they blame it on cryptocurrency... i just don't understand why the fuck on hell we need government and banks, they are obsolete, useless, slow, filled up with bureaucracy and fueled by corruption, so why do we need to pay a rent to live on this planet to institutions such as IMF or BCE Federal Reserve etc, why?