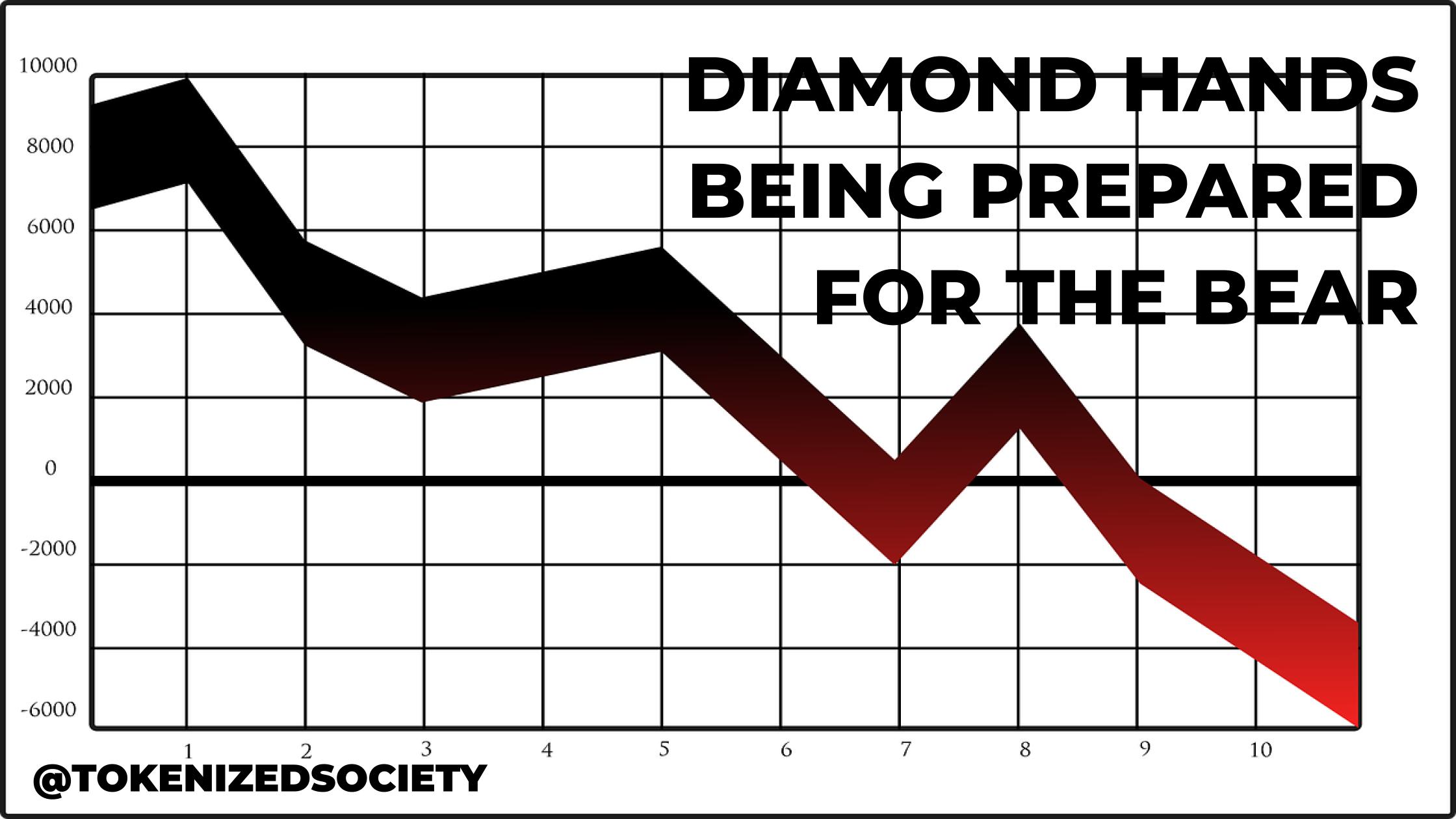

Diamond Hands - Being prepared for the bear

The downtrend of the markets can prompt many investors to panic sell but there are some tools that can help to avoid acting solely on impulse

I don't believe I have to spend any time introducing the present situation of the crypto market. If you have any skin in the game you probably know that there is blood on the streets and most coins are in an apparent free fall. It's a total meltdown!

I'm not one to read charts and find patterns to try and predict what the market will do. I understand and respect those who have the patience and the skill (even though that is debatable) to do that, but it's just not my thing.

I think this is a good trial of fire for the so-called diamond hands. It's easy to yell "HODL" when things are going well and the general feeling is that numbers will go up forever. Not as easy when all you see is red.

I'm curious to see how people will react but above anything, I'm curious to see how I am going to react. I'm fairly new to crypto and I don't believe I have seen a persistent downtrend in the markets before. As I said, I don't spend time reading charts so I don't know if this is the infamous bear market, feared by so many, but either way, I must say that I don't feel remotely close to panic selling.

I have a few friends that got into crypto around the same time as I did but no matter how I tried, I couldn't get them to try Hive. Interestingly, all of them are very desperate and at least one of them already declared that he is done for good with this crypto thing.

I would be lying if I said I haven't been checking prices because I have but I can honestly say that I'm not shaken. Not even a little. But how can I keep my cool while my friends who are just as experienced (or unexperienced, depending on how you look at it) as me are losing their minds?

Well, I'm probably not qualified to provide a scientific answer but I think I have an idea of things that are helping me to keep calm during all this craziness.

Emotional intelligence

While I'm no Daniel Goleman I have done quite a lot of reading on Emotional Intelligence, as it's one of the topics that interest me the most when it comes to human psychology. I believe that played a definitive role in helping me understand how I react to external stimuli and better manage my response rather than acting by impulse and doing precipitated things such as panic selling.

Investing money I can afford to lose

There is no sugar-coating it. Losing money sucks and we will try to avoid it at all costs but losing money you don't really need is completely different from losing money you were counting on to pay for your rent, food, your kids' school and things like that.

I am fully aware that I'm very privileged and I have some money that I can invest and even if I lose it all, I would still be able to make ends meet. It's not a lot of money but I wouldn't risk a cent if that meant I may not be able to keep a roof over my head in the following month.

Knowing what I'm getting into

This is one of the most important things and, I can't stress this enough, since I'm uneducated (and a bit skeptical) on the art of reading crypto charts, I rely solely on knowing what and who (whenever is possible) is behind the projects I invest in.

In the crypto universe, there are countless scams and an equal number of projects that, even though are legit, are just poorly designed and are bound to fail and that's why this is so important to me.

Basic notion of risk management

As a professional project manager with over a decade of experience managing risk is part of my daily routine and because of that, I'm always thinking about the likelihood of one of my investments failing and the impact it would have on my portfolio and on my finances. From there, the next step is to diversify accordingly and try to reach a healthy balance between risk and reward.

Personally, I don't want to bet everything on a moonshot that might never happen but I also don't want to spread myself too thin and find myself depending on 15 different projects to moon so I can make a decent amount. I know I have a limited amount of resources so I try to prioritize them accordingly.

Final thoughts

A market meltdown can be scary and even devastating for those who are not mentally prepared. I don't trust luck or any prediction that some gurus make on their YouTube channels so my best and only weapon is believing that I have done the best with the resources I have at my disposal and that I have a minimal understanding of the projects I'm getting into.

In fact, times like these present great opportunities if you believe in the fundamentals of those projects. Sometimes the best thing you can do is buy when everyone else is selling

Diamond melts at 4,027º C or 7,280º F so these hands can take the heat.

Posted Using LeoFinance Beta

https://twitter.com/tokenizedcity/status/1523822846463692801

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Very useful and I agree with many of your thoughts.

Posted Using LeoFinance Beta

Thank you

I'm glad you find it useful

Posted Using LeoFinance Beta

Some hands are just not made of hardcore steel. And these times are best testers to our Emotional Quotients which I am honestly still working on. You are right though on investing what we can afford to lose (this seems to be one of the golden rules of investing). And glad to know your hands are tough :)

Posted Using LeoFinance Beta

Yeah, I think emotional intelligence is something we have to work on all of our lives and I'm still learning but I think I already improved a lot since I started taking it more seriously. It is a gift in times like these!

Posted Using LeoFinance Beta

That is good :) And I believe it is indeed a blessing because it takes you away from doing something you will regret at a later time :)

Posted Using LeoFinance Beta

Sounds like you have your mindset in a pretty good place. Just stick to your personal guns and you will be alright.

If you have already not invested anything you can't afford to lose, you are way ahead of most.

Posted Using LeoFinance Beta

That's true

I trust in the projects I'm invested in and I'm not risking my financial sustainability so I'll be alright

Posted Using LeoFinance Beta

Not only can the hands take the heat. The end product thrives and out shines most metal. Thank you for the beautiful post

Posted using LeoFinance Mobile

You are welcome and thanks for the wise words!

Posted Using LeoFinance Beta

Those are some good points but it's too bad there are way too many people who invest based on emotions and that they don't have the conviction most of us have. I don't think I will be touching the normal crypto market but I am buying some Hive using HBD.

Posted Using LeoFinance Beta

Yeah, it's hard to take emotions off the equation but it's important to learn how to manage them. Not everyone can do that.

I'm also buying some Hive and LEO. Having some HBD can be a blessing when the market acts up

Posted Using LeoFinance Beta

Posted Using LeoFinance Beta

hahahah yea

reminds of something I saw last night on Discord:

image credits to @l337m45732

Posted Using LeoFinance Beta

LOL!

Hahaha I'm super proud of this

Posted Using LeoFinance Beta

Crypto currency is not easy now, you need to take out emotions and kill fear in you before you can succeed because alot of people has sold all their crypto.

Posted Using LeoFinance Beta

That's true. Hard to accomplish, but important

Posted Using LeoFinance Beta

Yes

Posted Using LeoFinance Beta

You really pinpoint some amazing facts which one needs to look into. Thanks for sharing this amazing post and have a wonderful day.

Posted using LeoFinance Mobile

I'm glad you found it useful! Thanks for the kind words

Posted Using LeoFinance Beta

You welcome

Posted using LeoFinance Mobile

It's been said that fortunes are made during bear markets, because that is when the buying opportunities present themselves. This is true, provided that we can tell the difference between a promising project with potential and a project that is going out of business. You and I have talked about CUB in this way a few times, and we stick with CUB.

If we can tell the difference between a shitcoin about to take off and a shitcoin on its way to becoming a deadcoin, then we decide accordingly. Technical Analysis definitely helps in this area, but Fundamental Analysis can do the same thing for the less technical among us (including you and me).

Posted Using LeoFinance Beta

Perfect! That's exactly how I feel about all of this

Posted Using LeoFinance Beta

There are 2 other takeaways I get from your post:

For the 2nd, you have your priorities. Anything else is there to support your priorities. There may be a "lottery ticket" or two in there, but for the most part, output from one process becomes input for the next process. LP rewards can be thought of in that way. Same with DeFi.

Posted Using LeoFinance Beta

Exactly! I couldn't have said it better myself.

I can't say this is the best strategy but it's what works for me.

I like to try my luck sometimes on those so-called lottery tickets, but the bulk of resources go to those 3 or 4 projects I believe in the most

Posted Using LeoFinance Beta