Nigeria could be the Next African Country to Accept Crypto Payments in Banks

The push for the adoption of cryptocurrencies and embrace in banks as legal tender is gradually gaining momentum. While some countries are on the heat of legislation on the classification of cryptos, others are looking forward to regulating its usage. In all, we'll have more countries join El Salvador soon, since cryptocurrencies and blockchain-based banking cannot be ignored for long.

In a recent news covered by Cointelegraph, the Nigerian president-elect is pushing for blockchain technology in the banking sector as he seeks to review existing Nigerian Security Exchange Commission (SEC) digital asset regulations to stimulate economic growth. This was presented in his manifesto recently released, and if implemented, would enable the use of blockchain technology and cryptocurrencies in the nation’s banking and finance sector. That sounds like a good news for Nigeria's economy since the huge population of the youths are already into crypto.

Presently, Nigeria is among the African countries with contentious legal status on Bitcoin. There are legal restrictions as to the usage of Bitcoin and the banks are forbidden to transact with cryptocurrencies. Tinubu's position on reviewing of existing SEC's regulations on digital assets could make cryptocurrencies to be more business-friendly.

“We will reform the policy to encourage the prudent use of blockchain technology in banking and finance, identity management, revenue collection and use of crypto assets. We will establish an advisory committee to review SEC regulation on digital assets creating a more efficient and business-friendly regulatory framework.” - Tinubu's manifesto. source

Looking forward, if the embattled Tinubu succeeds as Nigeria's presidents and get sworn in on May 29, then Nigerian Banks could be on their way to following South African counterpart which launched crypto payments via its Digital-Only Bank Gateway.

What Does this Mean for the Nigerian Economy?

If this review pushes through in time, then it would be possible to Store Crypto With a Commercial Bank or designated bank and it could be recognized as a legal tender.

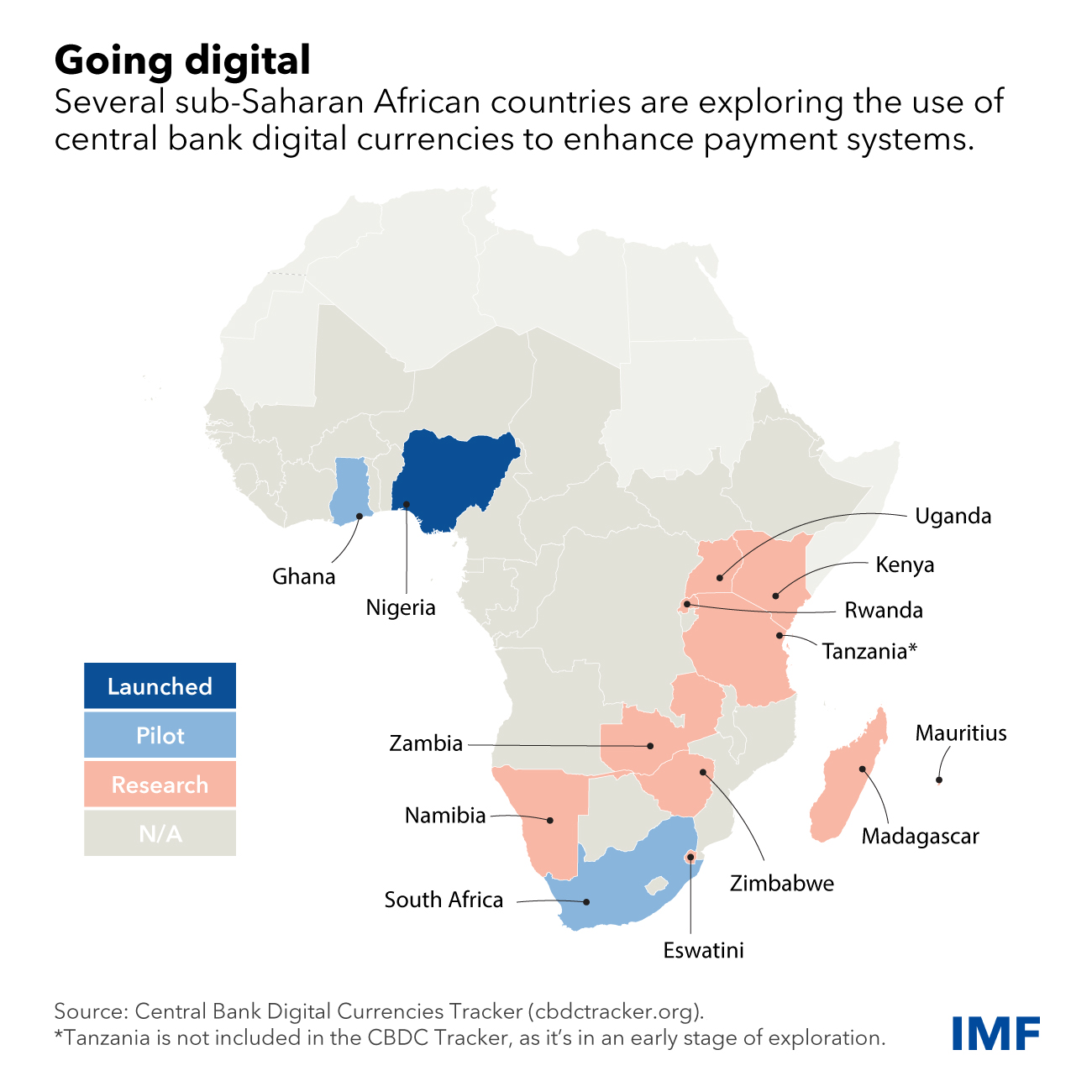

Already, the Central Bank of Nigeria (CBN) had launched eNaira - the country’s central bank digital currency — and plans to expand the adoption of the currency, which has not lived up to expectations. So far the patronage of eNaira has been low and the inclusion of other cryptocurrencies could change the landscape of eNaira.

Tinubu said, “We will also encourage the CBN to expand the use of our digital currency, the eNaira.”

As to whether this could salvage Nigeria's economy is not certain. However, since transacting cryptocurrencies would be legalized, the teaming Nigerian population already investing in crypto would expand their frontiers and it could curb increase their wealth base while curbing unemployment to a reasonable extent.

Looking into the Future

So far, Nigeria is leading African countries' exploration of digital currency. Nigerians’ interest in crypto has been reflected in the CBN’s milder position toward stablecoins. The bank recently published a research report titled “Nigeria’s Payment System Vision 2025,” which explores the creation of a new framework to accommodate stablecoin in Nigeria. We hope that if Tinubu lives to his word with accommodating cryptocurrencies in the Nigerian banks, should he be sworn in, then, we can drive some more value for cryptocurrencies, especially stablecoins.

Hive Dollars on the Limelight

Nigerians are a leading force when it comes to crypto ownership and transactions despite government's present tight fist against crypto. A good number of Nigerians are hivians and do own Hive Dollars (HBD), and this would mean that HBD could be better utilized off the chain by merchants and for service payments. This would obviously increase demand for this leading algo-stable coin.

Let's watch the events as they unfold and hope it favours the masses.

If you found the article interesting or helpful, please hit the upvote button, share for visibility to other hive friends to see. More importantly, drop a comment beneath. Thank you!

Let's Connect

Hive: https://leofinance.io/@uyobong

Twitter: https://twitter.com/Uyobong3

Discord: uyobong#5966

Posted Using LeoFinance Alpha

One thing I noticed recently is that there are many crypto users from Nigeria and many other African countries , and it is a good thing that different people from different continents are embracing crypto

Yes. Hive has been a blessing to many Nigerians. There is a high spate of unemployment in the country.

Posted Using LeoFinance Beta

Good to know that hive have become a blessing to so many people

https://twitter.com/1413161729106776065/status/1634253516783886339

The rewards earned on this comment will go directly to the people( @no-advice ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

That would be great. I am happy to hear about it, especially when knowing that we have quite a few Nigerians on Hive. This is the kind of mass adoption that I love.

The news was very heart lifting for me. It would drive a wider adoption of Hive across the country. I had relaxed my initial proposal of reaching out to local football clubs in the country to join Hive and the sports community.

Posted Using LeoFinance Beta

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

The government failed their people many times.

I'll be happy to see the Nigerians totally reject their CBDC and decide for themselves which Crypto currency to use. Hopefully Hive/HBD!

Posted Using LeoFinance Beta