Politics versus Economy - How does it favour Crypto?

The recent events bothering debt limits in the United States of America can be used to best describe how politics could impact an economy and parallel financial systems. Let's dive in.

The U.S. Debt Limit

As June draws near, there are wider concerns whether the two major parties in the United States Congress would end their deadlocked negotiations bothering the raise of the U. S. government's $31.4 trillion debt limit. The U.S. Treasury reached its statutory debt limit of $31.4 trillion on January 19, 2023, thus, pressing the Treasury to implement extraordinary measures and run down its Treasury General Account (TGA) balance to keep the government functioning.

MacroMicro reported that the TGA balance has declined from roughly $500 billion recorded at the start of February, down to $68 billion last week. Goldman Sachs also predicts that the Treasury's cash balance will likely dip to the minimum required $30 billion in early June.

If the minimum threshold of $30 billion be hit, there must be a raise of the debt ceiling to avert the much predicted economic catastrophe. Debt ceiling is the upper limit on the amount of money the US government can borrow. It is a legislative limit on the amount of national debt that can be incurred by the U.S. Treasury, thus, limiting how much money the Federal government may pay on the debt they already borrowed.

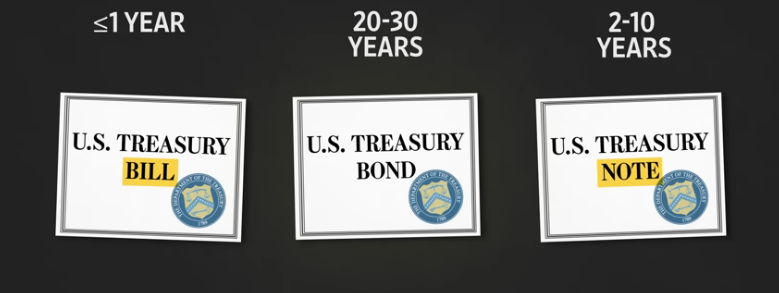

Like most government, the US government spends more money than it takes in, the reason for issuing Treasury bonds. A treasury bond represents a loan that investors make to the US government, which will be paid back with interest within a specific time. The US government borrows money through Treasury bonds to pay for its various expenses ranging from health care to social security. The U.S. Treasury is seen as the soundest and safest borrower on planet earth. However, failure to raise the debt ceiling would lead to a default. source

Will there be a Default?

A default is a situation that the US Treasury cannot make payments to investors holding the government bonds. Default could be classic or technical. In the case of a Classic Default, the US stops paying obligations to bond holders and this comes with big effects such as Stock market crash, job losses and this would likely lead to a recession in the US economy. This would go a long way to affect the global financial system which to a great extent is built around trust in the US economy.

Technical default on the other hand is the delays of some of the payments for a more or less extended period. This is considered a milder consequence of a default, though it could still cause some major economic distress similar to what happened in 1979, when the Treasury had to delay payments to individual investors due to a technical glitch. That delay led to a spike in Treasury yields, costing the government billions of dollars.

Defaults can only be averted by an agreement in the US congress. However, such agreement can only be reached if the two major political parties in the US - Democrats and Republicans can come to terms on this. Already, the opposition party, Republicans have placed a demand to be met before agreeing to the raise of the debt ceiling. This the require the government of the day to cut spending in several sectors in the US economy. The Democrats on the other hand wants the ceiling raised without any pre-conditions. We are unsure of the outcome of the negotiations ongoing, as some analysts call it deadlocked.

How would this affect global market and Crypto?

What are the chances that the US will miss the June 1 extension dateline and default on its debts? This could be a very far reaching risk. However, it is important to note that while such a risk would affect the US economy and other global economies linked to the US, a possible US debt result would impact differently on the crypto and the broader market.

Many analyses have been made on how US debt ceiling could affect the crypto market. Digital assets like Bitcoin, are sensitive to swings in the U.S. dollar liquidity, remained strong at $27k amid fears of government default and the Federal Reserve's continued rate hikes. It is believed that a possible default would make potential investors on the U.S. Treasury to seek an alternative investment, and crypto is tipped better.

The United States President, Joe Biden, has expressed opposition to a debt ceiling agreement with Republican leaders and alleges that debt ceiling would benefit crypto traders. He said this while attending the Group of Seven (G7) Summit in Hiroshima, Japan on May 21. President Biden called the Republicans’ proposed terms “unacceptable” during a press conference.

“I’m not going to agree to a deal that protects wealthy tax cheats and crypto traders while putting food assistance at risk for nearly a hundred — excuse me — nearly 1 million Americans.” source

The U.S. president's position clearly tells that he sees crypto as a rivalry option for investors in a case of failure to raise the U.S. Treasury Debt Ceiling. This may be a wake up call to crypto enthusiasts who could hope that the debt ceiling should not be raised. However, the effect on other economies could lead to another recession.

On the other hand, Coindesk reports that the Treasury's efforts to build back cash balances after resolution of the debt limit situation might suck out dollar liquidity from system, pushing Bitcoin lower. Analysts are pitching Bitcoin for a rise in the coming weeks after a tenacious support built at $27k.

Conclusion

Indeed, there is a strong relationship between politics and the economy. The Debt ceiling legislation as witnessed in the U.S. is an example. The effects of the relationship has the potency of impacting other economies and market of alternative commodities.

Let's watch the unfolding events as it unravels in the United States but only wish the best happens. But what do you think of the effect of this debt ceiling on crypto?

If you found the article interesting or helpful, please hit the upvote button, share for visibility to other hive friends to see. More importantly, drop a comment beneath. Thank you!

What is LeoFinance?

LeoFinance is a blockchain-based Web3 community that builds innovative applications on the Hive, BSC, ETH and Polygon blockchains. Our flagship application: LeoFinance.io allows users and creators to engage and share content on the blockchain while earning cryptocurrency rewards.

Let's Connect

Hive: https://leofinance.io/@uyobong

Twitter: https://twitter.com/Uyobong3

Discord: uyobong#5966

Posted Using LeoFinance Alpha