The Miraculous HIVE Pump, bHIVE & pHIVE Arbitrage and HE Tokens Response

There is nothing as chilling in the cryptoverse than the fact that Hive is thriving. While we may not have a big name that drives the markets this way, we all own Hive. We all make it happen. Out collective actions in community building that lead to new dapp creations and added utilities prides Hive to stand tall in the hall of cryptos.

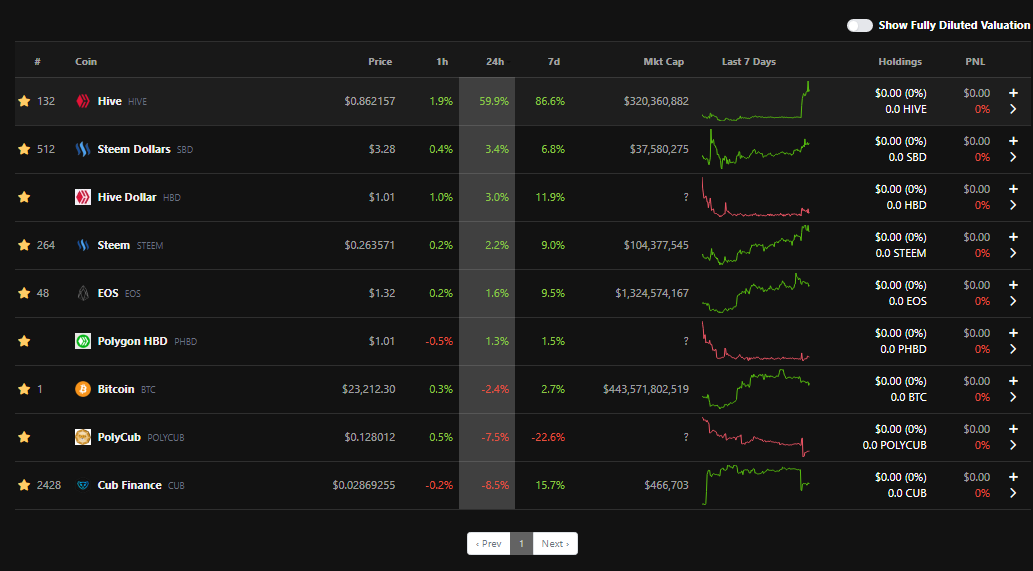

Starting August 1 with this buzz is a really cool. All the development that are ongoing on Hive despite the bear market is really not in vain. Sudden price actions as wee have seen around HIVE as high as 59% in the last 24 hours is certainly a blessing amid the blooded market. TO the best of my understanding, it's a surprise. I notice a message from Aggroed in the early hours of today, I never saw it sustained to this minute.

Ours is not the pseudo pump and dump. True value offered to live and humanity would always endear investors to buy HIVE into the long term. As this bear season elongates, the resilience of blockchains and crypto projects are being tested. Those with wrong footings are collapsing, but the story is different with Hive. The token may dump due to market pressures, but never to oblivion. True value locks here.

Today's pomp is getting some more bucks into the wallets of users with high liquidity or those who have patronized @LeoFinance's DeFi branches - PolyCUB and CubFinance which hold wrapped versions of HIVE as pHIVE and bHIVE respectively. Stalking and unstaking from the DeFi vaults in either platform is instant and that allows an investor to take profits from swinging markets . This is coupled with the liquidity that exists for HIVE on both DeFi platforms.

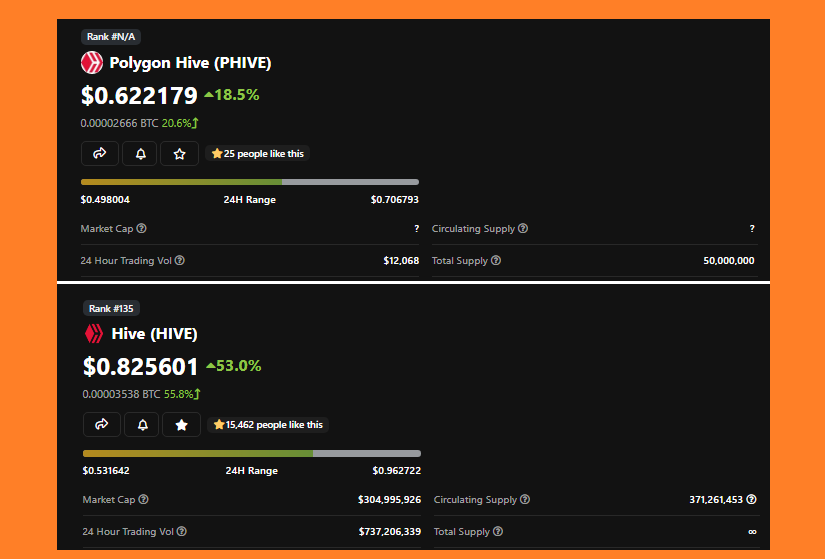

It's amazing to see from the thumbnail that while HIVE was trading on CEXes at $0.82, it was trading on Polygon (pHIVE) at $0.62. That's a whooping $0.2 difference signaling about 32% profit for whoever was arbitraging. When that is multiplied over Thousands of HIVE volume, then tangible profit were made. We know, over the time, the market balances, but early bidders can cash out big.

Truth is that HIVE and HBD prices on PolyCUB has always shown high stability die to the low slippage and deep liquidity against what is available on chain and on CEXes. We always need these deviations in exchanges for traders to invest huge and provide huge trading volumes for assets.

Looking away to Hive-engine tokens, HIVE pumps has always led to a plunge on HE token markets. This is so because second layer token investors need to tale profits too. Some SWAP.HIVE swap markets were already at full capacity.

I believe that if external markets are created for such tokens outside of their trading pairs with SWAP.HIVE, we could have a lesser effect of that selling pressure during sudden pumps as we had today.

In all, its been a fun and green day for HIVE and we all celebrate it.

Value will always attract value!

Posted Using LeoFinance Beta

https://twitter.com/Uyobong3/status/1554236630193635329

The rewards earned on this comment will go directly to the people( @uyobong ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.