After a Convex Bug, the token sink and then bounce back

Hi HODLers,

What is Convex?

Convex is a platform separated from Curve which is a lending/borrowing platform. One of the first and with one of the highest TVL.

Convex’s vote locking mechanism is key to the project’s token economy, one that allows for users to collect “bribes” from protocols and direct liquidity deposits into another protocol, Curve Finance.

To collect these bribes users need to lock their tokens for 16 weeks**.

Last friday, 72% of all $CVX tokens were locked to benefit from these rewards.

What happened?

A smart contract bug has forced a team to prematurely unlock a huge portion of its token’s circulating supply, sending markets into disarray.

It unlocked 30mn $CRX worth about $420mn which as mentioned, provoked a supply shocked.

Additional comments from the Convex team

“There were no instances of [the bug] being used prior to deployment of the new vlCVX contract. However, since Convex Finance contracts are immutable and non-upgradeable, a new contract had to be deployed. The new vlCVX contract has implemented a fix for this potential bug going forward,”

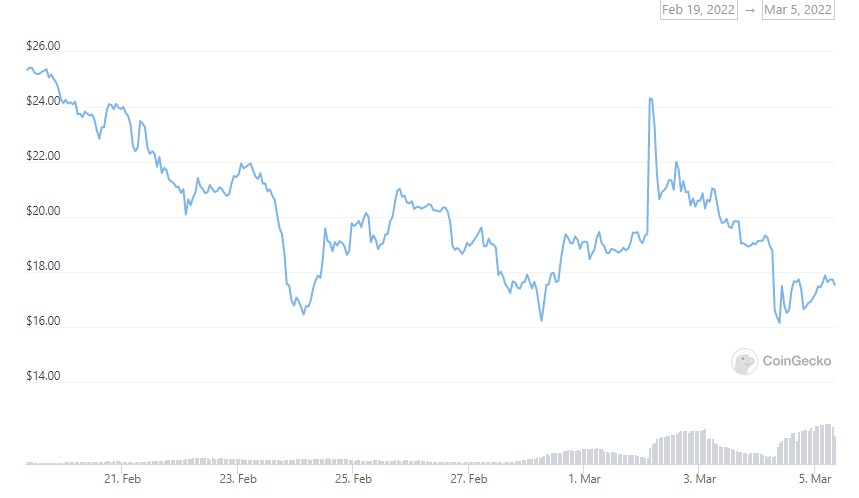

Convex $CVX Token Price

Latest Analysis

I will have a Shake Shack Burger with some Satoshis on the Side!

Russians and Belarusians citizens should NOT have their accounts frozen.

Posted Using LeoFinance Beta

Your content has been voted as a part of Encouragement program. Keep up the good work!

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more

Top. Thanks for this info.

greetings from germany

So the price dipped due to the extra unlocks but they don't believe it will affect anything in the long run? Why does unlocking early affect their returns? It just means they miss out on some APR from the tokens right?

Posted Using LeoFinance Beta