"Bitcoin is Gold" narrative is dead.

Hi HODLers,

First I would like to say a few words for our fellow Ukrainians going through a war as we speak. Hopefully, this will settle with the fewest casualties possible. I would also sympathize to many Russians feeling they will be negatively associated and impacted by the ongoing situation even if they probably would have wished anything but what is currently happening.

I will not develop anything else concerning this conflict.

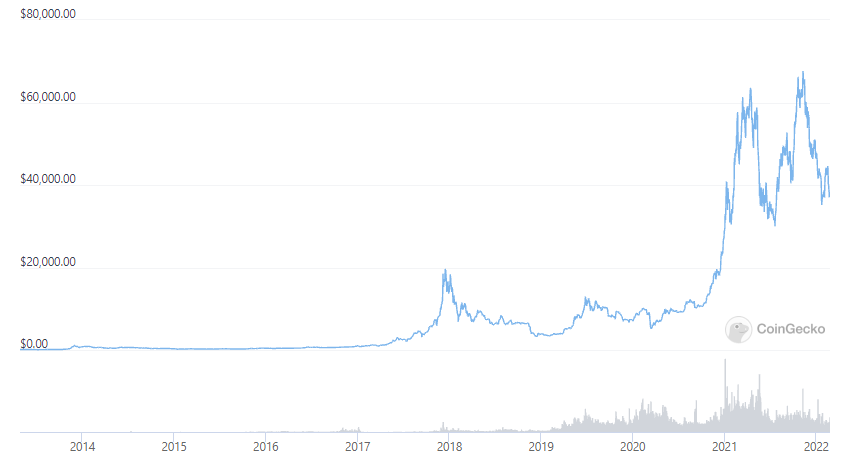

My thought process and the data has shown for a while that Bitcoin's narrative as a "safe asset" has been dead for a while. Correction since COVID where it first showed how correlated it was to market risk has just amplified.

With the current market krach and the downtrend due to geopolitical or financial (interest rates, inflation...) reasons; Bitcoin has shown what it truly is: A risk on asset. Meaning it has more to do with NASDAQ than with gold.

As you will see in the 2 charts below. Gold reacted in a much different way than Bitcoin.

This has many mentioned could be because Bitcoin's reserve narrative might be on a longer time frame and therefore there might be short-term volatility before it truly achieves this goal.

Time will tell I guess.

Bitcoin/USD Price Chart

GOLD/USD Price Chart

Conclusion

Treat Bitcoin as NASDAQ at least in the short term. Over the long term, the reserve curreny narrative might be true but it is still too early to tell.

Stay safe out there,

Latest Analysis

Canada bullying average citizens. Coinbase and Kraken CEOs having their backs!

Illinois and Georgia states propose tax incentives for Bitcoin miners!

FBI is coming after criminals... first... then probably us...

Posted Using LeoFinance Beta

Yes currently we see a strong correlation between BTC and Nasdaq. But correlations come and go so I am - as far as I understood - like you not too worried about it.

Obvious. Ukraine sold bitconis to finance their defenses !PGM

100 PGM token to send 0.1 PGM three times per day

500 to send and receive 0.1 PGM five times per day

1000 to send and receive 0.1 PGM ten times per day

Discord

Support the curation account with a delegation 10 HP - 50 HP - 100 HP - 500 HP - 1000 HP

So true, I guess gold is gold!

Posted Using LeoFinance Beta

At least for now ! Putin might sell some in the upcoming weeks though.

Posted Using LeoFinance Beta

I think that btc still had to less people using ut and to many big player who can manipulate it.

The war has already affect the crypto currency. They are also facing currency wahala because their currency is felling.

Posted Using LeoFinance Beta

Unfortunately, Bitcoin is still a speculative assets in the eyes of people. Only when the price looks affordable, people treat Bitcoin like a precious medal 😄 It is really interesting.

It is, but it has shown it can bounce quickly. Excited to see where we will be in a few years.

Posted Using LeoFinance Beta

What I was thinking while reading the part above. Long-term it might be an analogue. Short-term they seem well decoupled.

Its not-being-tied-to-any-particular-physical-space feature is quite important, though, and it separates the two in that regard.

It definitely does. Time will tell if we just had to "de-zoom" :D

Posted Using LeoFinance Beta

I like the "Bitcoin is better than gold" narrative! 🔥 Maybe someday evryone would understand that.

Posted Using LeoFinance Beta

Gold has some unique advantages and I do also own gold, but yes overall BTC has more advantages, that is why I own much more BTC than gold.

Posted Using LeoFinance Beta

Smart move sir! 🔥

Posted Using LeoFinance Beta

I do like that narrative too !

Posted Using LeoFinance Beta

As more institutions buy into BTC, it will become more correlated to the stock market. There is also quite a few BTC mining companies and other FinTech like Square that has a ton of BTC. So we can't really consider them seperate.

Posted Using LeoFinance Beta

Indeed, this is my point. When I joined, Bitcoin was supposed to be this decorelated asset / inversely related to the Stock Market. We have learned since Covid that it was not...

Posted Using LeoFinance Beta

People are going to take flight to currency in times like this because it's the most salable good, you don't take flight to reserve assets you can't exchange you want the liquidity.

As for the 2,

Lol bitcoin performed better than gold, gold got rug pulled

Posted Using LeoFinance Beta

Bingo, you are spot on. People need liquid cash right now, they are scared for what may happen and dont want risk at the moment.

BTC is still a safe haven asset for long term wealth storage however, as we see evidenced by many companies and even governments adding BTC to their reserves. BTC is not meant to be a place to put money for a month, it is meant to store wealth for long periods; people know it is not going anywhere at this point, it is far beyond the risk of failure now, the world has already accepted it.

Posted Using LeoFinance Beta

Couldn't agree more and well put, I can't even add anything more. We just need more people to reach this point in viewing bitcoin, which will come with time and as people who hold the asset long term continue to benefit

Oh for personal preservation, Bitcoin is immensely superior but if you want to hold an asset to protect your portfolio against stock krach. Bitcoin is not the one to hold, at least right now.

Posted Using LeoFinance Beta

It's already recovered and pushing 40k so how's your thesis holding up?

I guess THEY have to push another narrative now because bitcoin held well with the negative news that has been making rounds in the media for weeks now. It is still a speculative asset--the whole of crypto is speculative. Maybe in the long run this will change.

Posted Using LeoFinance Beta

BTC is the reserve currency of the $1700000000000+ crypto market, it has earned its place as a safe haven asset, the safe haven of the crypto market if nothing else. It is still volatile, but much less so than other crypto coins, but the point is that long term, people have faith that you can put a million dollars in BTC and come back in 5 years and it will be more than a million dollars in value when they return.

Hope that makes sense, thanks for your comment.

Posted Using LeoFinance Beta

+1 to this but a safe haven asset is supposed to work during krach, not long term. But do not get me wrong, I think it will eventually come through to be a safe haven asset in the medium-long run.

Posted Using LeoFinance Beta

Thank you for the clarification. And yes I believe that it will only grow in confidence and stability as time goes on. We can already see that with the increased volume + introduction of liquidity pools, that the BTC volatility has dropped over time, and that trend should continue, albeit slowly.

BTC is absolutely a safe haven asset, specifically for the crypto market; when the market is crashing and people fear for the future, they always retreat into Bitcoin. Massive corporations and even governments do not put BTC on their balance sheet for nothing. The fact is, the world has accepted BTC at this point, it is far past the danger of failing.

People have faith that if they put money into BTC, they can come back in 5 years and it will be a higher value than they started with, without having to worry. Can they come back in 5 weeks and expect it to be the same value or higher with a high degree of confidence? No. In the short term it will be volatile, but in the long term they absolutely can have that confidence.

Posted Using LeoFinance Beta

Gold is a difficult animal to predict and I gave up short term trading of this commodity a long time ago. The price has retreated since yesterday's highs but the long term performance is, I believe, still up. The main reasons being: a) a world where inflation is going to return in a big way b) the ever increasing costs of extracting the ore c) ever reducing accessible supply.

I guess the main point is the gold price will, in my opinion, always be less volatile than bitcoin.

Posted Using LeoFinance Beta

https://twitter.com/VinnieLemon/status/1497404637569163265

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.