HBD - USDC Pool is coming! Prepare to get rich, steadily...

Hi HODLers and Lions,

It took me a few days to realize the new normal concerning $HBD APR. 20% is sizeable.

If it was to keep a similar interest rate over the next 10 years and I keep making the same $rewards amount on my posts, I would have probably something close to $200,000 just with $HBD rewards.

Can you imagine how crazy that is?

And now as discussed many times by the LeoFinance team, it seems we are closer than ever to a pHBD and a stablecoin pool!

This would be amazing for Hive as finally non-Hiveans (Booooooooh!!!!) could benefit from this interesting stablecoin backed by let's call it "faith in Hive" as the only thing certain is that you will always get 1$ worth of HIVE for your HBD.

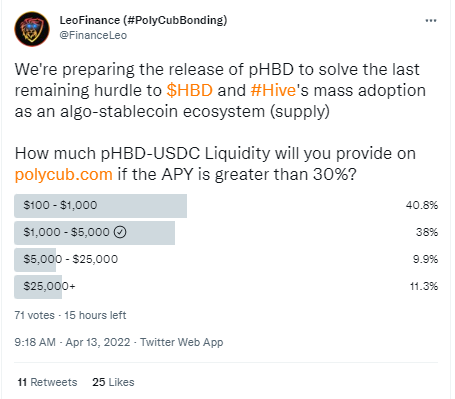

@leofinance Twitter account published this survey and as seen in Discord it seems pHBD will come sooner than soon.

20% was great but 30% is AMAZING and is sustainable! It would be 10% coming from fees + liquidity incentives and 20% from HBD APR.

New users might then put Hive on the map and maybe even create a Leofinance/Hive account to earn some HBD here and connect with our amazing community. A true Web3 community!

Our current HIVE ecocystem

I could easily see 5mn+ liquidity for this USDC-HBD pool.

Exciting stuff is coming!

In the meantime, stay safe out there,

Latest Analysis

Kevin O'Leary has now 20% of his portfolio in Crypto! But which ones!?

Is Mexico next to adopt Bitcoin as a legal tender? Vote later this year!

Are many Altcoins' ETFs just around the corner? CME stepping up!

Posted Using LeoFinance Beta

Still dont understand how this can work. Would this not lead into decreasing hive-price???

Neither do I, and all the posts I see are cheerleading and very little explaining, but I did put my questions here, hopefully someone would answer them

I believe this could be a downside in the long run. But if you look at LUNA/UST it pumped the price as more liquidity wanted to benefit from this stablecoin.

But I do agree that Hiveans could sell Hive to buy HBD in order to benefit from these yields. Also, in the event that HBD dePEGs strongly; we could see a lot of conversion of HBD into liquid HIVE therefore increasing supply.

I read somewhere that current HBD MktCap is close to 5% of HIVE Total Market cap, so at the moment, clearly not a systemic risk.

The +10% would come from CUB/Polycub or LEO rewards so HBD would still only print at 20%APR.

cc @chekohler.

Posted Using LeoFinance Beta

That is true but Hives market cap is held up by a razor thin buy wall, its not even a few million UST in dumping and it drives that price down to $0.10, so the systemic risk remains regardless of how far below the ratio HBD is

Fair point. But also maybe some of the investors buying into this HBD story might also holds Hive if they believe in the story? Who knows. Not too worried yet.

Posted Using LeoFinance Beta

If it's just the peeps here who use it, sure they're pretty price-insensitive, what I am thinking is if you're trying to use the 20% to attract large traders as UST and anchor are you'll bring with it people who are looking for a quick clip of the premium and don't care, we've seen so many DEFI pools turned into carcuses because of that

I don't see how it makes sense, would like to get your take on my critiques here

Just wondering but it got me thinking about how the 20% is covered. I am guessing Khal will have the account move the pHBD he gets into the savings account to earn interest but not all of it can be earning interest as there needs to be enough HBD in case people want to convert pHBD into HBD.

I don't think fees would cover most of the 10% so I am guessing it will get a distribution of the PolyCUB emissions.

Also, I believe this vault also has the early harvest penalty if you harvest before 90 days so make sure to think things through before going in.

Posted Using LeoFinance Beta

I will continue to put hbd into the savings. Slowly but surely xD

At least 1 hbd a day on average for me :D

1HBD a day keeps homelessness away!

Posted using LeoFinance Mobile

I am far from homeless haha xD

I think the APR is juicy considering all other stable farms in the whole crypto ecosystem. IMHO, it can be one of the best services that will attract new investors to PolyCUB.

In this pool, you get Hive APR + Security + PolyCUB rewards for your stablecoins. As long as peg is stabilized, there won't be any issue imho :)

Posted Using LeoFinance Beta

Still need to see how it works but it could be some kind of liquidity bonding to get the extra rewards.

In any case I would prefer to have 20% with 3D liquidity va 30% with 30D liquidity.

Posted using LeoFinance Mobile

Dumb question: in order to get in that pool you need an equal amount of USDC with that of HBD?

Posted using LeoFinance Mobile

At least initially yes. But then if one of the two completely tank, we could have a different ratio.

Parity should not be too hard to maintain imho.

Not financial advice obviously hehe 😉

Posted using LeoFinance Mobile

Great move from the leofinance team through PolyCub with the stable coin pool. Great to have stack some HBD before now. Can't wait to jump into what polycub is offering. Who wouldn't want some extra interest on the already juicy 20% APR. Exciting times

Posted Using LeoFinance Beta

Indeed, there is probably going to be an extra layer of risk (protocol, etc...) but I guess there is no gains without a little bit of risk :D.

I just hope it is not going to be: "No Pain, No Gain" xD.

Posted Using LeoFinance Beta

True that. No risk, no gain.

:-) I doubt we will see that

Posted Using LeoFinance Beta