How a Fantom DeGen almost "crashed" the network

Hi HODLers,

Today, I will shine some light on an event that happened last week on the Fantom Blockchain.

There are a lot of things to learn from it (the most important one is that leverage is evil).

Who are we talking about?

This Degen goes by the name of Roosh in the Fantom community.

He deposited $50 million worth of FTM (roughly 59 million FTM tokens) on a DeFi protocol called Scream (Lending Platform) to take out a loan for two other tokens:

$SOLID, from the protocol-to-protocol crypto exchange called Solidex, this was the ve(3,3) exchange developed by Andre Cronje and his team before they quit.

$DEUS, the native token for a Swiss-army financial services platform called Deus Finance

The DeGen Trader got $37mn worth of this 2 tokens as you have to be over-colateralized on Scream (as for most of the DeFi Lending platforms).

What did he do next?

The whale then locked up his haul of those two smaller tokens in a four-year staking contract. These contracts allow you to get the best APR on these platforms and to participate in governance.

So, he’s now levered and illiquid.

Crypto Markets started to drop...

And as any Altcoins $FTM took a nose-dive. Our trader is getting closer and closer to liquidation levels.

A $50mn liquidation is an important event and could have brought the network to his knees.

At some point, one of the members of the Deus Finance DAO lent Roosh $2 milllion to help prevent this.

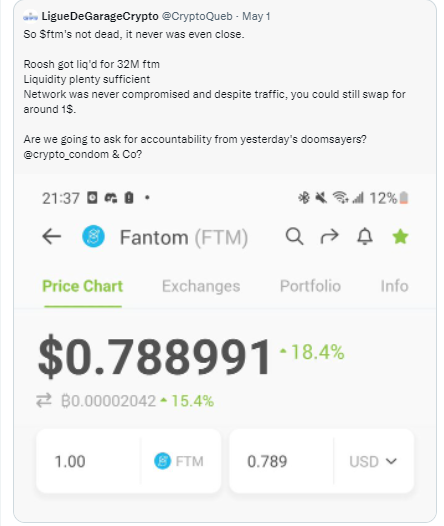

It did not completely prevent the liquidation as 11mn $FTM got liquidated pushing the price of $FTM from $0.85 to $0.79.

Following this 1st liquidation, three other followed bringing the position to just around 18mn tokens.

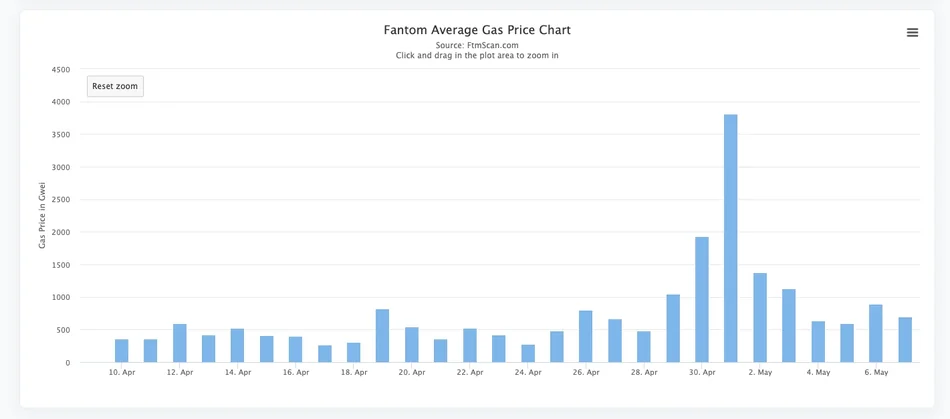

As these trades to liquidate took place on-chain, gas fees skyrocketed

(Source: FTMscan)

Congestion of the network is having a cascading effect as FTM price goes down:

- Users might want to sell $FTM making the gas fee issue worse

- Other DeFi users might want to add colateral to prevent their own liquidation but cannot get through with such high GWEI and failed transactions. These would push more liquidations and so on and so forth...

We could have ended in a death spiral!

But we didn't. Fantom just got slow and expensive for a while but kept running.

As our DeGen Fantom Whale put it in a funny tweet (I can't believe he is laughing after being liquidated)

Source:

How $50 Million in Loans Nearly Crashed Fantom

Latest Analysis

Posted Using LeoFinance Beta

hahahhaha! what a stupid whale man!

Are you an eth whale that has been trying to kill Fantom? Because that's all of this started. eth whales (AKA venture capitalist-powered cucks) have been pilfering fantom for the last year.

Posted Using LeoFinance Beta

I start to ask myself if he did not do this on purpose while having short positions on leverage on different CEXs... To be discovered :D

Posted Using LeoFinance Beta

https://twitter.com/LeoAlpha2021/status/1523097937676746752

https://twitter.com/VinnieLemon/status/1523121319553867777

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

this was interesting. It took me 3 reads to start to catch on. Thank god I'm too stupid and poor to even try to get involved something like that. Actually the only reason I've even heard of fantom is from hashkings lol. I feel safe on hive. quite a relief

Posted Using LeoFinance Beta

Hashkings? The Hive Blockchain game? Interesting, how come?

Take care mate.

Posted Using LeoFinance Beta

I'm not sure did he did this on pourpose ... loosing millions in the process, or just a bad trade.

Might be mallicious event as well, trying to put a bad name on the chain

The way this guy “does not seem to care” could effectively hint that it was malicious (imagine millions being short on CEXs at the same time?). Hard to tell but for somebody having millions, his strategy was kind of dumb imho.

Posted using LeoFinance Mobile

That is an interesting case. I know he is illiquid but is the problem that FTM dropped in price and he needed to pay back the loan? I am still a little confused.

Posted Using LeoFinance Beta

I guess it was but I am also not sure how FTM went down in value faster than DEUS or SOLID. This is probably rare as these are usually more volatile.

Posted Using LeoFinance Beta

Fantom lives to fight another day.

Posted Using LeoFinance Beta

Hell yeah brother, hell yeah. We're not dead yet.

Posted Using LeoFinance Beta

Indeed! "We will survive!" (8)

Posted Using LeoFinance Beta

Oh man, that whale must be hurting right now with such a loss. Or probably not! Glad FTM didn't spiraled down.

Posted Using LeoFinance Beta

The second that fantom goes back above $1, we're gucci bro.

Posted Using LeoFinance Beta

That's great for you, all the best!

What a mess...defi is like the wild west and one idiot can ruin it for others pretty fast.

Posted Using LeoFinance Beta

How did you think this was Roosh's fault? When things were riding high on the hog 2 months ago, Roosh was making millions each day from this strategy...smh

Posted Using LeoFinance Beta

So he never thought what could happen if the market takes another turn?

Well, he locked for 4 years so he's in this for the comparatively long-haul, compared to most "investoors".

Roosh didn't plan on Andre exiting after trashing Solidly before he left by leaving it an immutable, buggy mess but forcing all of Fantom's top projects to integrate with it.

You'll see the narrative turn around when Solidly+ launches.

I hear you. Still, 4 years is really long time in crypto.

This is a great article and a great dive into the most important top-level stuff that happened on Fantom.

However, this isn't the full story by a long shot.

You need to go in-depth in OxDao and Solidex and Solidly because everything that is playing out right now came from these 3 extremely important, outsized protocols on Fantom.

Yes, the money from Roosh is locked in Scream, however all the money he locked he used to get stables to purchase the majority of Solid. That's excruciatingly important because Solidly+, the revived version of Andre's doomed AMM meta project, is weeks or maybe 2 months tops from being released.

Crazy times. I'd be buying fantom right now if I was you.

Posted Using LeoFinance Beta

Interesting point of view and information:

I don’t get that part:

So he borrowed DEUS/SOLID - staked it but how did he get stablecoins later?

Solidly+? I haven’t heard about it! Any links to get me informed? I am very interested.

Thanks for your comments and support!

Posted using LeoFinance Mobile

https://debank.com/profile/0xddf169bf228e6d6e701180e2e6f290739663a784/history

Look at his wallet; he's buying Deus, Ankr and Solid and he's been trying to control Solid for months now. Once Solidly+ launches, he'll have nearly a majority stake probably

Posted Using LeoFinance Beta

I have never heard about a Solidly+ launch! Where did you see these rumors?

Posted Using LeoFinance Beta

This is hilarious. When will people start to realize how fragile these Ethereum copy chains are?

Posted Using LeoFinance Beta

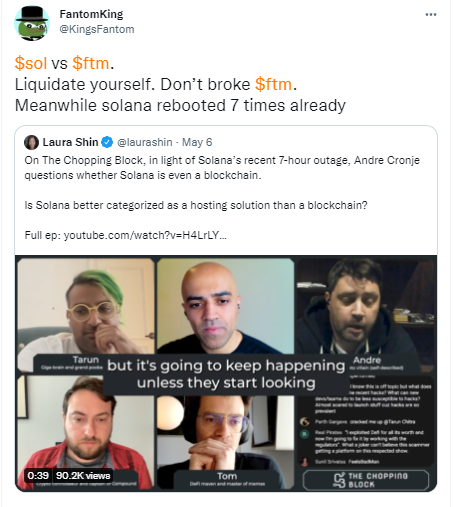

Well I agree to disagree, this happened on ETH too during mass liquidations events and also the network was always online, just fees were through the roof (still 200x less than ETH fees 😅).

ETH did have one of these recently with OtherSide NFTs

Posted using LeoFinance Mobile

I know it happens to ETH too, but it's less likely for the network to grind to a halt. Honestly I don't know shit about Fantom, I've just heard about its issues.

Posted Using LeoFinance Beta

I must have wrote it badly. Fantom was never close to a halt. Txs just got very expensive and took time to process. Exactly as what happens to ETH during dip or new NFT launch. There were no outage. This isn’t solans haha 😂

Posted using LeoFinance Mobile

Clearly I misunderstood! Was starting to think we were talking about solana. Hahah

Posted using LeoFinance Mobile

Casual 50 mil liquidation, no big deal

Posted Using LeoFinance Beta

Who has not had this happen to him? Seriously, everybody went through a 50mil liquidation event!

Posted Using LeoFinance Beta

Reading this felt like an intense financial movie.

Posted using LeoFinance Mobile

Greed rekt Mr Roosh, those level of trust in the market. What a courageous man

Posted using LeoFinance Mobile