Swivel Finance introducing fixed rates deposit to Crypto?

Hello HODLers,

Today I decided to write about a small project Swivel Finance.

Swivel Finance is a project aiming to tokenize cash-flow and fixed-rate lending service.

Multicoin participated to the $3.5mn raise and was joined by 3 trading desks: GSR Markets, SCC Investments and CMT Digital.

Then we found the usual investors such as OKEx Ventures, SevenX Ventures...

As mentionned by Decrypt:

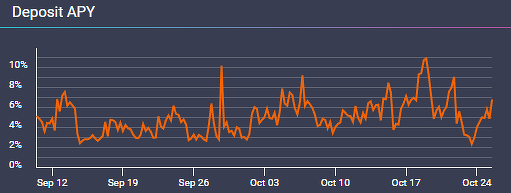

This may not be an issue for retail investors, after all, gains are gains. But for more buttoned-down outfits, such variability can pose serious risks for portfolio managers.

As PMs usually have cash obligations from other revenue sources and therefore if APYs can vary so quickly, they would have to have more cash on hands.

Deposit APY on Aave since September 10, 2021. Source: Aave

But this is already possible on Aave with aETH for example and on many other platforms such as Compound.

What does Swivel Finance bring to the table?

There are two tokens on Swivel:

- nTokens: traditional yield-bearing token such as aETH

- zcTokens: Locked up token for a predetermined period. As an example zcETH can be redeemed 1:1 for ETH once the period is over. zcETH are therefore trading at a discount (depending on the lenght of the period)

It might look like nothing but it allows traders and institutions to truly lock the interest rate on the asset they selected (it could be a stablecoin ofc).

To the best of my knowledge I do not know fixed rates for Crypto deposits except Binance programs when you can sometime lock a crypto for 30-90 days. But for 6 months? 12 months?

nToken would allow classic long and short spot yield rates.

The mainnet is expected to be launched in the coming month.

Latest Analysis

Posted Using LeoFinance Beta