UST PEG under pressure

Hi HODLers,

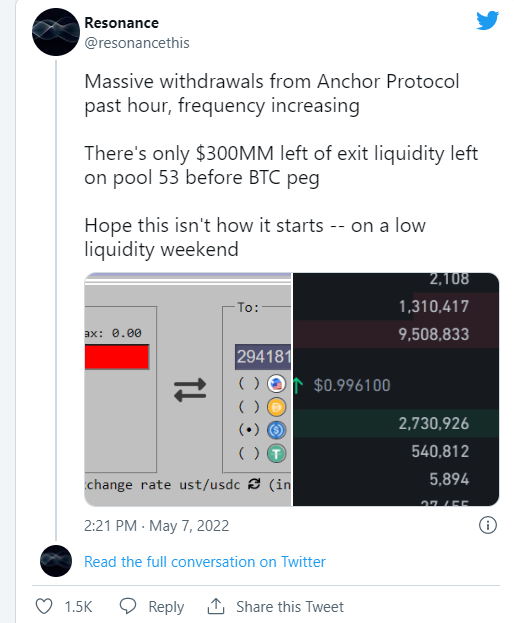

Pressure started to rise on UST after high-volume withdrawals from Terra's Anchor protocol.

Curve Protocol liquidty showed an unusual imbalance of around 65% usually it is 50%)

This is not a huge issue but it could be if it lingers for too long.

As nagaking said:

“From the [liquidity pool] perspective, there’s only really a problem if the pool never reverts to near 50/50 balance, corresponding to 1:1 price. So, imbalance per se isn’t an issue, but as the pool becomes more imbalanced and prices deviate further from 1:1, one obviously becomes more concerned that price/pool balance may not revert to normalcy,”

Also these pools tend to be able to absorb such volatility. $LUNA

Nevertheless, $85mn were exchanged and started the hit taken by $UST.

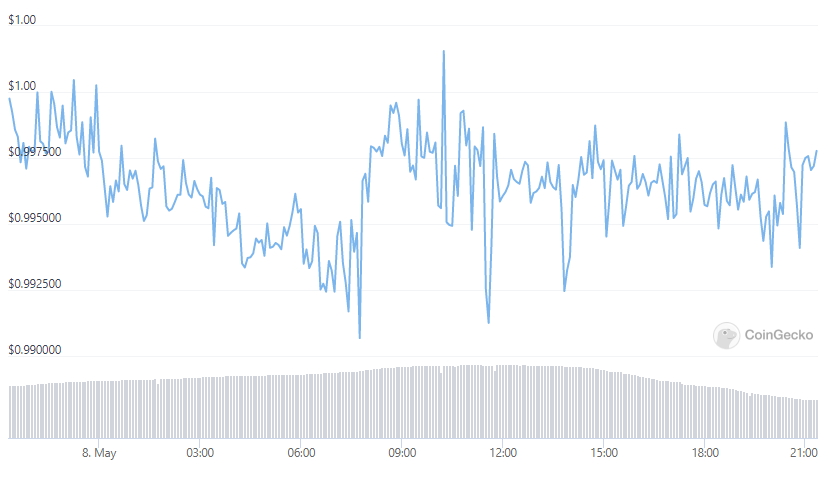

When UST dropped below its $1 peg yesterday:

- Arbitragers swooped in and traded LUNA for that discounted UST, generating a profit.

This mechanism helps maintain UST’s peg to USD because each time traders buy UST and swap it for LUNA, the Terra protocol removes that UST from circulation. The buy pressure on UST helps maintain its peg.

But the sell pressure on Terra means its price could tank in an effort to rescue its native network’s stablecoin.

Last 24hours $UST Price Chart

It could be a deliberate attack by whales playing some kind of liquidation style games and trying to get UST ot its knees. As I have said proeviously, I am not a huge fan of the sytemic issues that UST could bring to the Cryptocurrency ecosystem.

Nevertheless that is a theory. For now, it seems $UST is getting back closer to PEG which is good despite the bearish environement.

But what will happen if (God forbid!) Bitcoin drops to $20k?

That will be some heavy pressure on this decentarlized stablecoin.

Stay safe out there,

Latest Analysis

Posted Using LeoFinance Beta

Oh, I read some headlines about this but I didn't understand this portion until you explained it. So the arbitragers are keeping the peg up to date but this is also causing a lot of LUNA to be sold on the market (probably market price). If it doesn't work out well, I guess it could end quite badly.

Posted Using LeoFinance Beta

Yes indeed, I am no expert but as far as I understood. You can redeem 1 UST for 1$ worth of LUNA. And therefore you can make a profit but then, sellof is accentuating on LUNA

Posted using LeoFinance Mobile

I called this weeks ago and people here called me a negative asshole, when will people learn and stop talking shit about things they don't understand

Well that is why I like you. Not sugarcoating it hehe. It was going to end badly but then the timing is another story.

Now that shit hit the fan. Let’s see what happens…

Posted using LeoFinance Mobile

Agreed lol none of us know the timing, they still have a bunch of bitcoin and premined tokens to try and hold the peg

Being the asshole I am I’d take 25k bitcoin for 2 months to see Do Kwon get liquidated

Well, we have USDC, HBD and others at hand. Curious to see how HBD will hold during a potential bear market.

Posted using LeoFinance Mobile