𝐂𝐫𝐲𝐩𝐭𝐨 𝐖𝐞𝐚𝐭𝐡𝐞𝐫 𝐅𝐨𝐫𝐞𝐜𝐚𝐬𝐭 - #21 The Market Overreacted Yesterday

What a beautiful sell-off, Yesterday's sell-off made Coinbase trades get stuck and fail and there were many other exchanges that did not admit their trades failed during the enormous sell pressure we saw.

Of course, the hope was to go below that 8.1% year-over-year inflation that was expected, and just as Coinbase that hope failed. Failed by 0.2%.

BTC dived 11% and dipped below 20K just because of a measly 0.2%. Now personally I think that; or the market was blown up by hopium, which I do not have too many data points for. Or the market overreacted.

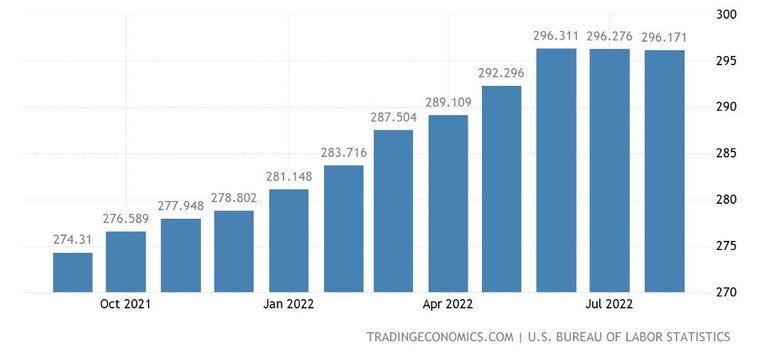

The CPI was lower than last month, and the previous month. It stopped rocketing up like it did earlier this year and even seems stable at the moment.

Source: US Bureau of Labor Statistics

Now we know that the FED wants to get inflation under control, without pushing the nation into a huge recession. Jerome Powell already admitted last that he would keep fighting inflation so it does not really matter if we get two hikes of 75 points or one of 100 points and the next one of 50 points.

What I don´t get is the following, the FED once to achieve 2% inflation by late 2023 and the way they measure it is year over year. Currently, it´s trending stable, dipping a bit even. If that would continue, wouldn´t we be at 0% by June next year? E.g. if we keep it stable at 296 points as was the case these last three months, wouldn´t we be at 0% by June next year?

The market is such a drama queen

BTC was doing quite well these last couple of days considering everything. And yes it started from a short squeeze, but it kept up, and broke the bear flag pattern. Even the 100-day moving average (MA) indicated the possibility of continuing this bullish trend. After the news, which in my opinion was not good or bad BTC entered the oversold territory.

The market reacted as if the world was on fire AGAIN. And that reaction was not based on facts, but on sentiment.

Just to be safe I still would go easy on buying this dip, as sentiment often does more to the market than facts. And the fact is that sentiment drove BTC down 11% in a day and we still have that FED meeting in a week.

On the other hand, if you are DCAing the bear market, buying a bit of Dip is always a good thing even if it´s just because you feel good knowing you bought it at a temporary discount.

But of course, that is no financial advice- It´s what I will probably be doing. And I will try to flip that buy with 5-10% profit before the FED meeting next Wednesday.

The Crypto Weather Forecast is my take on the crypto market, sometimes serious, sometimes sarcastic, often with a wink, and Always Honest.

Posted Using LeoFinance Beta

Funny how fear can influence everything. I will certainly add to my BTC positions over the next few days. Only bummer is I need to sell HIVE for it...

!BEER

Posted Using LeoFinance Beta

View or trade

BEER.Hey @whywhy, here is a little bit of

BEERfrom @solymi for you. Enjoy it!Did you know that you can use BEER at dCity game to **buy dCity NFT cards** to rule the world.

It sure did.

Volitility is the name of the game

AKA Market manipulation

Not a huge dump, but not the direction I thought we were going to head once we ticked over $22K. Oh well. It will happen eventually....

Well 11% in a day that is a serious dip if you ask me, but yes in a year we should be away from anything starting with a 2.

It's crypto though. 11% is like a walk in the park!

Lots of fear and fomo

Yay! 🤗

Your content has been boosted with Ecency Points, by @mypathtofire.

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more