𝐂𝐫𝐲𝐩𝐭𝐨 𝐖𝐞𝐚𝐭𝐡𝐞𝐫 𝐅𝐨𝐫𝐞𝐜𝐚𝐬𝐭 - #23 ETH should drop to $1000 to be in line with its #2 position

Howdy Folks,

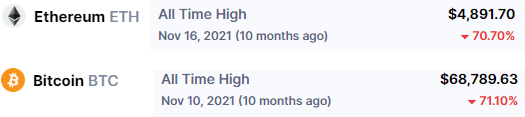

Where BTC seems to be recovering from the CPI dip and ETH merge Aftermath, ETH itself is down where it should be. Well No that is a lie, it should be down even more.

ATM ETH is only down 70% from its ATH last November, being the number two coin should mean you do not have to be down as deep as the common ALTS, but you should at least be bowing for king Bitcoin.

NOW ETH is not yet bowing, which can mean two things:

It wants to prove it´s ready to take on Bitcoin. Or It has another dip coming to take it to 80% of its ATH which would be just above $1000. With the FUD of not being centralized anymore after the merge, I don´t see the flippening happening any time soon.

Hence the current $1400 might not be the buy-the-dip moment for ETH just yet. Especially with that FED meeting coming at us this Wednesday. I will put in some buy orders below $1200 and expect to see them filled before next Friday.

Follow The FED FUD

Some of you might have seen me mentioning that FED meeting already several times, that is because it´s really bugging me. We did not have any in August, and my friend JP made clear he wants to keep fighting that inflation till it´s back at 2%.

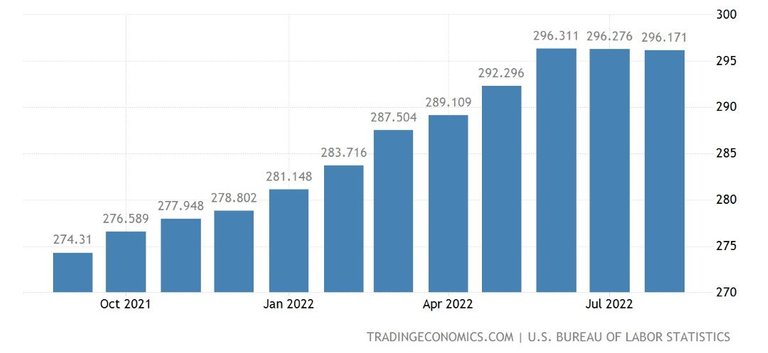

Now as I mentioned previously the inflation in the US seems to be stable and coming down, meaning that if they keep that up by June 2023 it would be below 2% as they measure it year over year.

And indeed the FED should not stop the fight too early, but in the past, they have been known to correct too long. The US economy seems stronger than expected; unemployment is still very low, and annual retail sales are up, which would allow the FED to keep raising interest. Rumors say that there is even a 100-point rate hike on the table.

If that 100-point rate hike will become reality markets will tank. In addition, globally we are seeing more signs of a recession. If that rate hike hits the market and is followed by this recession increasing you would create a nice explosive cocktail to blow up both the crypto and the stock market as spending will be fully going on hold.

Bottom Line Forecast

That is what I will expect to see in Q4 of 2022, a final massive market dump. It will be s short one, six months top. Because this is a new type of recession and that inflation year over year will be disappearing come June.

While at the same time governments around the world are already planning on spending more money to deflect this energy crisis and recession. Hence by December, there should already be a lot of signals showing more money will become available. In January spending will go up, and by June we will be looking back at the 2022 bear market.

And by that time Bitcoin might no longer be King Crypto....but that is a bet I am not taking.

The Crypto Weather Forecast is my take on the crypto market, sometimes serious, sometimes sarcastic, often with a wink, and Always Honest.

Thanks for the read!

Posted Using LeoFinance Beta

That makes sense! I might buy some more at that price!

Same here there will be a flippening it will just take another bull market and a bit !CTP

So I can buy BTC and relax for a while. If it goes another leg down, this could be epic, but I guess there would.be strong buying at that level.

Yay! 🤗

Your content has been boosted with Ecency Points, by @mypathtofire.

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more