How crypto helped turn a 22K debt into 25K profit - Part 2

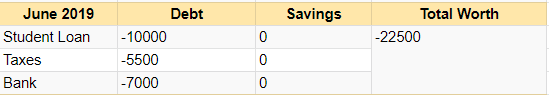

I ended part one yesterday really at the bottom of my wealth, with being in dept over 22K in euros.

If you want to know how I got there please check out Part 1 of my story:

How crypto helped turn a 22K debt into 25K profit

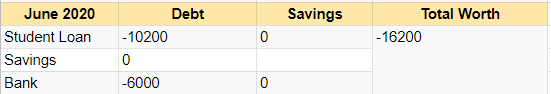

Now, where were we? Right, it was 2019 and these were my stats.

When you hit rock bottom the only way is up. right?

Now for a bit of good news, I got lucky.

June 2020 arrived, the deadline for the tax assessment passed and I got...... nothing. This gave me an extra year to save money for the last one, which would expire by June 2021.

So by June 2020, things were finally starting to turn around. Or so it seemed.

The Times They Are a-Changin'

Over the last 2 years, my girlfriend and I lived on a very tight budget, with no room for anything but the direct necessities. But I did more to improve the financials.

1. Renting out my parking spot

I was renting an apartment with an underground parking place, but as we did not have a car, we were not using it. Now officially you are not allowed to sublet something you are renting. But if nobody is looking, why not. Renting out that spot makes me one month of rent each year.

2. Keeping score

Secondly, we started keeping track of all money coming in and going out. And if I say we, I mean my girlfriend. I made sure the money was coming in, and she made sure to document every penny going out.

3. Why don´t you get a (better paying) job

The biggest game-changer was my promotion, it was already discussed in early 2020 but didn´t go into effect till that summer of 2020.

Due to the tax situation I felt I really had no choice. I explained the whole thing to the hiring manager (a person in our company I met before) and made clear what I would need to earn to be dealing with this situation. He got it and I got even more than I asked for.

Hence in all honesty I was already on my road to financial recovery prior to getting into crypto.

But getting into crypto could only be done due to my financial status becoming a healthy one. Because you should never invest what you cant afford to lose and until 2020 (as you can see) I could not afford to lose a penny.

Actually looking back the last time my finances were healthy was when I was 12 years old, before I started borrowing money from my little brother.

The Gift

That same year I received a huge birthday/Christmas. As I was already saving up to pay the 3rd and last tax assessment, I could use my gift for my first ever (crypto) investment.

So I bought......

Bitcoin!

And put a $250 on an exchange to see if I could trade my way up.

Now as mentioned I am thankful to the guy that pushed me into crypto at the right time, or maybe just a little too late (but that was my fault as I had no funds).

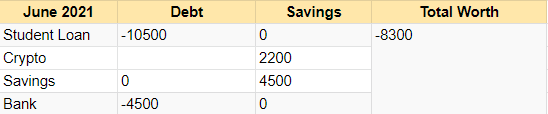

My initial $1000 BTC did very nice in 2021 and thanks to the bull run I had tripled my 250 dollars by the time we hit the bottom in the summer of 2021. During these low months, my portfolio was still worth about 2200 euros.

On top of that, I seem to have slipped through the cracks again with regard to paying the overdue taxes. Which put my savings at 4500 euros. That was quite a jump forward reducing my debt by 14K in 2 years' time.

But 2021 did not end yet

We had a 2nd bull run in October/November of 2021 and I was involved in several projects of which one did amazing. I was able to take out all my investments and still have a 12K portfolio by Christmas.

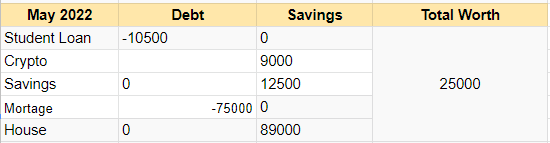

Now over time, that portfolio dropped a bit thanks to this lovely bear market but as it´s May and I am still holding over 9K in crypto I think it´s okay to put that number down for June.

As I was used to saving 4500 because of the taxes I did so again this year. But I managed to save much more. I took out 1250 euros from my crypto investments and another 1250 euros from the profit in December 2021. Which totals 11.500 in savings.

Due to my new job and increased salary I was able to save another 700 euros each month by sticking to the old budget and that money I could use to buy more assets. No crypto this time but bricks.

Instead of throwing away money paying rent, I was able to buy an apartment and pay to become the owner of my first bit of real estate.

Now 2022 was not all happy-happy joy-joy as after 12 years of silence I was contacted by the student loan instance?????

Twelve years of nothing and it was as if they could smell the money. All of a sudden they knew where to find me. Well, we made a deal and I started paying them already so my Student Loan did not increase.

I did save enough to pay off my bank loan and my financial position by June 2022 must look something like this:

Well maybe not exactly like this because over these last couple of days, I decided to move a bit more fiat into crypto due to the dip. Aiming at reversing the numbers for savings and crypto.

So where did that Crypro help you?

I knew you were going to ask that. And the answer is simple.

First of all crypto made me money more money than anything else, but that is the least important part.

Crypto and stacking sats became a game. The more I could stack, the better. So I started looking into the best places to earn, and once I started earning I looked into the best places to store those earnings.

Best does not mean the highest APY´s, but basically a safe place where I can store holdings from a good project and get a nice little bit of interest.

Now, all that reading and writing about crypto taught me a lot about finances. Something I did not care for all those years I was flat broke.

I started to play that stacking sats game also with my fiat. I can´t help it, I am a baby I love games.

Where was I still Losing Money?

The loan I took out to pay for the credit card debt cost me more than the return I could get if I used that money to invest in a solid crypto project. So I decided to pay off my bank loan 3 years before the deadline.

How can I increase my holdings?

Increasing my holdings led to me buying an apartment and basically staking a bit of money into a project each month. While no longer throwing away money monthly for that same roof over my head.

Where do I make the most interest?

The things I learned taught me that I should not pay off my Student Loan in one go!

The interest on that loan is only 2 % a year. If I invest that money in Bitcoin the expected roi will be much greater than 2%.

The whole stacking sats game made me realize to just keep picking up pennies from the street, just like I do in the crypto-verse (earning through Brave, PreSearch, Cake Defi, NoiseCash, Torum, HIVE) because those little bits will be a lot if you do it daily.

There is money to be made on the streets.

An Amazon product you receive that has just a bit of damage. I got many products for free or at a discount just by contacting the seller (not Amazon).

Shoppping once a week and not every other day and buy a lot when the prices are low (I also buy more seats when a coin is on sale).

Review your monthly payments like insurances to ensure you only pay for what you need and keep comparing yours to the offers out there.

Bottom Line

Of course, in the end, it´s the mindset that you need to change.

You need to step up and say enough is enough...I ain´t paying for this sh!t anymore. Then get rid of your ex-wife and start getting rid of that debt.

Once that mindset is changed, diving into crypto will help in understanding finances and how you can make the most of what you got....or have not got (yet). At least that is what it did for me.

Let me know your story as I am very curious to know how your wealth is doing today.

Posted Using LeoFinance Beta

Nice article. One thing it underlines is the importance of good habits and looking at the long-term. Like you say, little and often pretty soon amounts to something worthwhile.

Indeed, but it really started with changing that mindset, saying to yourself I do Not want this PEEP anymore.

I loved reading your story, you cannot stay in misery all the time and you can balance the odds in your favor.

Thank you and indeed you need to stand up and say enough is enough and change the rules of the game (in your favor).

Honestly, this is some real good news. I still have a few thousand dollars in debt due to medical bills so eventually I'll be able to handle that off and just pay my regular expenses. Crypto is helping me build my wealth.

Crypto definitely helped and is helping me look for the smart money ways to deal with debt