Four Decentralized Exchanges (DEX) to Watch as the Crypto Market Comes of Age

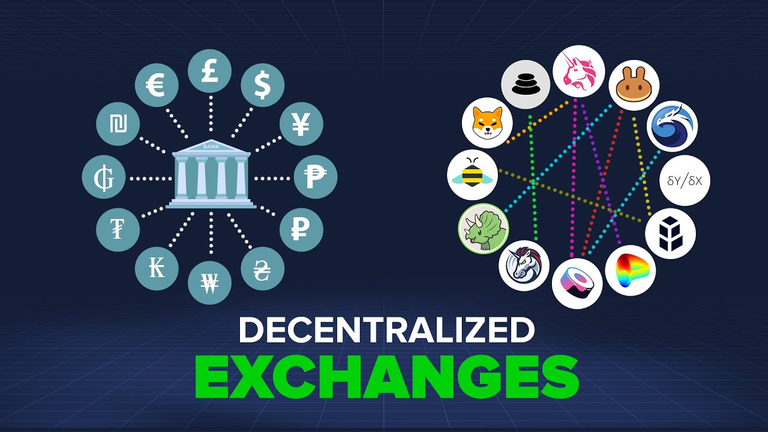

The crypto market structure has evolved into a full suite of financial services that features centralized and decentralized products. Unlike in the past, crypto natives now have an option to purchase digital assets through centralized or decentralized exchanges. The latter became popular following the debut of Decentralized Finance (DeFi) protocols, which are powered by smart contracts.

According to data from The Block Research, DEXs accounted for close to $1 trillion of total crypto market trading volumes in 2021. More importantly, the larger share of ‘crypto whales’ and veterans prefer using DEXs over CEXs.

“We see that DEX users carry out much larger transactions than centralized exchange users. This is likely because DeFi is also more popular in countries with bigger, more established cryptocurrency markets, which also tend to be wealthier countries.” noted a recent report by Crypto Intelligence firm Chainalysis.

While several DEXs have been launched within the past two years, some have emerged as more superior ecosystems. This is because of the difference in the underlying infrastructure, tokenomics and network incentives, amongst other factors. In this article, we will highlight five leading DEXs that every crypto investor ought to know.

Fluid

Contrary to its counterparts, Fluid is a liquidity aggregator powered by Artificial Intelligence (AI) and quantitative models. This DEX aggregator solves the issue of fragmented liquidity across the crypto ecosystem by matching orders with the best prices, ultimately reducing the latency in DEX trading. The project enjoys the support of prominent ex-bankers who previously worked for some of the biggest banks, including Goldman Sachs and Bank of America.

Recently, Fluid raised $10 million in a funding round led by Ghaf and GSR capital. The newly injected funds will be used to advance the platform’s liquidity aggregation solutions for the benefit of the larger crypto market. Commenting on the milestone, Fluid’s President and CEO Ahmed Ismail, expressed optimism on the underlying value proposition,

“FLUID will transform the virtual assets industry by solving a number of combined challenges that arise from fragmented liquidity which remain unresolved today. In effect, we provide retail and institutional investors access to a secure, robust framework for participation in the virtual assets market.”

SOMA.Finance

SOMA.finance is the pioneer globally compliant multi-asset DEX to offer tokenized assets backed by various financial instruments, including cryptocurrencies, equities, ETFs, STOs and NFTs. The project has partnered with Tritaurian Capital, a U.S licensed broker, enabling crypto innovators to issue tokenized assets while giving retailers access to a secure ecosystem with the blessings of the regulators.

With the DEX set to launch officially in the coming months, SOMA.finance will initially feature 20-30 tokenized assets and a Reg D compliant utility token dubbed $SOMA. Notably, SOMA.finance also leverages the Automated Market Market (AMM) model, meaning that users will be able to trade all the listed assets within a P2P and decentralized ecosystem. More importantly, the exposure to regulated synthetic assets will be a game-changer in the DeFi market.

OraiDEX

Built on the Oraichain AI-powered blockchain ecosystem, the OraiDEX introduces a multi-chain interoperable platform where crypto users can swap a wide range of digital assets. This CosmWasm smart contract DEX was launched in March 2022, alongside a meta-staking program that allows ORAI token holders to delegate their tokens to the Oraichain mainnet, after which one can stake the native ORAIX token on OraiDEX.

Additionally, OraiDEX also announced a fairdrop program for the ORAI, ATOM, OSMO, AIRI, KWT and LUNA token holders. They have since taken snapshots of the wallets in these ecosystems and will soon be rewarding the whitelisted participants with the ORAIX governance tokens. As for its primary value proposition, the OraiDEX platform features a bridging solution that integrates some of the leading DeFi chains, including Atom and Luna.

PancakeSwap

Currently the second largest DEX is trading volumes, PancakeSwap is a BNB chain crypto exchange designed to support BEP-20 tokens. The platform’s infrastructure is based on the Automated Market Maker (AMM) model, enabling crypto users to swap BNB native tokens without a centralized limit order book. Some of the wallets that are compatible with this DEX include trust wallet, BNB chain wallet and the Coinbase wallet.

It is also noteworthy that PancakeSwap features several LP programs and yield farming incentives for the players who opt to stake their LP tokens. More interestingly, this DEX has introduced an opportunity for the NFT enthusiasts to list BNB-native digital collectibles to meet the growing demand in the industry. Unlike Ethereum-built DEXs, Pancakeswap is more cost-friendly and reliable when it comes to transaction finality.

There you go, those are the most popular in the market today and also the most reliable decentralize exchanges.

Posted Using LeoFinance Beta