Satoshi Nakamoto's dream about decentralization

Satoshi Nakamoto invented Bitcoin

It is on October 31, 2008. Satoshi Nakamoto has just published Bitcoin's White Paper. After the whole day, when he had a finger on the mouse button, finally he takes courage to do the final step.

Satoshi's hands are shaking as if he just realized something important has happened. Something groundbreaking, which of he was thinking about for a couple of years. "I'll sit down tomorrow and send information about the white paper to the people on the Cryptography mailing list," he says to himself, "I wonder what Adam will say!" Adam Back was one of those with whom Satoshi continuously consulted his idea.

Satoshi lay down on the mattress and immediately fell asleep under the weight of the moment. In a while, a picture of the future began to appear in his dream.

The dream about the future

It is on April 29th, 2020. There are no ASIC miners or mining pools. All bitcoin holders are also block verifiers on their full-node wallets, and all are also miners and mine new blocks. Users want maximum decentralization level and network security.

The current crisis of traditional markets is not affected by cryptocurrencies at all, as Satoshi has cleverly set the maximum cap of coins. Bitcoin is thus subject to controlled and at the same time declining inflation. It cannot be printed billions now or in the future, as is the case with dollars or euros.

The bitcoin community is very popular and friendly. The price of bitcoin attacks the $ 8,000 level. At the same time, the date of the third halving is fast approaching. Exactly as Satoshi had planned.

Satoshi went to his favorite coffee shop and paid for his coffee with a cheesecake by his cell phone bitcoin wallet. The transaction lasted a few seconds and cost him $ 0.001 in fees.

Satoshi wakes up in the morning with a smile on his face. "I don't think that's possible; I can't believe bitcoin will work in 12 years," he looks at himself in amazement in the bathroom mirror, "I've created something amazing!"

"In your face, Chancellor!" shouted Satoshi loudly in his bathroom.

Satoshi Nakamoto opens an email client and starts writing an email about yesterday's success. About the fact that he finally managed to write and publish the White Paper called: “Bitcoin: A Peer-to-Peer Electronic Cash System”.

He sends this information to his friends from the Cryptography Mailing List. "They'll be the first to know about Bitcoin!" He says to himself, sending a link to a nine-page document he completed yesterday with a click of the mouse.

He receives an answer from Hal Finney the same day. "Great job, Satoshi," Hal replies, "I have only a few comments and questions, I'll send them to you tomorrow."

The second dream about the future

He falls asleep in the evening and has a dream of bitcoin again. It is again April 29th, 2020. This dream looks exactly the same at the beginning, the price of bitcoin attacks the $ 8,000 mark, and the deadline for the third halving is approaching. But there are slight changes.

In this dream, bitcoin users are divided into three separate groups with completely different interests.

Users send bitcoins to each other. But without the expensive specialized computing equipment of ASIC miners, users have no chance of disturbing in the nonce search competition, and therefore not the opportunity to mine any bitcoins. The user community has no word in the network consensus or decision on the future direction of the Bitcoin protocol. If they don’t agree with the development and direction of the Bitcoin network, the only thing they can do is sell their bitcoins.

The user base is divided into aggressive bitcoin maximalists, supporters of the block’s expansion hard forks such as Bitcoin Cash and Bitcoin SV, and among people searching for a new holy grail between various altcoins.

The price per transaction is around $ 0.5, which is about $ 0.5 more than in yesterday's dream.

The other two groups with different interests and incentives than users are miners and pool operators.

Consensual decision-making power is in the hands of pool operators, or if it is the same entity, also large miners. It is they who decide on its further development and on the selection of the block during a possible fork.

Miners are not concerned with decentralization or network security; they are only businessmen and "manufacturers" of bitcoins, workers, who provide their hashrate to pool operators. They have clearly given their financial incentives. They must pay their costs for equipment, electricity, and human resources, and these all over must be lower than the income from the sale of mined coins. Their only goal is to maximize profits.

Pool operators have the most power at the Bitcoin network.

There are a few of the largest mining pools that have enormous power, and this power is therefore strongly centralized in their hands. Satoshi can do nothing about it, he is not in charge anymore!

Satoshi wakes up in the middle of the night sweaty and goosebumps. "I didn't mean it that way!" He says to himself, "But fortunately it was just a dream, I hope that yesterday's one will come true!"

Bitcoin mining farm

Present situation

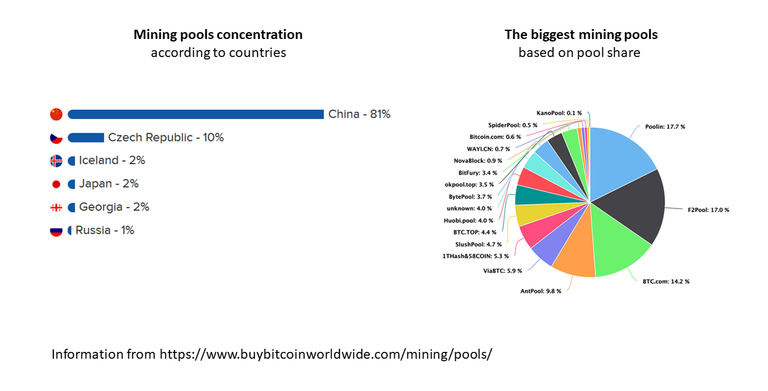

The 6 largest mining pools are from China thanks to cheap electricity. If the hashrate of the four largest were merged, their share would be 60% of the total hashrate. Thanks to the geographical distribution and latency of the network, they are also favored in finding a new nonce and thus creating a new block. This is a real threat of decentralization.

Bitcoin was created in response to the corrupt legacy financial system. A blockchain is an immutable tool of the truth. But it became a hard business of the gigantic mining farms and the power is centralized in the hands of several Chinese pool operators.

Is this a good state of affairs? Is this, what Satoshi really wanted most of all?

Algorand fulfilling the vision of Satoshi

Algorand is a decentralized blockchain platform for smart contracts that uses the Pure Proof of Stake (PPoS) algorithm to conclude consensus within the network.

The algorithm has low computational complexity and cheap and fast transactions (currently about $ 0.0002). The blocks are final immediately after promotion and approval within a maximum of 5 seconds. The block can be verified by each owner of at least 1 ALGO coin (approximately $ 0.18). The block proposer is randomly and secretly selected in each block.

By involving the whole community in the process of proposing and verification of the blocks, the maximum decentralization level is achieved. And without compromising on scaling or security. Algorand proved what many projects before him were not capable of. To solve the so-called blockchain trilemma.

The Algorand Foundation is behind the project and has a strong team of cryptographers led by Silvio Micali. Micali is a co-author of Zero-Knowledge Proof technology and in 2012 he received the Turing Award for laying the foundations of modern cryptography, the equivalent of the Nobel Prize in the IT sector.

The first block of Algorand was mined on June 11, 2019, and since then another more than 5 million blocks have been mined. The Algorand blockchain has its native cryptocurrency ALGO.

Algorand bet on true decentralization because the network is controlled by all its users. They are thus the creators of the blocks, verifiers, and their users at the same time.

It is clear that Satoshi could not foresee the development of the future of mining and the potential enormous power of mining pools, even concentrated in one location and thus centralized!

I believe that if Satoshi Nakamoto could comment on the current situation, he would certainly like the solution of Algorand.

Photos are CC0 license

Congratulations @blockchainfo! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare to others on the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @hivebuzz:

Vote for us as a witness to get one more badge and upvotes from us with more power!

The heck around blockchain hacking is what I'm trying to wrap my head around as to what economic implications or importance it has. More reason I believe smart contract platforms will do the mainstream job.

I think the double-spend problem is the major one. Yes, there will be smart contracts used for all kind of stuff, I don't think the simple transferring value is the main usage in the next future, we need a change in many ways.

Double spend attack on bitcoin blockchain I can't wrap my head round it. Though I already see that only Bitcoin has to offer - value movement. Economically, not compare to Ethereum.