The Rarer the bitcoin, The Higher the price

Quite possibly the most important feature of Bitcoin is its fluctuation in value.

In the beginning of Bitcoin, the cost of Bitcoin BTC can fluctuate by as much as 15%, when estimating the standard deviation for each day goes back more than 30-60 days.

These fluctuations towards Bitcoin's start and rise in appreciation put it at a level with the general monetary forms of Sierra Leone, Uzbekistan and Nigerian Naira in terms of purchasing power.

Despite the fact that Bitcoin's instability has diminished recently, generally between 2-4% in the previous year, Bitcoin's value projections have remained a mainstay of the creative mind of digital money experts and supporters.

Many investigators are looking at charts to find small changes in Bitcoin's cost to help figure out where digital money might move to the next stage.

On the whole, some have suggested that the cost of Bitcoin will ultimately not go into anything, while others have said that there is no hypothetical breaking point for how high it will be.

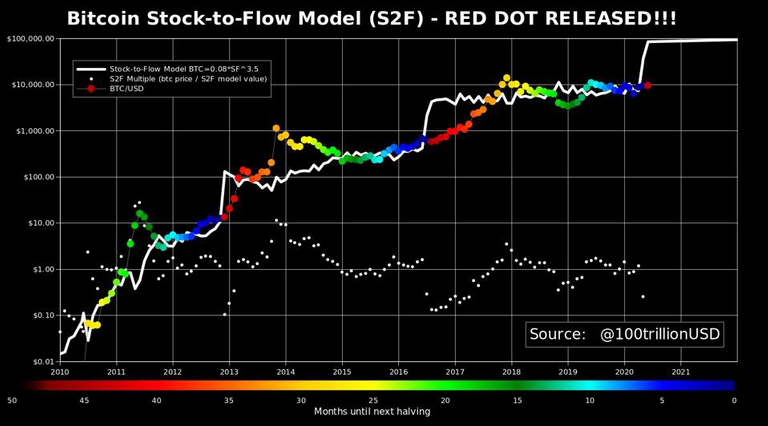

As Bitcoin continues to be scarce, so will the cost:

This has led to a warm discussion about the benefits of this model.

Some even accept that this model is the driving force behind the participation of institutional financial backers in the bitcoin market.

This model shows that Bitcoin will be worth multiple times over the next few years.

Others accept that distorting the organic market is a questionable motivation to contribute, and it also has some flaws in the model.

The "Stock-To-Flow" format is made by an anonymous Twitter client by the alias "", who claims to be a Dutch financial backer with a cash and legal foundation and oversees nearly $ 100 billion in resources.

The model is to determine the ratio that is based on a supplier's current perspective versus the amount being exchanged.

The higher the number, the more it takes to create to meet current needs and the greater the extraordinary resource.

Gold, for example.

The 'Stock-To-Flow' model for gold has a range of around 66, which means that it would take 66 years of gold creation to provide the current measure of the current stock of gold.

Products such as gold and silver try to expand their stock considerably, since hunting for gold is both expensive and tedious.

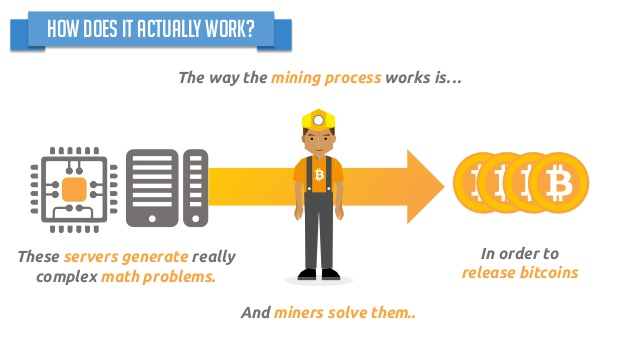

Bitcoin is comparable in that it is also uncommon by plan:

While the mysterious bitcoin maker Satoshi Nakamoto has made Bitcoin, it should have restricted stock, as it will be difficult to remove it from the organization in the long run.

Virtually 90% of Bitcoin's stock has been mined and removed.

This growing shortfall, says the "Stock-To-Flow" model, is an explanation that Bitcoin's cost is needed to hit $ 1 million sometime in 2025 for what it deserves in light of the upward tension over cost.

Recently, PlanB led an overview of a large number of customers asking the number of approval to evaluate the "Stock-To-Flow" model that the cost of Bitcoin will continue to evolve according to its assumptions.

33% of the respondents agreed with the "PlanB" framework and accept that what this model hints at will materialize.

What the model does is give us some clues to show that [supply and demand] is an important variable in understanding Bitcoin's value.

Analyze the "stock to flow" model:

Quite possibly the most vocal critic is Vitalik Buterin, Ethereum's fellow donor.

Buterin clearly accepts that the effect of bonus splitting in mining is difficult to refute, so the Stock-To-Flow model is not particularly helpful.

He agrees that the model's accuracy can be as productive in forecasting Bitcoin's future cost as the Hungarian models in the past have been in predicting monetary outcomes.

Regardless of the analysis of the "Stock-To-Flow" model, it bounces back and forth across the crypto space, if the financial backers agree.

Images Credit

Thank You