Can yETH bring the Ethereum bull back?

Bitcoin topped $12,000 some days back before crashing toward $10,000. The global stock market also plunged along with Bitcoin. $10,000 is a crucial support for Bitcoin. Ethereum outperformed Bitcoin in the last a few months as per growth but it was not immune to the crash. Presently Ethereum price is hovering around $340+ support level. The crypto market suddenly looks a bit bearish. The recent Sushi exit scam also impacted the market badly as the investor trust was hampered. The DeFi game just started some months back. Uniswap, a DeFi platform, was outpacing leading CEXs as per trading volume before the market crash. Is the DeFi wave over now? Not really! The yield farming frenzy and the surge of numerous food tokens was a bit abnormal but DeFi is a too powerful concept to be buried with a single blow. It is important to ride the wave to feel it and you can’t ride the wave that was never born. DeFi is ever-evolving.

"Just take your time - wave comes. Let the other guys go, catch another one." - Duke Kahanamoku

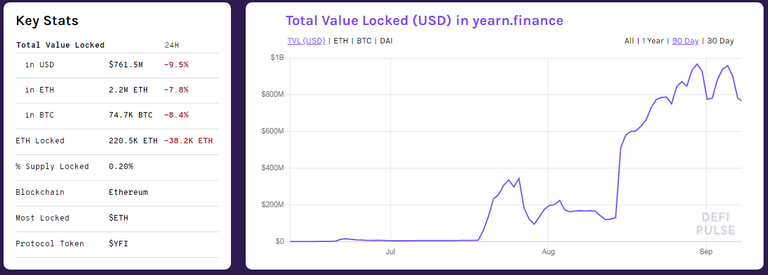

Image from Defipulse – Yearn.Finance TVL

The yETH strategy – DeFi triforce

Yearn.Finance has recently deployed its yETH strategy. yETH is a single asset fund strategy on Ethereum. yETH is a tool which enables the investors to earn automatic yield across DeFi protocols when they stake Ethereum holdings. yETH is basically a vault. It was created by a community member and the vault was deployed after community voting. The yETH vault currently takes ETH from you, borrows DAI with your Eth from MakerDao, deposits DAI into Curve and then earns CRV + Trading fees. To simplify the whole process, ETH will be used as collateral to mint DAI for yield farming. Overall, the strategy is bullish for ETH, DAI & YFI. Yearn.Finance TVL is supposed to skyrocket soon. Here is a detailed post to understand yETH by Yearn.Finance founder Andre Cronje.

https://twitter.com/0x_Lucas/status/1300939051143278592?s=20

yETH vault strategy has 200% collateralization to acquire MakeroDao’s DAI. It seems to be justified to me but obviously the strategy has a lot of risks involved. A massive price fall of ETH may lead to the liquidation of the vault.

https://twitter.com/AndreCronjeTech/status/1300980235597381634

The impact of yETH on CRV & YFI

yETH is a great strategy to extract yield from your idle ETH. But you borrow DAI with ETH collateral and supply that DAI to Curve to earn CRV. This CRV is sold for ETH and ETH is deposited to yETH vault. Obviously it makes the vault more robust and justifies the aim of deriving more ETH yield but it also creates selling pressure on CRV. CRV price can go down due to yETH in the near future. YFI, the governance token of Yearn.Finance, will obviously gain more momentum due to this. YFI price was moving very sharply before the recent market crash and it reached the ATH of $39,600 some days back.

https://twitter.com/Rewkang/status/1301684203566768129?s=19

This is the beginning of DeFi. Ethereum’s high gas fee is a problem area. Layer2 solutions are already being built on Ethereum. Layer2 can take the DeFi transactions off-chain and help DeFi to grow with the minimum gas fee. It’ll take some more time to develop the solutions. The DeFi ecosystem is also evolving on some other blockchains but everything originated from Ethereum and DeFi can’t become the tide without Ethereum. The crypto market should be stable within a few days as there is no big reason for the market drop. yETH can be a black hole for ETH. ETH will enter into the vault but it may not come out of it due to the extremely high yield. The locked ETH will be used to generate DAI. The flow of DAI will supercharge the DeFi ecosystem. Long way to go. Don’t lose hope.

Cheers!

[paragism]

Your current Rank (143) in the battle Arena of Holybread has granted you an Upvote of 15%

@tipu curate

Very interesting post (as usual)

Do you mean they have 1 ETH for 2ETH worth of DAI? If so, indeed ETH needs to not lose 40-505 ! Quite amazing topic. Too bad ETH fees are a pain in the ass...

The sell pressure on CRV is also quite a "side-effect", this is the main issue for all these farming protocols imho. Who buys the earned token in the long run?

Definitely not me 😂

Upvoted 👌 (Mana: 0/12)

Thanks for your kind attention. If they have 2 ETH, they'll borrow 1 ETH worth of DAI by making 2 ETH collateral. But it looks safe to some extent. Obviously, if ETH price drops drastically, there will be the liquidation of the vault.

Okay, then they only use 50% of deposit as collateral. Quite safe with ETH asset indeed 😄

These schemes are so new... they actually scare me! 🤭

Everything is experimental in DeFi

Congratulations @paragism! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOP